- GBP/USD pushes higher following last week’s bullish breakout

- With the June highs taken out, the 2024 peak is in sight

- US inflation report key event risk for session

- A core reading of 0.2% or less may accelerate the bullish move

GBP/USD eyeing 2024 highs

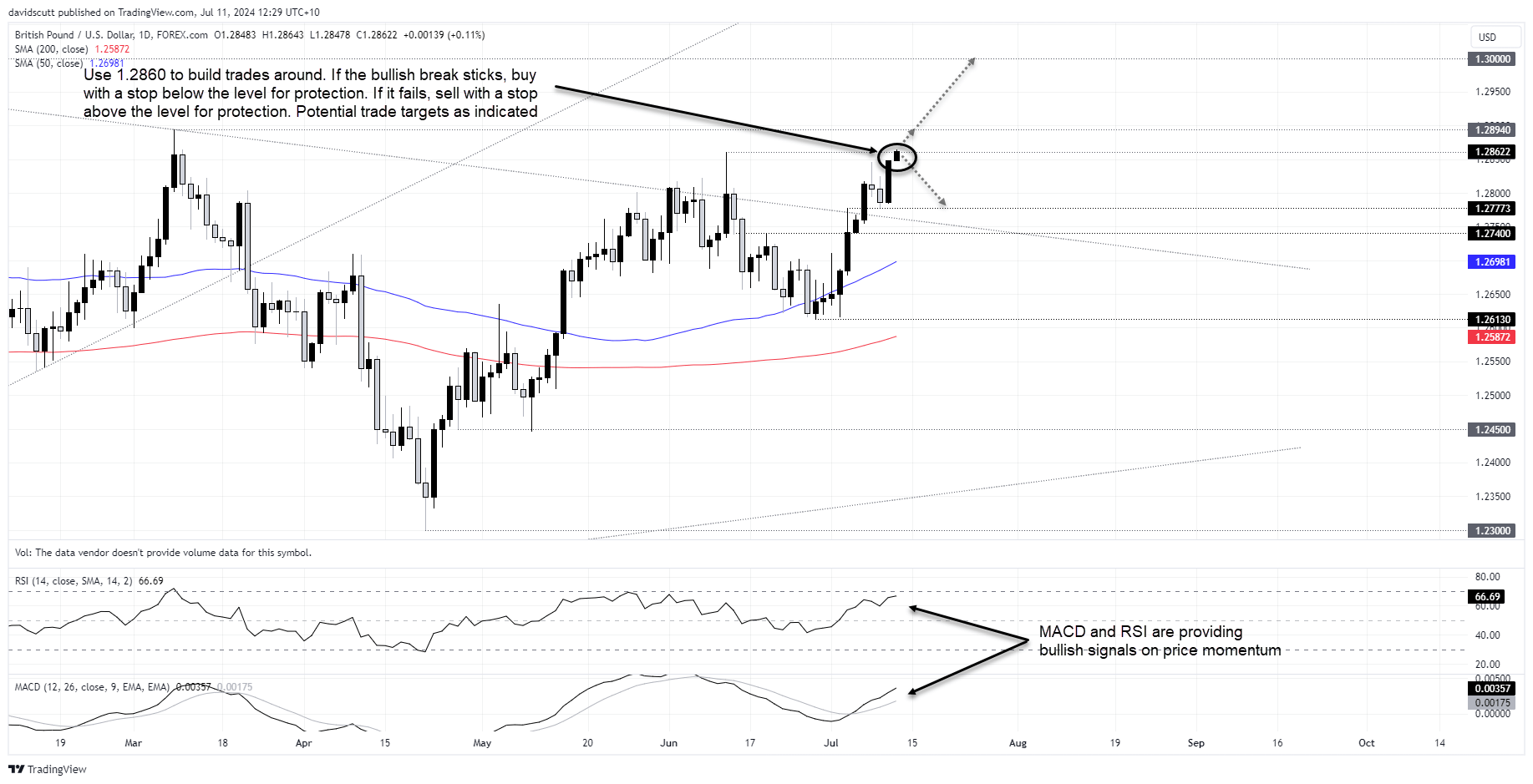

GBP/USD has taken out the highs struck in June, pushing further above 1.2800 on Thursday. A test of the 2024 highs now looks to be on the cards. While there is UK data on the calendar, you get the sense it will be the US inflation report later in the session that will determine what happens next for Cable. For now, it’s looking good.

Breakout brings out buyers

The weekly chart explains much of the recent price action, with GBP/USD breaking out of the triangle it had been coiling in over the past year. Unsurprisingly, the break has encouraged further buying, pushing GBP/USD into territory where it struggled earlier this year.

With RSI and MACD providing bullish signals on momentum, the ducks are lining up for upside. Above 1.28937, 1.2996 and July 2023 peak of 1.31423 are the levels to watch.

GBP/USD trade setups

Zooming in to a daily timeframe provides more clarity on potential setups, depending on whether the break of the June high sticks.

If GBP/USD holds above 1.2860, consider initiating longs targeting 1.2894, the high set in March. A tight stop below 1.2860 would offer protection. If the March peak were to be broken, consider lifting your stop to just below that level, allowing for an extension for a test of 1.3000.

Alternatively, should GBP/USD be unable to hold above 1.2860, you could sell with a tight stop above today’s high for protection. The obvious target would be 1.27773, where Cable bounce prior to the latest run higher. Given the price action and momentum, the short trade screens as the lower probability setup.

Managing event risk

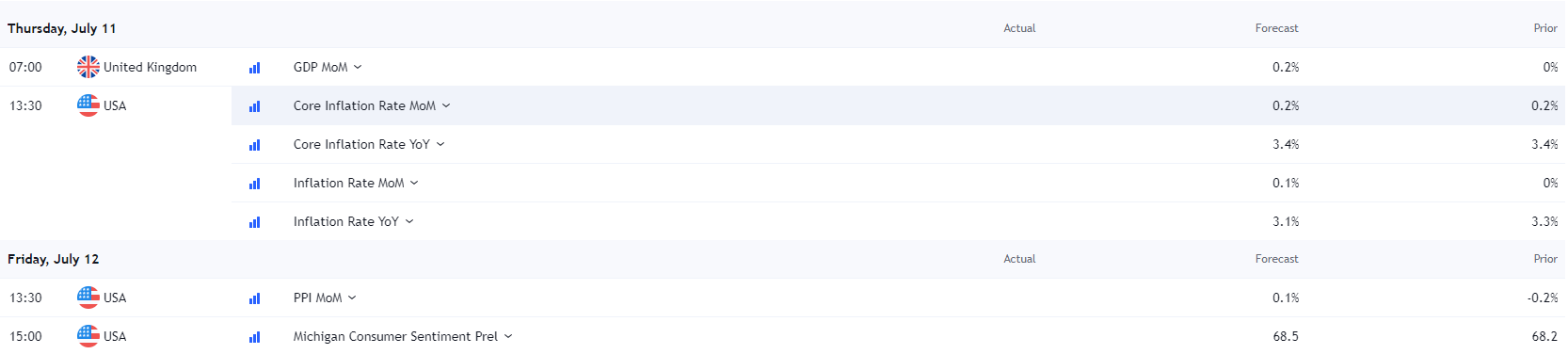

This calendar from TradingView reveals the event risk for GBP/USD over the coming days. Times are set for London.

While UK GDP may create volatility should it deviate too far from consensus, it’s likely to be superseded by the US inflation report later in the session, especially the core figure. With markets 70% priced for a September rate cut from the Fed, a reading of 0.25% or more may create headwinds for risker assets classes given it would dent the case for near-term cuts. Such an outcome would create reversal risk for Cable.

Alternatively, a monthly core reading of 0.2% or less may amplify tailwinds for GBP/USD given the likelihood that September rate cut bets will swell, boosting cyclical asset classes.

-- Written by David Scutt

Follow David on Twitter @scutty