Looking for something specific? Jump ahead using these links:

- What is the FTSE 100?

- About FTSE 100 constituents

- How is the FTSE 100 calculated?

- What does the FTSE 100 price mean?

- Average returns of the FTSE 100

- FTSE 100 market hours

- How to trade the FTSE 100

- FTSE 100 companies ranked by market capitalisation

What is the FTSE 100?

The FTSE 100 is a stock index that tracks the 100 largest publicly-traded companies listed on the London Stock Exchange (LSE). The companies are ranked by market capitalisation – the combined value of the FTSE 100 is worth more than 80% of the entire LSE’s market cap.

The FTSE 100 is used as a benchmark for the economic health of the UK. If the price of the index rises, the constituents share prices are rising, which generally indicates a positive economic situation. Whereas a falling FTSE is a sign that the companies (and the wider economy) are experiencing a period of contraction.

FTSE is a combination of the two companies that founded the index: The Financial Times and the London Stock Exchange. The FTSE 100 is now completely owned by the LSE.

So, whether you’re a trader or an investor, if you’re interested in UK stocks, you’ll need to keep an eye on the FTSE 100’s price movements. That being said, as the FTSE constituents are both domestic and international, the index is sensitive to global political and economic events.

If you’re only interested in a UK barometer, the FTSE 250 has fewer international firms so is commonly used instead of the FTSE 100 now.

About FTSE 100 constituents

Constituents of the FTSE 100 are considered ‘blue chip’ firms in the UK, in that they have the highest value. While these companies are often used to measure the UK’s economy, a lot of FTSE 100 constituents are now multinational firms.

Want to see the full list of companies? Click here.

To be included on the FTSE 100, a company must be listed on the LSE, its shares must be denominated in pounds, and it must meet the index’s minimum float and liquidity requirements.

FTSE 100 constituents are reviewed every quarter – usually in March, June, September, and December. If a company is no longer in the top 100 companies by market cap, it will be removed from the index and replaced with a new stock. It’s important to keep an eye on any changes to the FTSE 100’s constituents, as it will impact your exposure to different sectors of the economy.

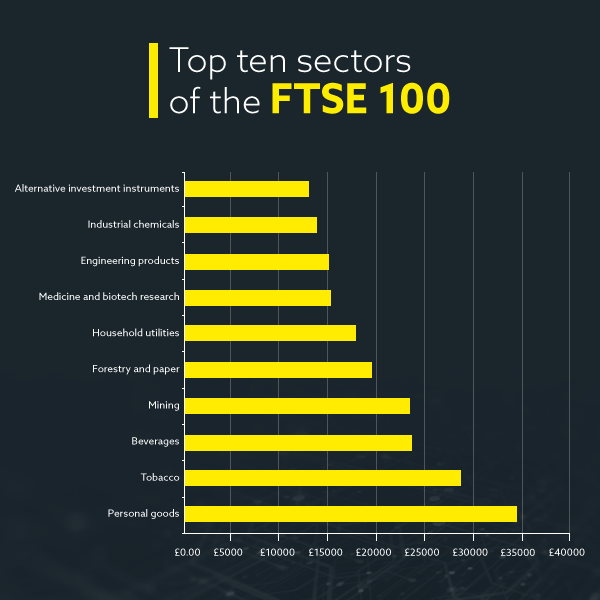

Here’s how the top ten sectors of FTSE 100 companies looked after the adjustment in March 2021:

How is the FTSE 100 calculated?

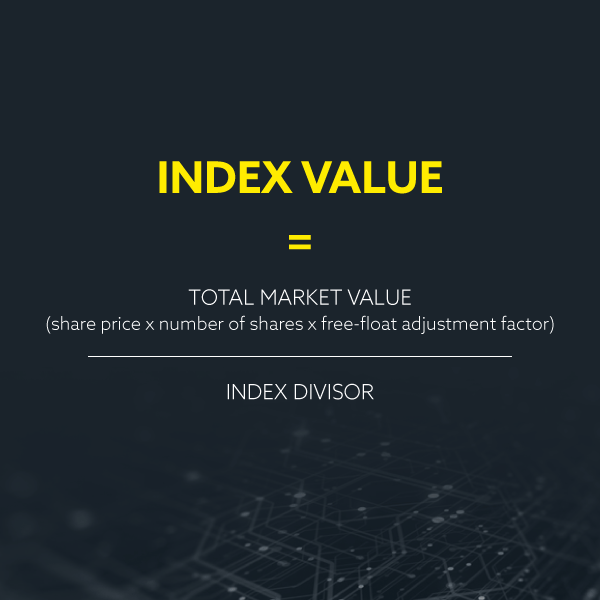

The FTSE 100 is calculated using the total market capitalisation of all 100 constituents. As the index is market-capitalisation weighted, companies with higher values will have a higher influence over the index’s final value.

The calculation starts by multiplying each company’s current share price by the total number of shares it has issued.

This number is then multiplied by the company’s ‘free-float factor’, which indicates how many shares are still available on the market. The free-float adjustment factor essentially helps to account for differences between the number of shares available – usually rounded to the nearest 5%. A company with a larger portion of floating shares will have a larger influence on the index’s value.

The market caps of all of the companies are combined and then divided by the index divisor – this is a figure that is applied to the index to make its value more manageable. The FTSE 100’s divisor started at 1000 points in 1984, but as the composition of the index has changed, so has the divisor. This is to make sure the index’s value can be compared to historic data.

What does the FTSE 100 price mean?

The price of the FTSE 100 indicates whether the value of the companies on the index are rising or falling. If the price of the FTSE 100 is increasing, it means that a specific company or group of companies are experiencing gains, which is reflected in the price of the overall index. Likewise, if the FTSE 100 price is falling, it means that companies on the index are experiencing a decline in price.

How much the FTSE 100’s price moves will depend on the company’s weight in the index. So, changes in the biggest companies on the FTSE, such as Unilever, Rio Tinto or GlaxoSmithKline – will have a larger impact on the overall index than smaller cap firms like Burberry, Taylor Wimpey or Sainsbury’s.

Average returns of the FTSE 100

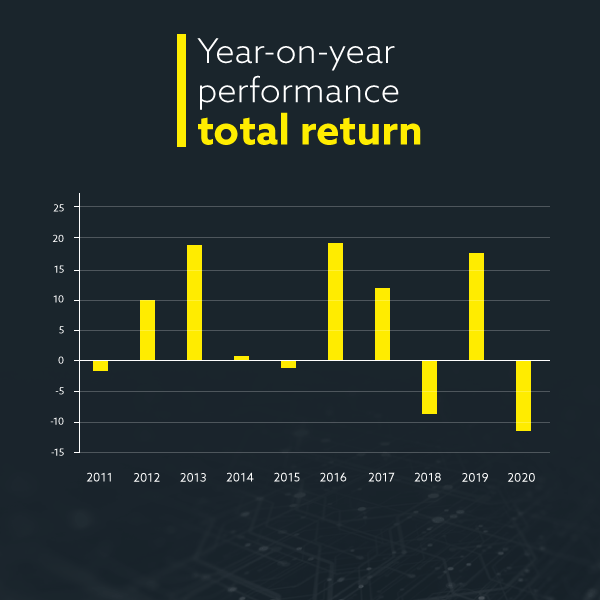

Over the last ten years, the FTSE 100 has an average annual return of 5.4%. The FTSE 100’s average returns are essentially what managed funds will have earned in profit for investors over the course of a year – naturally, the returns of the FTSE will vary depending on whether dividends paid are reinvested or not.

You can see the yearly returns from 2011-2020 below.1 Remember, past returns are no guarantee of future performance.

FTSE 100 market hours

The FTSE 100 opens at 8am and closes at 4:30 (GMT), which are the hours of the London Stock Exchange. When you trade the FTSE 100 with us, you’ll be able to get exposure to the index for much longer. Our FTSE 100 market hours are:

|

GMT |

EST |

|

|

UK 100 |

1am to 9pm |

9pm to 5pm |

|

UK 100 Futures |

1am to 9pm |

9pm to 5pm |

How to trade the FTSE 100

There are a number of ways that you can trade the FTSE 100, the most common are derivatives such as CFDs, futures and options, as well as ETFs. All of these instruments enable you to get exposure to all 100 companies from a single position.

FTSE cash CFDs

Contracts for difference (CFDs) are derivatives that take their price from the underlying market, in this case the FTSE 100. As you’ll never be taking ownership of an asset, you can speculate on whether the UK index is going to rise or fall in value.

You’d be agreeing to exchange the difference in the price of the FTSE from when you opened your position, to when you closed it. The more the FTSE moved in your chosen direction (up or down), the more you’d profit. The more the FTSE moved against you, the more you’d lose.

Cash CFDs have some of the tightest spreads on offer, which have made them popular among day traders who open and close positions quickly. However, holding a position overnight would result in additional charges.

Learn more about CFDs.

FTSE 100 futures

Futures contracts are agreements to exchange an asset a set price on a set expiry date. Unlike most futures, FTSE contracts don’t have an underlying physical asset to exchange, as an index is nothing more than a number representing a group of stocks.

FTSE futures are purely speculative – you’d be estimating whether the FTSE will rise or fall by a certain amount by a set date.

The value of FTSE futures can be somewhat difficult to predict, as the relationship between futures and the underlying index can work both ways. While the value of FTSE futures is naturally influenced by the underlying 100 companies themselves, the FTSE 100 is also influenced by futures pricing – that’s because the futures market opens way before the London Stock Exchange. So, if the price of futures increase, the value of FTSE 100 is likely to open higher, and vice versa.

When you trade FTSE futures with us, you’ll be using CFDs to speculate on the futures market. Usually, you’d use futures for longer-term positions, as the costs of maintaining a position overnight are included in the initial spread.

FTSE 100 options

FTSE 100 options are contracts that give you the right, but not the obligation, to buy or sell the index at a set price on a set date.

Like futures contracts, index options are different from other types of option has there are no underlying assets involved. But unlike futures, when you buy an options contract you can get the right to let your contract expire worthless if you want to.

There are two types of options you’d use to speculate on the price of the FTSE 100. If you’re bullish on the FTSE 100, you’d use a call option – this would earn you a profit if the index increased in value. If you were bearish on the FTSE 100, you’d use a put option, which would earn a profit if the index fell in value.

FTSE 100 stocks and ETFs

Another way to trade the FTSE is through exchange traded funds (ETFs), which are investment instruments that hold a group of stocks – in this case, the shares of constituents on the index.

The majority of FTSE ETFs will be weighted in exactly the same way that the index is, giving you identical exposure. Examples include the Vanguard FTSE 100 UCTIS ETF and iShares Core FTSE 100 UCITS ETF. Other types of FTSE 100 ETFs will give each company an equal weighting, give you a short exposure or leverage your position, so your returns would look different than the underlying.

Alternatively, you could trade the individual constituents’ shares. This would give you exposure to just one part of the index, but you could choose just the stocks and sectors you’re interested in.

Find out more about share trading with us

FTSE 100 companies ranked by market capitalisation

Here are the FTSE 100 companies by market capitalisation as of March 17 2021.2 You’ll notice there are 101 companies listed – this is because Royal Dutch Shell has two classes of shares on the LSE.

|

Rank |

Ticker |

Company name |

|

1 |

ULVR |

Unilever |

|

2 |

AZN |

AstraZeneca Plc |

|

3 |

HSBA |

HSBC Holdings Plc |

|

4 |

RIO |

Rio Tinto Plc |

|

5 |

DGE |

Diago Plc |

|

6 |

GSK |

GlaxoSmithKline |

|

7 |

BATS |

British American Tobacco Plc |

|

8 |

BP. |

BP PLC |

|

9 |

RDSA |

Royal Dutch Shell Plc 'A' |

|

10 |

RDSB |

Royal Dutch Shell Plc 'B' |

|

11 |

BHP |

BHP Group plc |

|

12 |

RB. |

Reckitt Benckiser Group Plc |

|

13 |

AAL |

Anglo American Plc |

|

14 |

GLEN |

Glencore Plc |

|

15 |

PRU |

Prudential Plc |

|

16 |

LSEG |

London Stock Exchange Group Plc |

|

17 |

VOD |

Vodafone Group Plc |

|

18 |

REL |

RELX Plc |

|

19 |

NG. |

National Grid Plc |

|

20 |

BARC |

Barclays Plc |

|

21 |

LLOY |

Lloyds Banking Group plc |

|

22 |

CPG |

Compass Group Plc |

|

23 |

FLTR |

Flutter Entertainment Plc |

|

24 |

CRH |

CRH Plc |

|

25 |

EXPN |

Experian Plc |

|

26 |

NWG |

NatWest Group Plc |

|

27 |

AHT |

Ashtead Group Plc |

|

28 |

FERG |

Ferguson Plc |

|

29 |

ANTO |

Antofagasta Plc |

|

30 |

ABF |

Associated British Foods Plc |

|

31 |

SMT |

Scottish Mortgage INV TST Plc |

|

32 |

TSCO |

Tesco Plc |

|

33 |

OCDO |

Ocado Group Plc |

|

34 |

LGEN |

Legal & General Group Plc |

|

35 |

BA |

BAE Systems Plc |

|

36 |

AV |

Aviva Plc |

|

37 |

BT.A |

BT Group Plc |

|

38 |

SSE |

SSE Plc |

|

39 |

STAN |

Standard Chartered Plc |

|

40 |

IMB |

Imperial Brands Plc |

|

41 |

SN. |

Smith & Nephew Plc |

|

42 |

III |

3I Group Plc |

|

43 |

SGRO |

SEGRO Plc |

|

44 |

AVV |

Aveva Group |

|

45 |

WPP |

WPP Plc |

|

46 |

JET |

Just Eat Takeaway Plc |

|

47 |

NXT |

Next Plc |

|

48 |

IAG |

INTL Consolidated Airlines Group SA |

|

49 |

PSN |

Persimmon Plc |

|

50 |

HLMA |

Halma Plc |

|

51 |

ITRK |

Intertek Group Plc |

|

52 |

ENT |

Entain Plc |

|

53 |

EVR |

Evraz Plc |

|

54 |

MNDI |

Mondi Plc |

|

55 |

IHG |

Intercontinental Hotels Group Plc |

|

56 |

CRDA |

Croda International Plc |

|

57 |

ADM |

Admiral Group Plc |

|

58 |

JD. |

JD Sports Fashion Plc |

|

59 |

RTO |

Rentokil Initial Plc |

|

60 |

SKG |

Smurfit Kappa Group Plc |

|

61 |

CCH |

Coca-Cola HBC AG |

|

62 |

SPX |

Spirax-Sarco Engineering Plc |

|

63 |

RR. |

Rolls-Royce Holdings Plc |

|

64 |

INF |

Informa Plc |

|

65 |

BRBY |

Burberry Group Plc |

|

66 |

MRO |

Melrose Industries Plc |

|

67 |

BNZL |

Bunzl Plc |

|

68 |

SDR |

Schroders Plc |

|

69 |

HL. |

Hargreaves Lansdown Plc |

|

70 |

BDEV |

Barratt Developments Plc |

|

71 |

KGF |

Kingfisher Plc |

|

72 |

POLY |

Polymetal International Plc |

|

73 |

PHNX |

Phoenix Group Holdings Plc |

|

74 |

STJ |

St. James's Place Plc |

|

75 |

RSA |

RSA Insurance Group Holdings Plc |

|

76 |

SGE |

SAGE Group Plc |

|

77 |

WTB |

Whitbread Plc |

|

78 |

TW. |

Taylor Wimpey Plc |

|

79 |

FRES |

Fresnillo Plc |

|

80 |

SMIN |

Smiths Group Plc |

|

81 |

UU. |

United Utilities Plc |

|

82 |

JMAT |

Johnson Matthey Plc |

|

83 |

DCC |

DCC Plc |

|

84 |

PSON |

Pearson Plc |

|

85 |

SLA |

Standard life Aberdeen Plc |

|

86 |

ICP |

Intermediate Capital Group Plc |

|

87 |

SMDS |

Smith (DS) Plc |

|

88 |

SVT |

Severn Trent Plc |

|

89 |

BME |

B&M European Value Retail |

|

90 |

BKG |

Berkley Group Holdings Plc |

|

91 |

AUTO |

Auto Trader Group Plc |

|

92 |

MNG |

M&G Plc |

|

93 |

HIK |

Hikma Pharmaceuticals Plc |

|

94 |

SBRY |

Sainsbury (J) Plc |

|

95 |

LAND |

Land Securities Group Plc |

|

96 |

PSH |

Pershing Square holdings |

|

97 |

RMV |

Rightmove Plc |

|

98 |

WEIR |

Weird Group Plc |

|

99 |

AVST |

Avast Plc |

|

100 |

BLND |

British Land Co Plc |

|

101 |

RSW |

Renishaw PLC |

1 FTSE Russell, 2021

2 London Stock Exchange, 2021