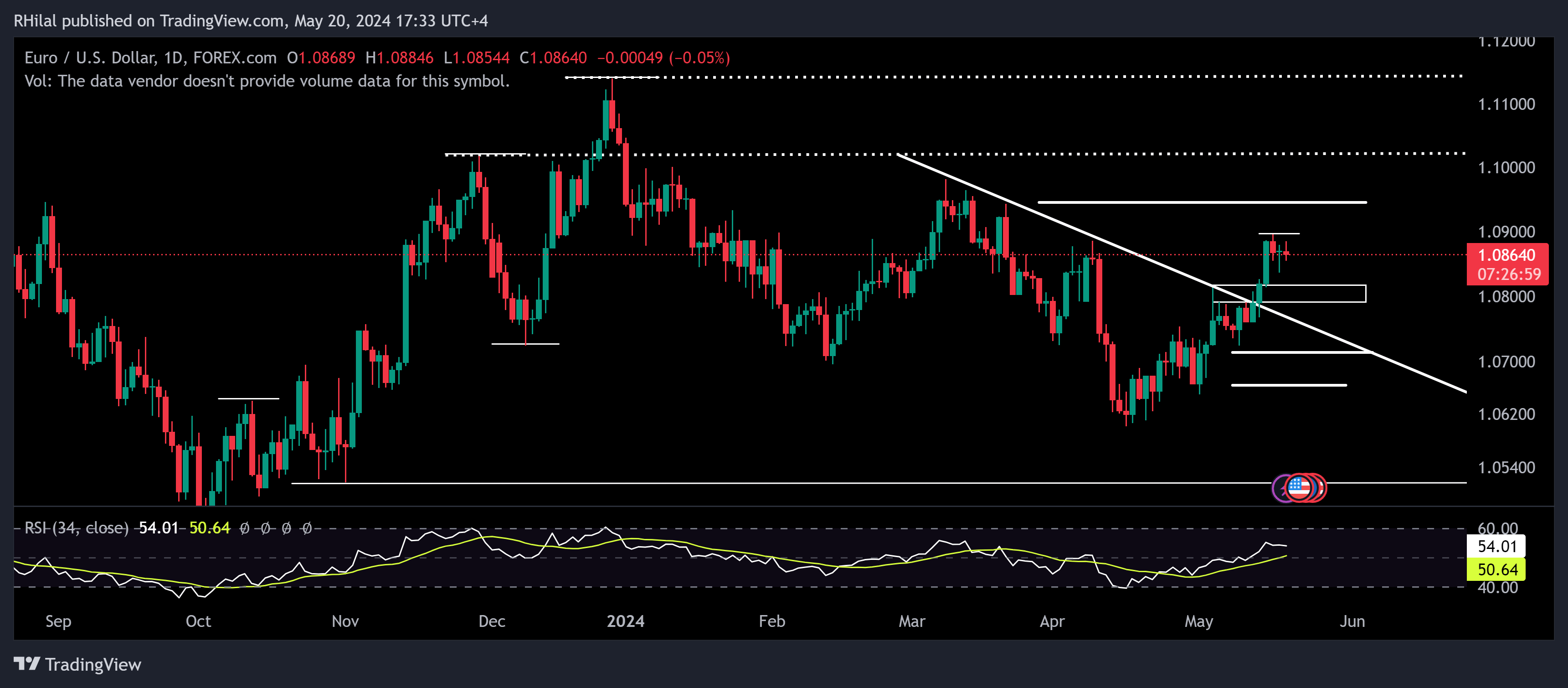

- EURUSD Outlook: the 1.09 resistance is challenged for further uptrends

- Volatility is expected with FOMC minutes on Wednesday

- Volatility is expected with the release of Flash PMI Data on Thursday

With markets eagerly anticipating any signs of an upcoming Fed rate cut, the upcoming FOMC minutes are watched closely on Wednesday for potential insights. April’s data is still insufficient to justify rate cut decisions, and more data is needed to assess policy directions.

Currently, markets are trading on the fragile hopes that rate cuts are on the near horizon. This optimism boosted EURUSD to climb slightly below 1.09. Beyond the potential volatility from the FOMC minutes on Wednesday, the Flash Manufacturing PMI data on Thursday is set to stimulate further volatility onto the Euro charts at the time of its release.

Quantifying the volatility from a technical perspective:

The EUR/USD pair is still challenged by the 1.09 resistance. From a smoothed relative strength perspective, the chart indicates more room for upside momentum, and a breakout above 1.09 is needed for further confirmation. Upside targets remain at the previously mentioned March highs near 1.0950 with further potential resistance near 1.1020. On the downside, short-term support can be expected near 1.0814 and 1.0780. A deeper drop can find support near 1.0750 and 1.0730 consecutively.