It’s been more than three months since our last “State of the 2020 US President Race” report, and while we’ve seen countless massive storylines (ongoing protests across the country, another 100k Americans dying from COVID-19, the biggest quarterly decline in GDP in more than 70 years, the death of a Supreme Court justice, the leak of Trump’s taxes, the acrimonious first Presidential debate, and President Trump getting hospitalized – and now released – with COVID-19, to name just a few), perhaps the biggest “October Surprise” is how stable polls of the race have been over the last few months.

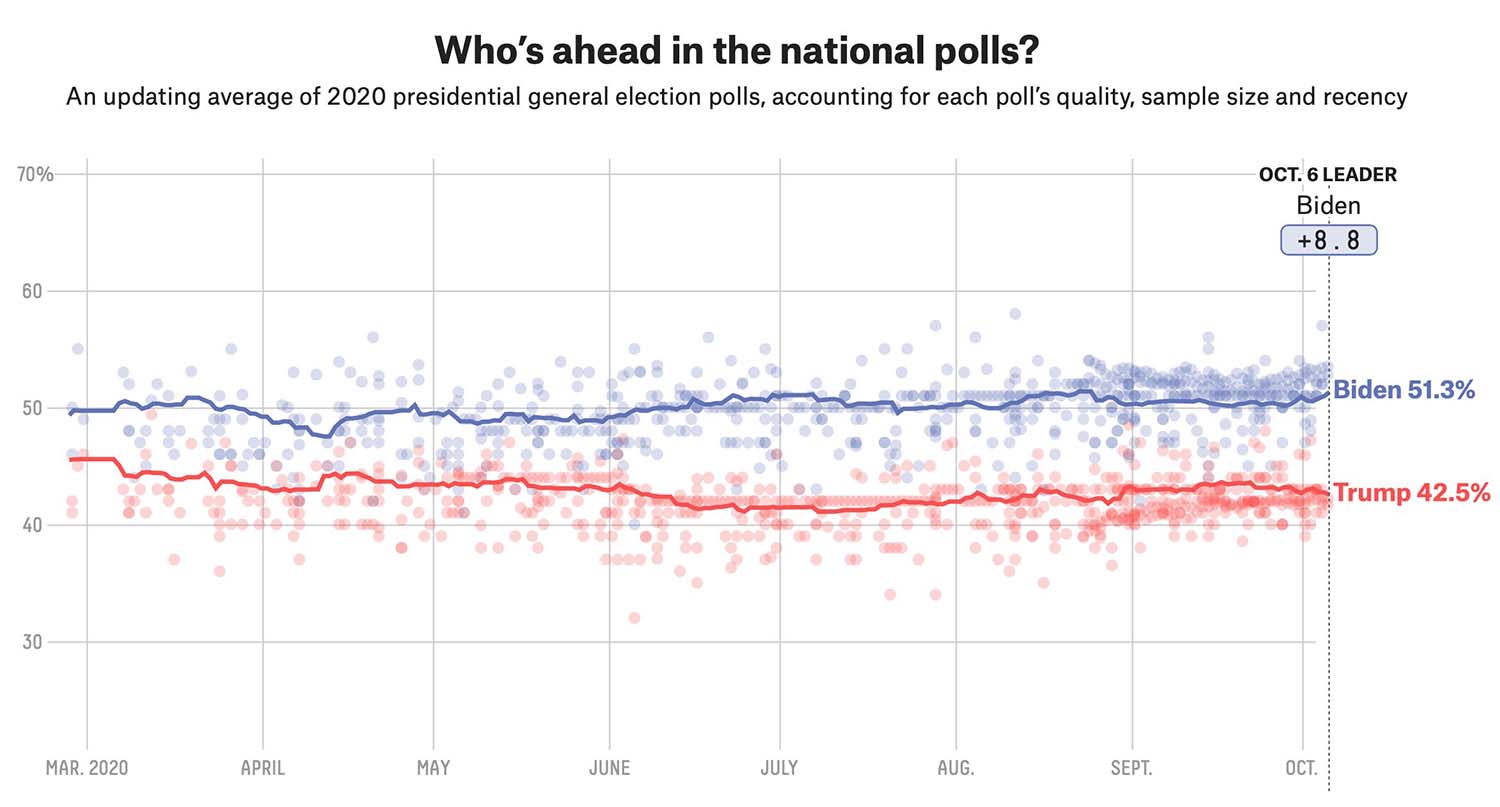

Back in late June, the RealClearPolitics polling average showed Biden leading 51-41; the equivalent figure today is 51-42. Meanwhile, the FiveThirtyEight polling average has also gone from 51-41 in favor of Biden in late June to 51-42 now. In other words, neither of these polling averages has moved meaningfully, but more than three months have passed, leaving far less time for the underdog (Trump) to turn things around:

Source: RealClearPolitics

Source: FiveThirtyEight

Of course, as we all recall, Trump was able to overcome a deficit in the popular vote to upset Hillary Clinton four years ago on the back of a late shift in undecided voters (of which there are far fewer this time around) and an advantage in the makeup of the Electoral College (a big tailwind for the Republican candidate in 2020 as well). That said, it’s worth noting that the 2016 race was far more volatile, and that Clinton never held a lead nearly this large in the final month of the race, so to the extent that the polls are indicative of the current state of the race, Biden remains the clear frontrunner. Betting markets agree, with prediction markets like PredictIt showing Biden as a 64-39 favorite as of writing.

Just as significantly, control of the US Senate may also come into play in 2020, creating the potential for a “Blue Wave” scenario wherein Democrats retail control of the House of Representatives, take control of the Senate, and win the Presidency (my colleague Vincent Deluard wrote about this scenario and the potential market implications back in July). In particular, traders will be watching tight Senate races in states like Iowa, Maine, North Carolina, Montana, Georgia, Colorado, South Carolina, and Arizona as potential Democratic pickups. While not necessarily the base case scenario, a “Blue Wave” would align the priorities of all federal lawmaking bodies, raising the odds of a major stimulus bill and potentially reviving the risk of inflation.

Market Implications

It’s always a fraught exercise to make market predictions based on political projections, so readers should take any speculation (including ours!) with a hefty grain of salt. That said, as the polls have tilted further toward Biden in recent days, we’ve seen the US dollar trend lower, US stocks recover, treasury yields spike, and gold regain the $1900 level. The combination of these moves suggest that traders are preparing for a potential reflation trade, where more aggressive government spending could boost nominal GDP growth at the risk of rising inflation. This type of environment, if seen, may benefit the following assets in the runup to the election and beyond:

- US stocks, including beaten-down value and cyclical stocks

- Growth-oriented currencies like the Australian dollar

- Precious metals including gold and silver

By contrast, the following more conservative assets could struggle:

- US fixed income of all types

- “Bond-like” investments (preferred stock, utilities, REITs, etc)

- Safe haven currencies like the Japanese yen and Swiss franc (and perhaps even the US dollar itself!)

Finally, we wanted to check in our proprietary “Trump 30” and “Biden 30” thematic indices, which contain 30 stocks that may benefit the most depending on which candidate wins the election (please note that these indices may not be available to trade in all regions). Supporting the general theme of the article, the Biden index is dramatically outperforming the Trump index since mid-August, suggesting that traders are already shifting their allocations based on their expectations for the election.

Source: GAIN Capital

With potentially “game-changing” news trickling out by the hour, the only guarantee is that we’ll have plenty more twists and turns in the four weeks leading up to Election Night. As always, we’ll continue to cover all the major developments and put them in context to help you trade through this truly unprecedented election and beyond. Stay tuned!