The volatility rippled across the charts on January 5th, 2024, following the consecutive release of the non-farm payroll and the ISM Services PMI results, leaves a question mark for today’s scenario. For today:

-

U.S. non-farm payroll results dropped towards 175K, adding bearish pressures to the U.S Dollar Index and bullish pressures upon the EURUSD charts

-

ISM PMI Services are expected to increase further into industrial expansion metrics, from 51.4 to 52. Being a leading economic growth metric alongside the ISM PMI Manufacturing Index, the strength of its result can either amplify or reverse those imposed by today’s NFP results.

EURUSD - 1H Time Frame – 05/01/2024

With direct negative correlation to the U.S Dollar Index, the previous impact of the mentioned indicators stirred a volatility range of 72 pips on the EURUSD chart, giving caution to the release once again.

EXY – 4H Time Frame – Logarithmic Scale

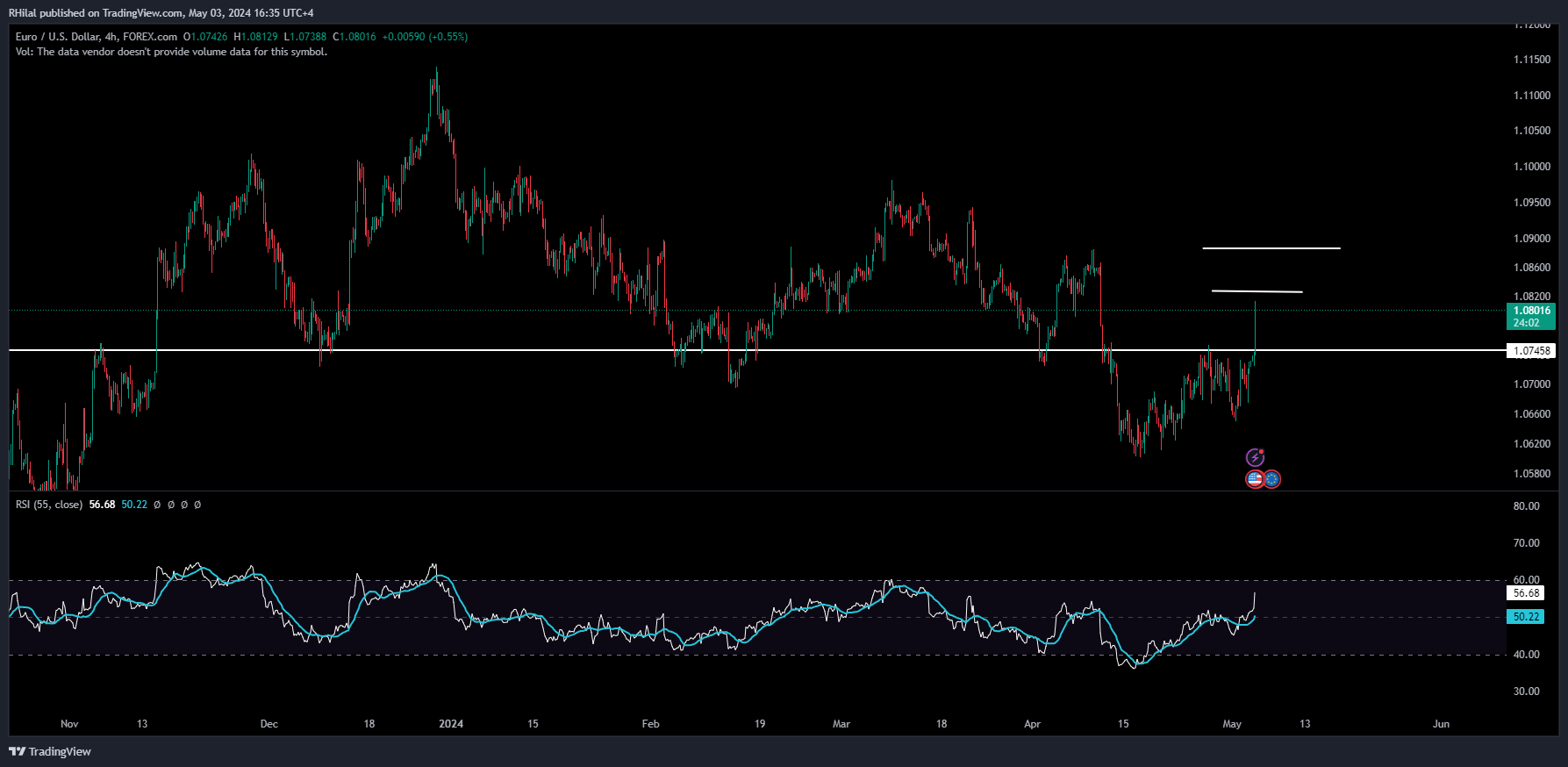

EURUSD – 4H Time Frame – 5/03/2024

The EURUSD jumped amid negative non-farm payroll results, surpassing the significant 1.0750 zone, and heading towards the potential resistance levels near 1.0830 and 1.0880 highs consecutively. The smoothed relative strength index is in a strong bull mode; however, if bearish momentum enters the play, prices can potentially hold support near 1.0750 again.

The upcoming ISM Services PMI result is watched closely for a momentum addition or reversal to the current chart trends.