- UK economic data needs to deliver a meaningful surprise to cause a lasting impact on GBP/USD this week

- UK wages growth is expected to accelerate in April on the back of a big increase in the minimum wage rate

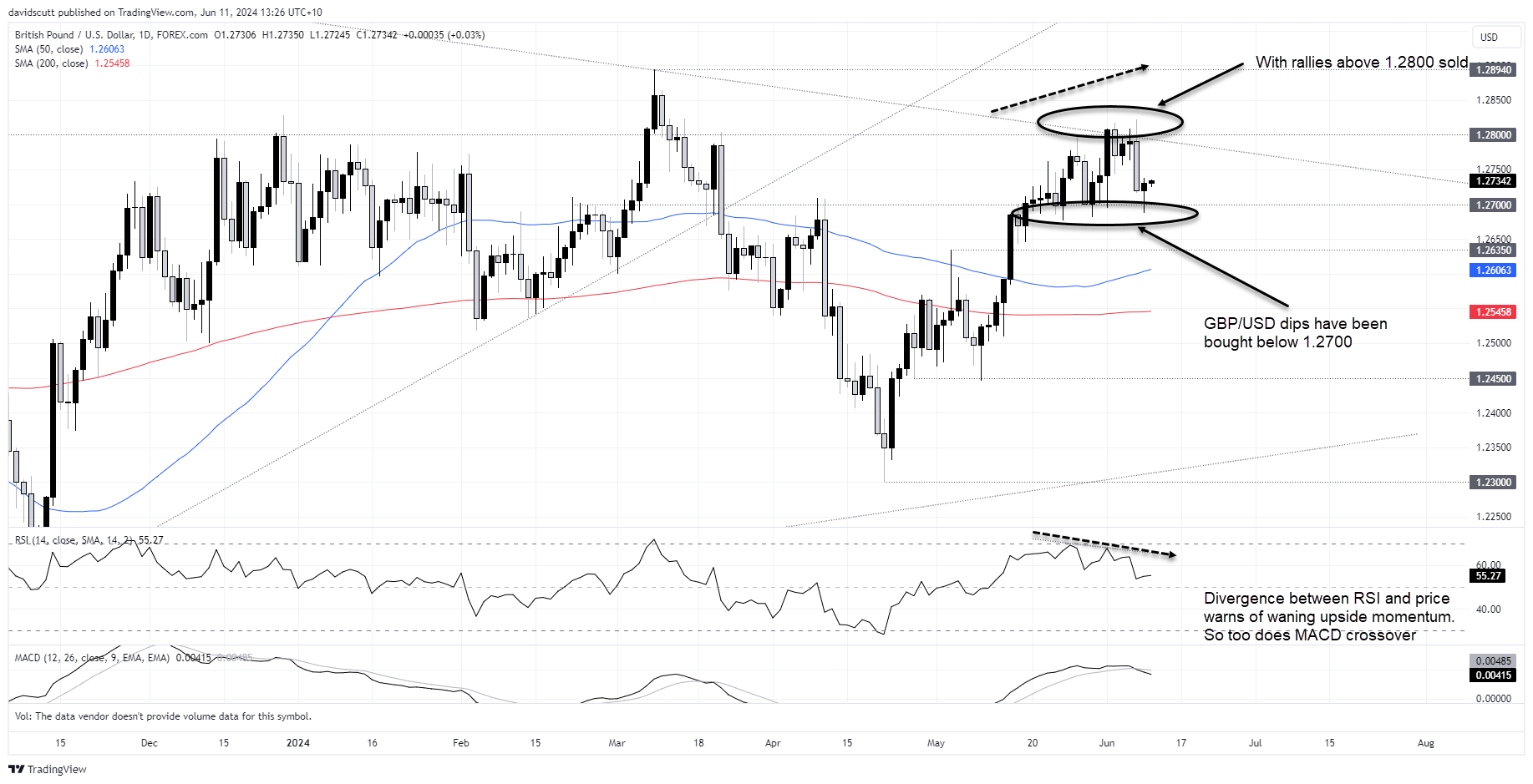

- Buying GBP/USD dips at 1.2700 and selling rallies at 1.2800 has been an effective strategy recently

GBP/USD looks set to remain in the trading range it’s been stuck in for weeks despite the arrival of wages and unemployment data from the UK later Tuesday, with traders likely to fade any significant moves ahead of the Fed interest rate decision and US inflation report on Wednesday.

US risk events tower over everything

As covered in the GBP/USD outlook, investor risk appetite has been influential on GBP/USD over the past month, pointing to the likelihood that Wednesday’s confluence of major US risk events will dictate how the pair fares in the days ahead, rather than UK data.

That’s why fading kneejerk reactions to today's data is favoured unless it causes a definitive shift in the UK interest rate outlook. As things stand, the SONIA curve has 35 basis points worth of cuts priced for the Bank of England this year, near the least amount seen since October 2023.

Eyes on UK wages after sticky services inflation print

After headline, services and underlying UK inflation came in far above expectations in April, dashing hopes for a rate cut from the Bank of England in June, it’s likely most attention will be on the wages figure given the linkages to services prices.

Underpinned by a hefty 9.8% increase in the minimum wage rate, average earnings are tipped to grow 6.1% in the three months to April relative to a year earlier, according to economists surveyed by Bloomberg, up from 6% in March.

Unemployment is seen holding at 4.3% despite an expected 100,000 decline in employment in the three months to April. While such an outcome should be deemed weak, volatility in the survey continues to generate doubts about its veracity, seeing more emphasis being placed on the wages side of the report right now.

GBP/USD range trade favoured

Looking at the GBP/USD daily, it shows how effective trading the range has been since the middle of May with dips below 1.2700 bought while probes above 1.2800 have been sold. It’s hard to see that changing unless the wages figure delivers a major surprise.

Should GBP/USD dip below 1.2700 but be unable to go on with the move, consider buying with a stop below 1.2780 for protection. The initial target would be the top of the range at 1.2800.

While less likely given where GBP/USD sits in the range, should we see another failed test of 1.2800, consider selling around the figure with a stop above 1.2820 for protection. 1.2700 would be the initial trade target.

Beyond the existing range, 1.2635 is next cab off the rank on the downside while 1.2894 is the same on the topside.

-- Written by David Scutt

Follow David on Twitter @scutty