The Pound is adding to yesterday’s Brexit inspired losses as the 8th round of Brexit trade talks are due to kick off in London. Boris Johnson continues to attempt to inject some sort of urgency into the talks which have made little progress in months. The PM’s threat that if no progress is made, no deal preparations will be ramped up, come following yesterday’s new deadline for a deal – 15th October and as the government plans to override parts of the Brexit divorce treaty. Boris appears to be pushing the EU to its limits in last chance saloon. However, given the EU’s warning that the UK mustn’t hamper with the Brexit deal, these talks appear to be unraveling before they have even started.

The Pound is extending losses trading at a two-week low a light economic calendar could keep the bears firmly in control. $1.31 is clearly in target now, whilst unfavourable Brexit headlines across this week could see sterling losses ramp and $1.30 become a very real target. A weaker Pound is beneficial for the multinationals on the FTSE so we could finally see the UK index play catch up with its peers that it has trailed behind since the mid March recovery.

Demand concerns hit oil

Oil can’t shake off demand concerns, particularly as US driving seasons comes to an end It’s refocusing the market on demand expectations, just US covid cases are on the rise again in the US. Data showed that coronavirus cases rose in 22 states over the Labor Day public holiday weekend, cases are also climbing sharply in the UK and in mainland Europe raising fears that oil demand will stay lacklustre for longer. Quite simply people won’t look towards extended travel is coronavirus cases are surging again. WTI fell 1.9% overnight striking and trades at $39.0.

With oil trading lower USD/CAD is a touch softer, although holding above 1.31 as the BoC meeting tomorrow also draws into focus.

Euro lifted by mixed German trade data

Mixed trade data from Germany has been enough to reverse earlier losses in the Euro and push EURUSD back over $1.18. Whilst imports increased an anemic 1.1%, German exports jumped +4.7% mom, after a 14.7% rise in June. Another surge in exports is boosting optimism surrounding a strong GDP rebound. Eurozone GDP will move into focus

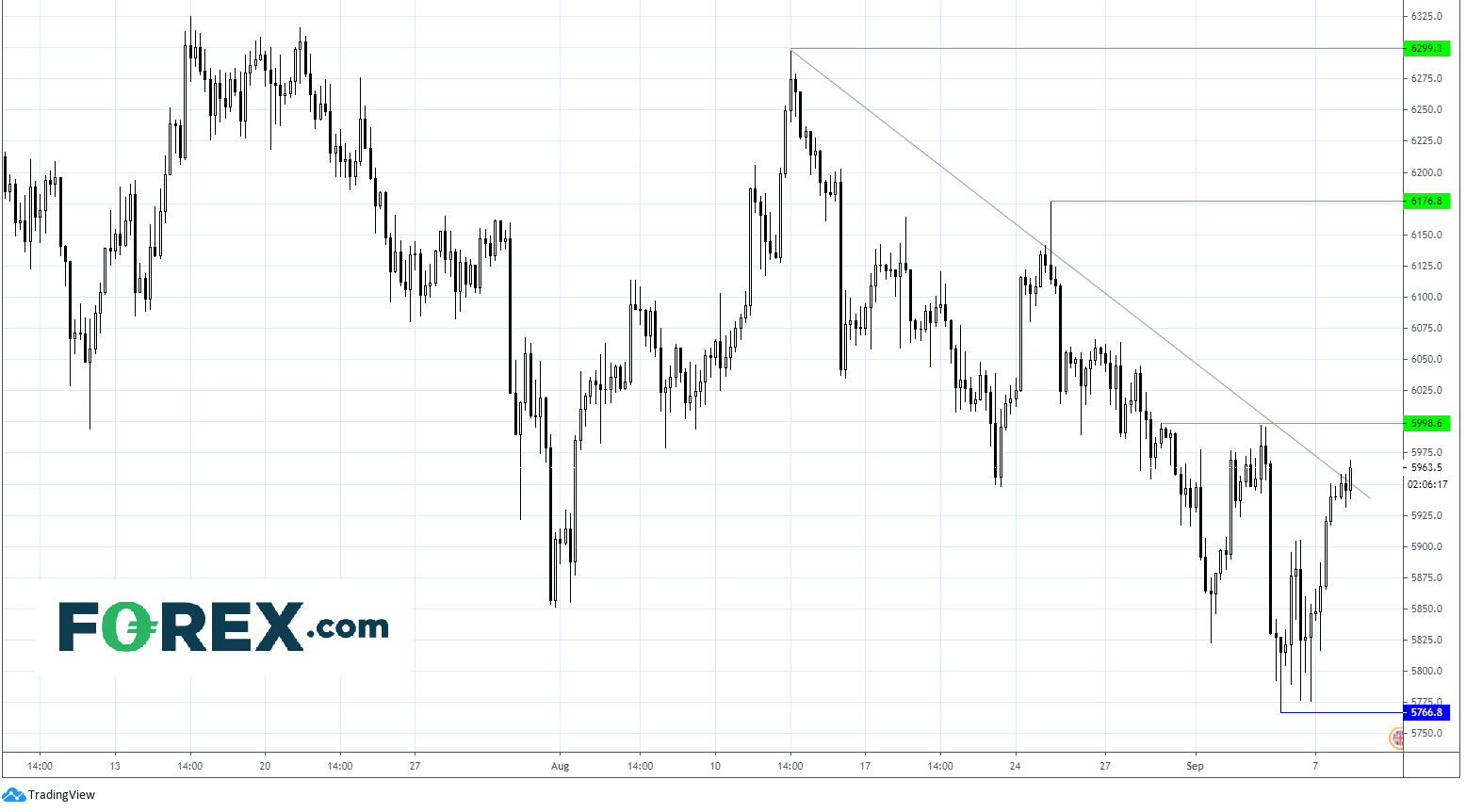

FTSE Chart