The FTSE was unable to add to its gains from the day before, after the Bank of England cut rates by 25 basis points in a close decision that, on balance, appeared less dovish than the vote split would have had you believed. A sharp drop in Japanese shares overnight dented investor confidence somewhat, which came hot on the heels of a technology-fuelled rally on Wall Street on Wednesday. Investors were monitoring the situation in the Middle East after Iran threatened “harsh punishment” for Israel, which it says was responsible for assassinating Hamas’s leader. Oil prices surged on Wednesday, supporting energy names, before dipping a little today. Investors will also be keeping an eye on US technology earnings, with Apple and Amazon set to report their results after the closing bell on Wall Street. With so much going on, we are seeing two-way trades in most markets, without much follow-through. Despite the intra-day volatility, the FTSE outlook remains positive in the longer term view.

A split BoE cuts rates to 5%

For a long time now, the market had been expecting the Bank of England to make tis first rate cut after one of the most aggressive tightening cycles, and so it proved – although it was a knife-edge call. Only 5 members voted for a cut, while the remaining 4 had asked for rates to remain unchanged. The market had expected 6 members to vote for the 25-basis point rate cut, which is why we initially saw the pound dip and the FTSE rise by a few points. Anyway, interest rates are now at 5%, still way too high for many peoples liking. The decision was “finely balanced”, and the Bank has warned that they will need to be careful not to cut rates too quickly or by too much. The details of the rate statement sounded a bit more hawkish despite the vote split. Indeed, those who voted for a cut – Bailey, Breeden, Dhingra, Lombardelli, and Ramsden – found it "appropriate to reduce slightly the degree of policy restrictiveness” and felt that "inflationary persistence had not yet conclusively dissipated, and there remained some upside risks to the outlook".

BoE Governor Bailey highlighted that risk at his press conference, saying: “Key indicators of inflationary pressures remain elevated, and recent strength and economic activity is added to the risk of more persistent inflationary pressures. And this of course, gives us pause for thought much about it will need to remain restricted sufficiently long until the risks to inflation remaining sustainably around the 2% in the medium term, have dissipated further.”

After the rate decision, traders were pricing in around a 90% chance of another 25 bps cut in November.

Can oil prices extend their gains

Wednesday’s big reversal qualifies as a key reversal day on oil, but we now need to see some follow-though which has been lacking in all previous bullish attempts. As well as raised geopolitical risks and reduced chances of a ceasefire in Gaza, oil prices have been supported by further sharper-than-expected drop in US oil stocks, suggesting US driving seasons is well and truly underway. Should oil prices rise further, then that’s something that could support the FTSE outlook given the impact energy stocks like BP and Shell have on the index. At the time of writing, however, oil prices were a little weaker on the day.

Japanese stocks tumble amid yen resurgence

Japanese stocks took a nosedive overnights as exporters felt the pinch from a surging yen, while the Bank of Japan's historic tightening measures pushed up rates and hit real estate shares hard. Automakers and department stores—which had thrived on a tourism boom fuelled by a weaker yen—also saw significant declines. Further falls in Japanese shares could have negative ramifications for global stocks, although most of the impact will likely be contained to Japanese shares.

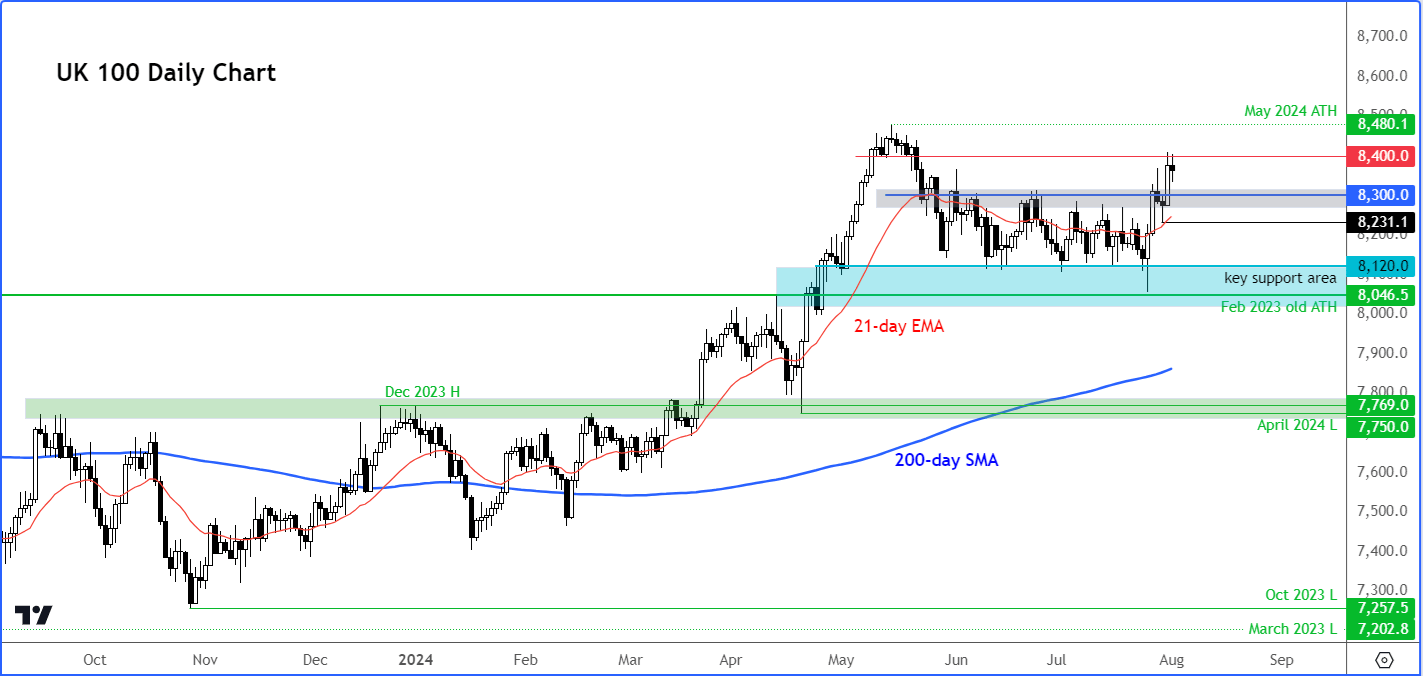

FTSE outlook: Technical analysis and levels to watch

Source: TradingVIew.com

The FTSE is still pointing higher from a technical point of view despite today’s slight weakness. The UK benchmark index broke below a well-established support level around 8120 area last Thursday, before quickly recovering to rally into the close. That false breakdown marked a key reversal pattern and since then we have seen every dip being bought. Now back above the 21-day exponential moving average and prior resistance levels such as 8300, the path of least resistance remains to the upside until the charts tell us otherwise. As things stand therefore, the technical FTSE outlook is positive, even if it lacks short-term momentum.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R