- UK FTSE 100 futures stage bullish breakout on strong volumes

- GBP/USD attracts buyers below 1.2850

- UK markets to be heavily influenced by US tech earnings in the coming days

- US Fed, BoE rate decisions will be in focus later in the week

FTSE 100 futures break higher

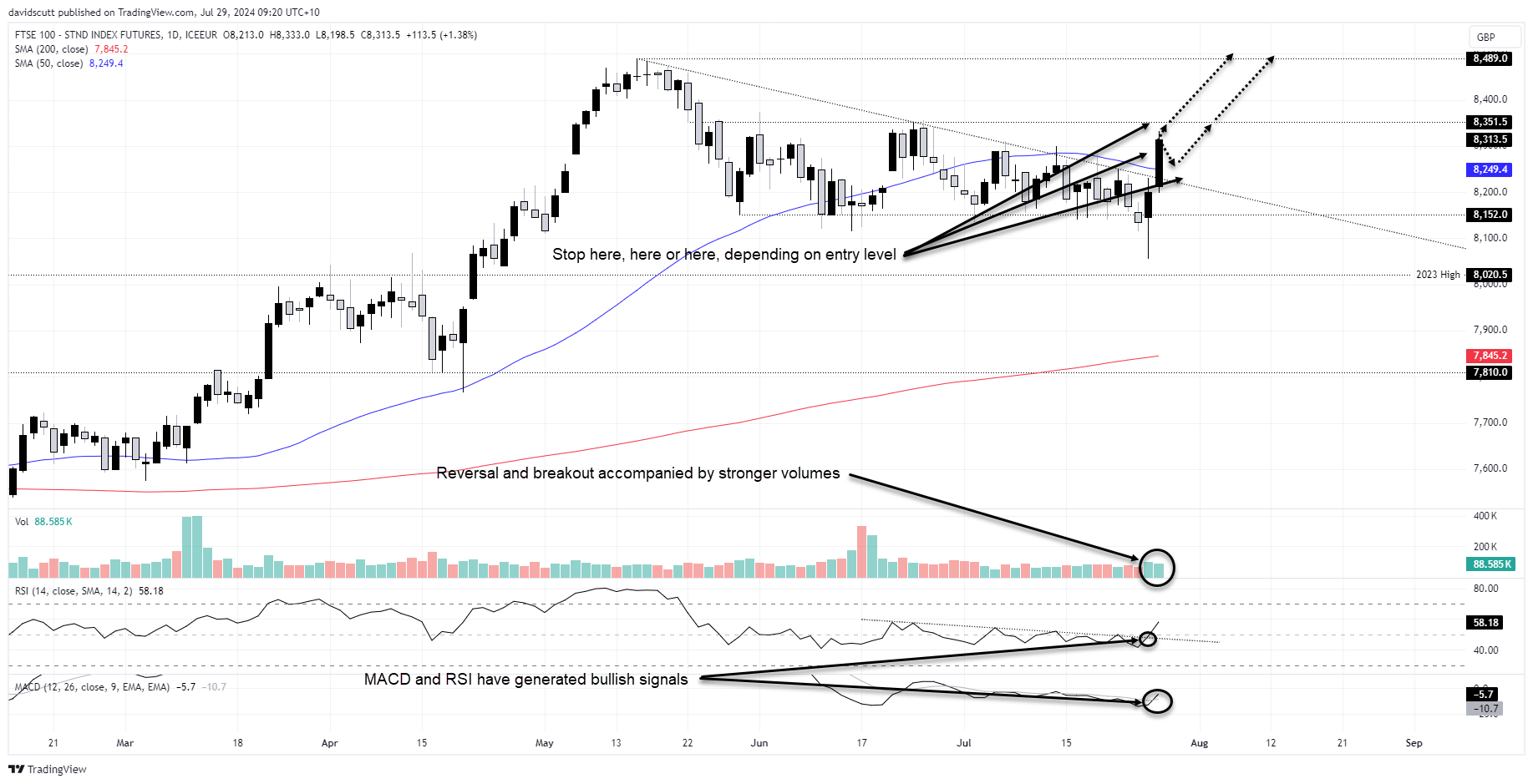

From dire to delightful in the space of two sessions – that’s was the rollercoaster ride UK FTSE 100 bulls had to endure late last week with futures taking out stops layered below 8152 before reversing hard on Friday, breaking above the 50-day moving average and downtrend resistance dating back to the record highs of May. Closing at the highest level since June 24, it looks like the move may extend further this week with MACD and RSI triggering bullish signals, hinting at a potential retest of the former highs.

Trade ideas

Those positioning for such an outcome have a variety of setups to choose from depending on how the price action evolves on Monday.

Ideally, a retest and hold above the 50-day moving average would be the preferred setup, allowing for a stop to be placed below the level for protection. Potential upside targets include 8351.5 and record high of 8489.

For those itching to buy the breakout immediately, you could place a stop below 8300 for protection. Targets would be the same as those mentioned above. The final option would be to wait for a potential break and hold above 8351.5, allowing for longs to be established above with a stop below to protect against reversal. That setup would need to target 8489 to make the trade stack up from a risk-reward perspective.

Risk-laden week awaits

Even though the composition of the indices is very different, you get the sense Microsoft’s earnings report after the market close on Wall Street on Tuesday will be highly influential on whether the FTSE sees record highs this week.

Should the bullish momentum be sustained, it will come down to the market reaction to the Fed interest rate decision on Wednesday and Bank of England policy decision on Thursday. The Fed is likely to leave rates on hold but signal a rate cut is likely in September. The BoE outcome is far less certain with markets deeming the outcome a coin flip.

With other central banks turning dovish, I suspect we may see the MPC do a RBNZ and reprioritise growth over the threat of an inflation reacceleration, delivering the first cut of the easing cycle. If it does lower rates, the signal on the likely path of rates in the future is likely to be more influential on the decision itself, so keep an eye on Governor Bailey’s press conference.

GBP/USD basing at 1.2850?

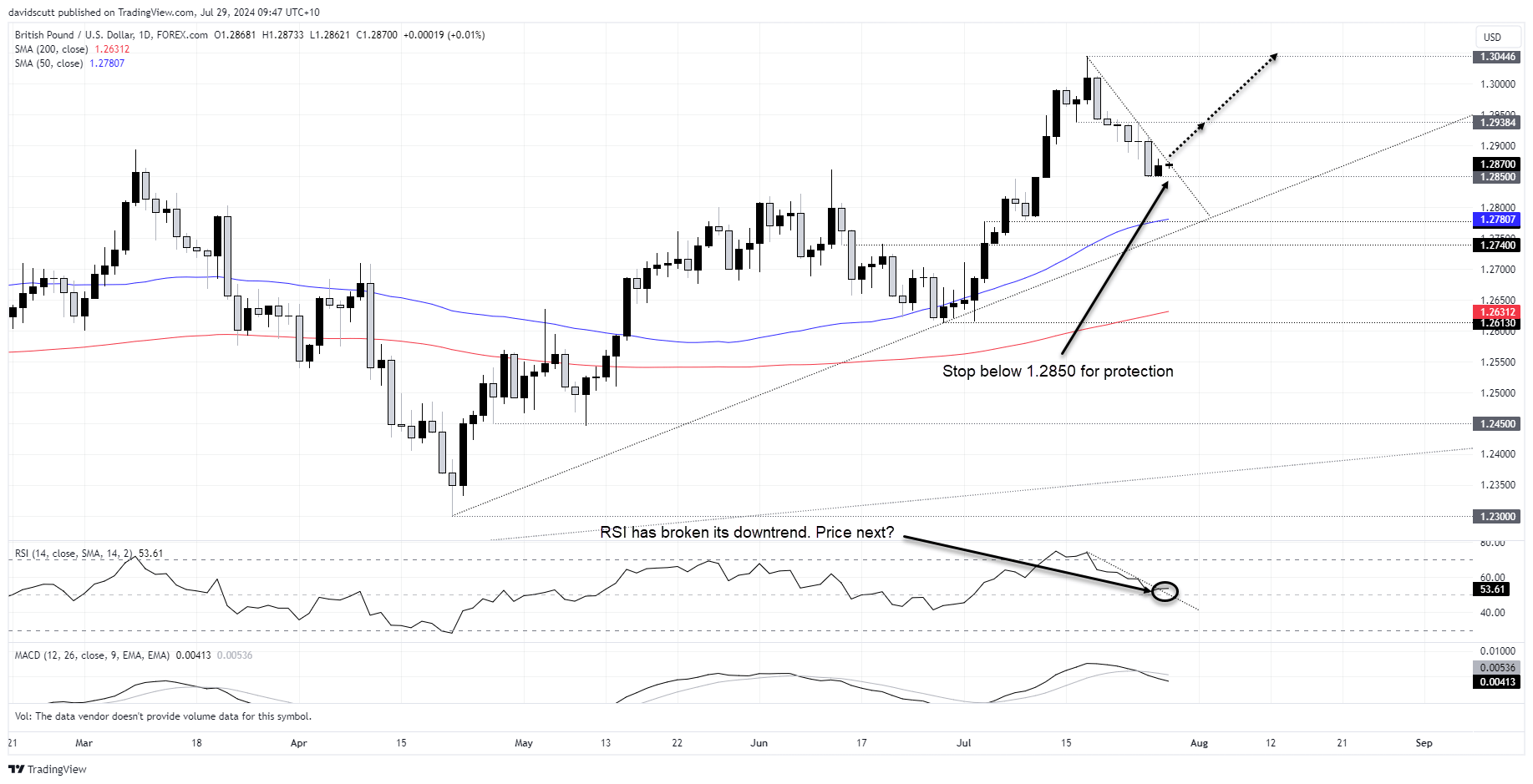

While not as spectacular as the move in UK stock futures, GBP/USD looks like it may soon break the downtrend it’s been stuck in from the highs struck on July 17, squeezing up against the level in early Asian trade after looking like it may have based at 1.2850 last week.

While MACD has yet to confirm, RSI has already broken its downtrend, pointing to a potential reversal of bearish momentum. Like FTSE 100 futures, GBP/USD is likely to be influenced by not only central bank rate decisions but also the performance of riskier asset classes, sitting with a correlation of more than 0.8 with Nasdaq 100 S&P 500 futures over the past 10 trading sessions. That suggests US tech earnings may dictate its moves early in the week.

Should we see the downtrend break, traders could initiate longs with a stop below 1.2850 for protection. Upside targets include 1.293854 and 1.30446. As with any of the trades discussed in this note, consider using trailing stops, or lifting your stop loss to entry level, should the price action work in your favour initially.

-- Written by David Scutt

Follow David on Twitter @scutty