- FTSE analysis: CPI-related gains mostly given back, but…

- Expectations of a sooner-than-expected BoE rate cuts re-ignited

- FTSE analysis: London-listed energy stocks could find support from crude oil

- FTSE technical analysis: bullish trend confirmed

The big news this morning was from the UK, as inflation data came in sharply below expectations, sending the pound lower and FTSE higher, as it gave rise to renewed speculation about a sooner-than-expected rate cut by the Bank of England. While the pound's post-CPI weakness persisted, the UK’s benchmark stock index started to retreat noticeably from its earlier highs, after briefly breaking to its highest level since May. But with the recent trend being positive for the FTSE and indeed global equity markets (outside of China), we could see dip-buyers step back in, as they have done so on multiple occasions in recent weeks. Looking ahead, we will have US consumer confidence data later in the day followed by the final GDP estimate and jobless claims on Thursday. On Friday, we will have UK retail sales data before the focus shifts to US core PCE inflation data on what will probably be the final important day of the year for the markets. UK retail sales are expected to come in at +0.4% month-over-month following a 0.3% decline the month before.

FTSE off highs after CPI gave it a big boost

At the time of writing in mid-morning London session, the GBP/USD (-75 pips) was still testing its earlier session lows around 1.2650, while the FTSE was off some 90 points or 1.1% from its best levels. It was now up less than half a percent on the session. Some investors were clearly happy to bank profits just in time for a last-minute Christmas shopping spree. But the weaker inflation report may encourage dip buyers to emerge late in the session or in these last days of the year, as the FTSE approaches key support levels.

In case you missed it, the Consumer Price Index in the UK came in notably weaker this morning. It reached an annual rate of 3.9%, marking its lowest level since 2021 and a significant drop from October's 4.6% print. The market had anticipated a milder decline to 4.4% on the headline CPI front. Core CPI inflation also surpassed expectations, printing 5.1%, which was down noticeably from the previous reading of 5.7% and well below the expected 5.6%.

A closer look at the inflation data reveals that food price inflation, a major contributor to the cost-of-living challenges, has returned to single digits for the first time since June 2022. Energy prices have declined, and the inflation in the service sector, closely monitored by the Bank of England, has decreased to 6.3% from 6.6% previously.

Will the BoE cut rates sooner?

Today’s inflation report suggests the Bank of England may have been overly cautious at its policy meeting last week, when it pushed back against rate cut expectations and kept rates steady at 5.25%. The fact that UK bond yields have fallen and stayed lower after the CPI report, with the benchmark 10-year yield falling to its lowest level since April at just north of 3.5%, means investors are pricing in sooner rate cuts despite the BoE warning. Futures markets have priced in a total of about 145 basis points in rate cuts for 2024, equivalent to five 25 basis-point cuts. This could be a welcome relief for UK banks (needing to sell more mortgages) and home building sectors.

FTSE analysis: London-listed energy stocks could find support from crude oil

Another source of support for the FTSE could come from the energy sector, with rising oil prices, now up for 6th consecutive session. Brent is now back above $80 and WTI around $75 per barrel. Crude oil prices have staged a decent recovery in recent days on the back of concerns over supply disruptions as the world’s biggest shipping companies diverted journeys away from the Red Sea following the Houthi rebel attacks. The ongoing OPEC+ efforts to withhold supplies are also helping to offset demand concerns. Should oil prices rise further then heavy weighs such as BP and Shell may experience a surge in demand for their shares, helping to further fuel the FTSE rally.

FTSE technical analysis: Bullish trend confirmed

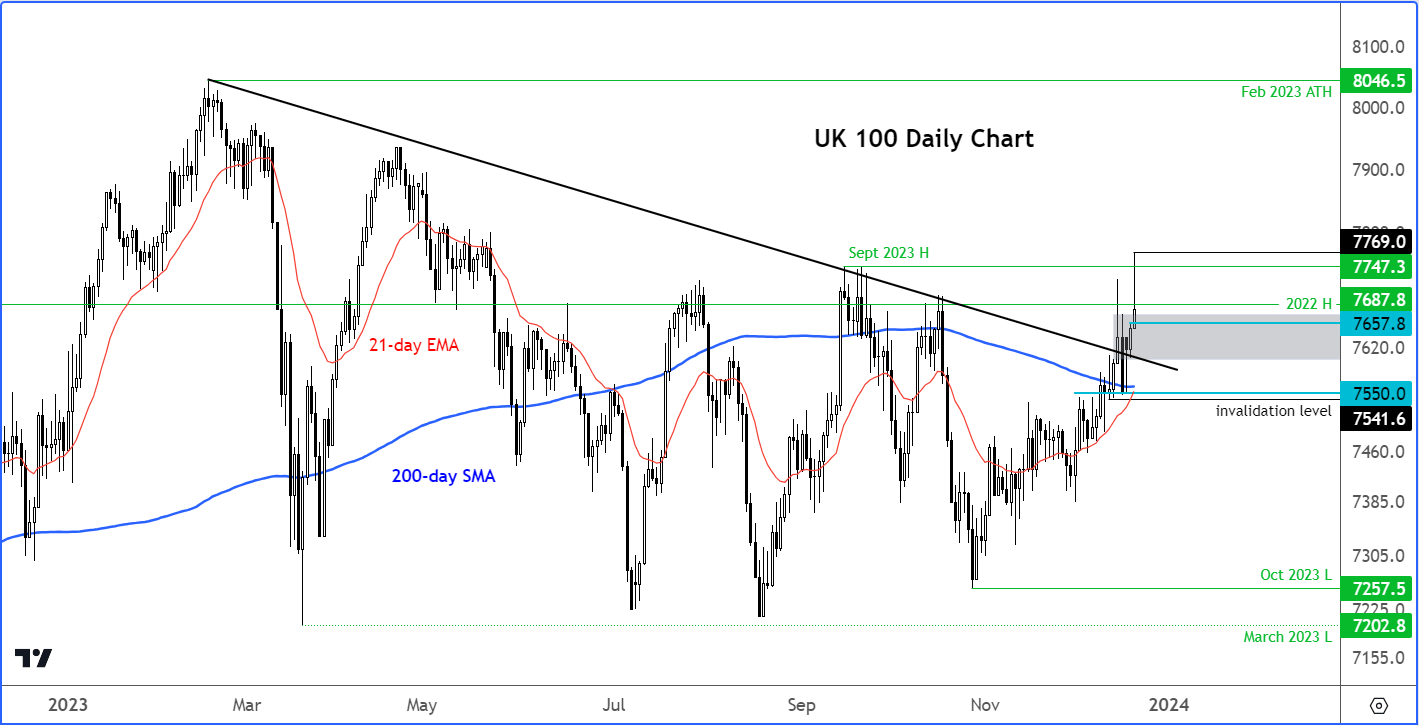

Source: TradingView.com

The bearish trend line that has been in place since the FTSE last hit a record high in February of this year, was taken out a few days ago and following a period of consolidation, the index has moved above it again. The broken trend line is a sign that the FTSE is finally joining the global stock market rally. The UK index has also broken above the 200-day average around 7550 in recent trade. The short-term 21-day exponential moving average, meanwhile, looks set to cross the 200 in what many will regard it as another bullish signal.

In terms support, 7675-7655 is now the first area of defense for the bulls to watch, followed by 7550.

Resistance is seen around 7750 or thereabouts, which had acted as strong resistance back in September, when the index made a high of 7747 before dropping. So, this area needs to be reclaimed by the bulls if we are to see a run towards the February’s record high at some stage in the coming weeks.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R