- FTSE analysis: Dovish BoE sends UK stocks higher, pound lower

- SNB cuts rates while bets over ECB cuts increase on the back of poor PMI data

- FTSE analysis: technical levels and factors to watch

It has been a stellar day for the FTSE for a change, with the UK index outperforming with gains of 1.5% to sit at the top of the global leader board. Only a handful of stocks were in the red, with miners and banks dominating the top of the index. Today’s big rally means the index may be hit with mild profit-taking, but any short-term dips could be bought as the bullish momentum slowly gathers pace following the index’ key technical breakout last week.

FTSE analysis: Dovish BoE sends UK stocks higher, pound lower

The FTSE has been boosted by expectations that the Bank of England is going to start cutting rates in the coming months, with markets pricing in three 25bps cuts for 2024 with the first one in June. This comes after the BoE Governor Bailey said the UK economy is “moving in the right direction” as the Bank held rates unchanged with one member voting to cut. The other 8 all voted for no change. A couple of hawkish officials (Catherine Mann and Jonathan Haskel) who had previously demanded to hike rates, dropped their calls.

BOE Governor Andrew Bailey said the UK is “on the way” to winning its fight against inflation. In another dovish twist, Bailey also said that the MPC will need to “act ahead of time” on policy moves, which means that it doesn’t need to see inflation “come all the way down to a sort of sustainable level consistent with the target” before cutting rates. What’s more, Bailey thinks bets on three rate cuts this year are “reasonable” now that inflation has fallen to its lowest level in two-and-a-half years in February.

We also saw the probability of a rate cut by the European Central Bank rise with markets pricing in three 25 bps cuts by year end, while the Swiss National Bank surprised with a rate cut this morning. The day before, the US Federal Reserve signalled that three cuts are in store in this year. With all these central banks indicating that interest rates are heading lower, global stock markets rallied across the board.

FTSE analysis: technical levels and factors to watch

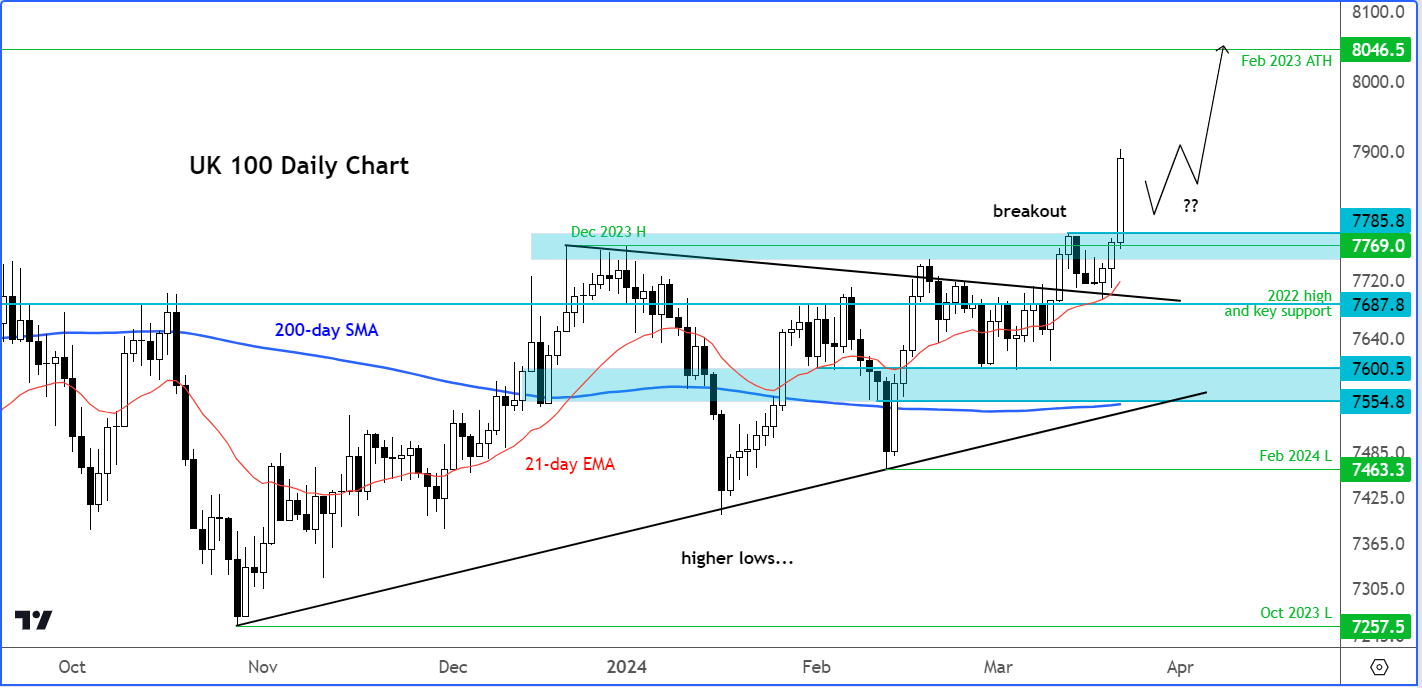

Source: TradingView.com

I have been highlighting the possibility of this type of a breakout on the FTSE in a number of my recent FTSE analysis articles. Well, today the breakout was already on the way before the BoE meeting. But it then continued to push higher as more and more resistance levels broke down. With the index looking set to close well in the green today, any short-term weakness in the coming days could be bought. After all, it has just recently broken above a 10-month consolidation pattern. So, more gains should be expected moving forward. It is important that former resistance levels now turn into support on any short-term pullback. Among these, the December highs that has recent been broken at 7769 is now the most important support level to watch. Ahead of this comes last week's high at 7785.

On the upside, there are not many obvious reference points to watch now until the until the February 2023 all-time high at 8046. Round figures such as 7900 and 8000 are additional levels to watch for potential profit taking.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R