FTSE rises to a record high as the GBP struggles around a 5-month low

- Rate cut optimism lifts FTSE & pulls GBP lower

- UK services PMI data expected at 53 vs 53.1 in March

- FTSE rose to an all-time high

The FTSE has risen to a fresh record high, boosted by weakness in the pound and hopes that the Bank of England will soon start cutting interest rates.

The pound tumbled to a low, below 123 yesterday as investors increased expectations of a rate cut by the Bank of England. At the end of last week, Bank of England vice president Sir David Ramsden said that inflation was cooling and that he believes inflation will remain around the Bank of England's 2% target for the coming three years, suggesting that he doesn't need too much more evidence to start cutting rates.

A weaker pound benefits multinationals, which make up around 80% of the UK FTSE 100, as it brings a preferential exchange rate. Meanwhile, retailers are extending gains again today, boosted by the prospect of households having more disposable income.

Looking ahead, UK PMI data is in focus and is expected to show that the UK economy continued its recovery in April. The services PMI is expected to stay at around 53, while the manufacturing PMI is expected to hold steady at 50.3, both above the 50 level that separates expansion from contraction.

Bank of England's chief economist Huw Pill is also due to speak later. Any dovish comments could help the pound fall and the FTSE rise further.

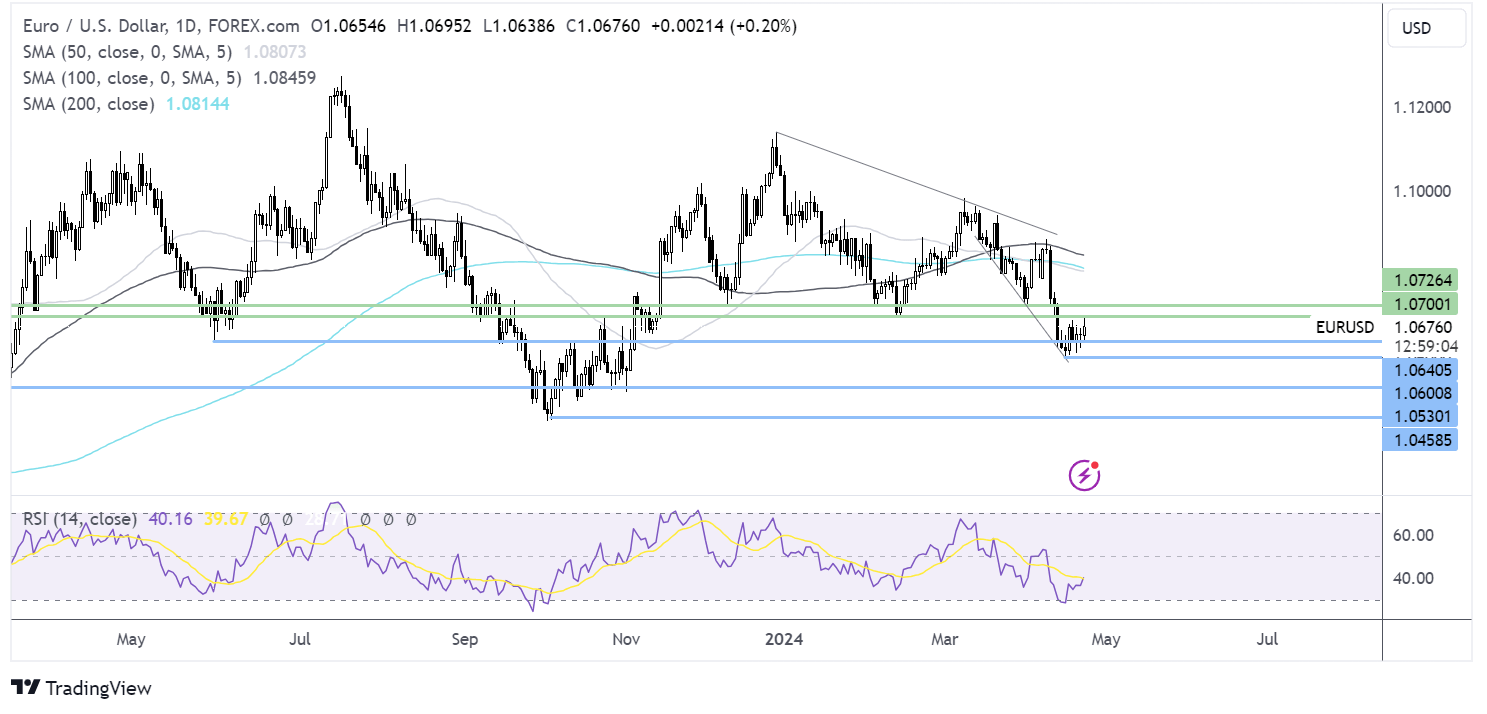

FTSE forecast – technical analysis

FTSE, supported by its rising DMAs, rose firmly through 8000 and pushed above the February 2023 previous ATH of 8046; this level is acting as the immediate support, while buyers aim towards 8100.

The longer upper wick suggests that there was little buying demand at today’s higher levels. Immediate support is at 8046 and 8000. Below here, 7960, the April 2023 high, comes into play.

EUR/USD looks to PMI data

- EUR composite PMI to rise to 50.8 from 50.3

- US PMI data is expected to highlight a more robust US economy

- EUR/USD holds steady at 1.0650

Euro USD is rising after encouraging German PMI data and with PMI data in focus for both the eurozone and the US.

German services PMI rose to 53.3, rebounding strongly from 50.1 in March, suggesting that the service sector is starting to fire up. The manufacturing PMI was weaker than expected at 42.2, still well below the 50 level that separates expansion from contraction.

Eurozone PMI data is expected to show improvement in both the service and manufacturing sectors, lifting the composite PMI to 50.8 from 50.3. Improving PMI data will add to the view that the eurozone economy is recovering from its downturn.

However, gains in the euro could be limited given that the ECB is expected to cut interest rates in June. This contrasts with the Federal Reserve, which is expected to start cutting interest rates later this year.

Fed officials have been adopting a more hawkish stance, highlighting the strength of the US economy and sticky inflation as reasons to be patient with rate cuts.

Today's US PMI data is expected to show that the manufacturing and service sectors grew faster in April. Strong PMI data will add to the view that the US economy is performing well, and there is little urgency for a rate cut anytime soon, supporting the USD.

Data later in the week, including US GDP figures and core PCE, or additional clues about when or if the fed.

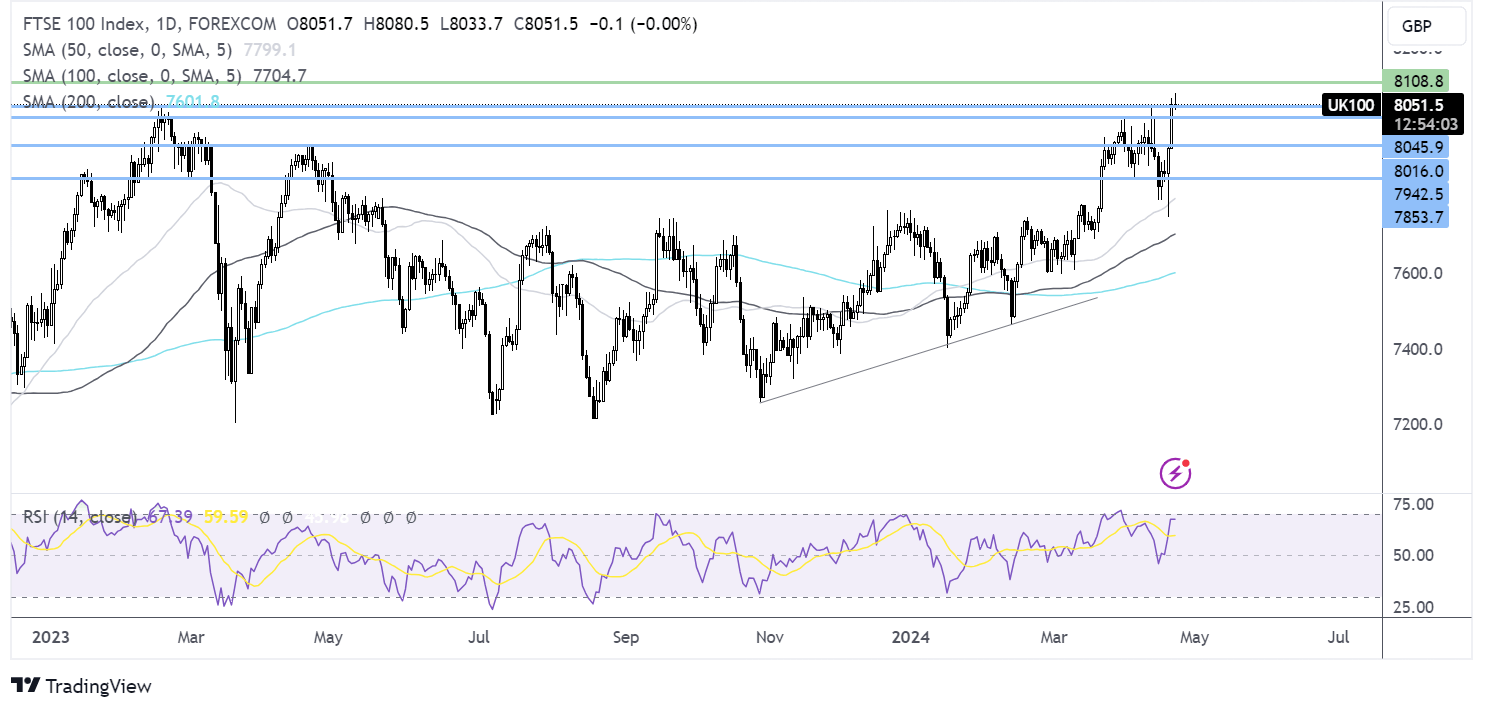

EUR/USD forecast - technical analysis

EUR/USD has extended its recovery from 1.06, the 2024 low, and is heading towards 1.07. Buyers will need to overcome this level to extend the recovery toward 1.0725, the December low, and expose the 200 SMA at 1.0820.

Failure to rise above 1.07 could see sellers retest support at 1.0640, the May 2023 low, ahead of 1.06, the 2024 low. A break below here creates a lower low.