This morning saw the EUR/USD rise above 1.10 handle as I had been banging on about it in my recent notes. The EUR/USD outlook remains cautiously positive for now, with investors eyeing a potentially weaker-than-expected US CPI report later. Will that come to fruition and how high could the euro rise from here?

What is supporting the EUR/USD?

With industrial data remaining weak in the Eurozone and after a dismal ZEW survey for Germany yesterday, you might be wondering what on earth are FX traders smoking by bidding up the EUR/USD?

Well, from the Eurozone side, it is sticky inflation in the services sector that is preventing markets to price in aggressive rate cuts from the ECB. At the moment some 50 to 75 basis points of cuts are priced in by year-end, as opposed to around 100 bps for the Fed.

While weakness in Eurozone data persists, this popular FX pair has largely been driven largely by two factors: 1) recent weakness is US dollar and 2) positive risk sentiment.

Today, all eyes will be on the US CPI inflation data which should have an impact on both of these influences.

EUR/USD outlook: All eyes on US CPI

Following a weaker PPI report on Tuesday, investors will be hoping for a weaker CPI print today compared to a headline and core prints of +0.2% expected.

If seen, or even if the data is line with forecasts, this could further cement expectations for a 50-basis point rate reduction in September and a total of 100 bp cuts for 2024. This scenario should further boost the EUR/USD outlook.

However, a strong print, which is evidently not priced in, could have a big negative impact on this and other major FX pairs.

Eurozone industrial production disappoints again

The only disappointment in eurozone data today was again a familiar story.

News of 0.1% month-on-month drop in June in industrial production disappointed expectations but it shouldn’t have. The drop in June continues a long-standing trend of decline in the eurozone's industry. Although a recovery has been anticipated for some time, evidence for an imminent turnaround remains scarce. This obviously doesn’t bode well for GDP and what it means for overall growth is that once again the services sector will have to pick up the slack.

As mentioned, this latest disappointment should not have come as much of a surprise, truth be told. For, PMI surveys and other leading indicators had pointed to a weakening outlook anyway and more weakness was reported at the start of the third quarter.

So, we should therefore expect to see further contraction in production in hard data. Perhaps this is why the euro hardly reacted to the release of the disappointing data this morning.

Eurozone GDP expands 0.3% in Q2

The 0.3% rise in eurozone economy between April-June was bang in line with expectations as well as the preliminary estimate and comes after a similar performance in Q1. GDP is backward-looking and doesn’t tend to move the euro much as most of the time it is already priced in, especially given the fact this is the second estimate and we have seen several other growth pointers that come out ahead of the GDP.

With industrial output struggling to turn the corner and recent PMI data from the services sectors being far from great, GDP growth in Q3 is likely to weaken.

But for as long as we have a weaker US dollar story, this should worry the EUR/USD bulls too much.

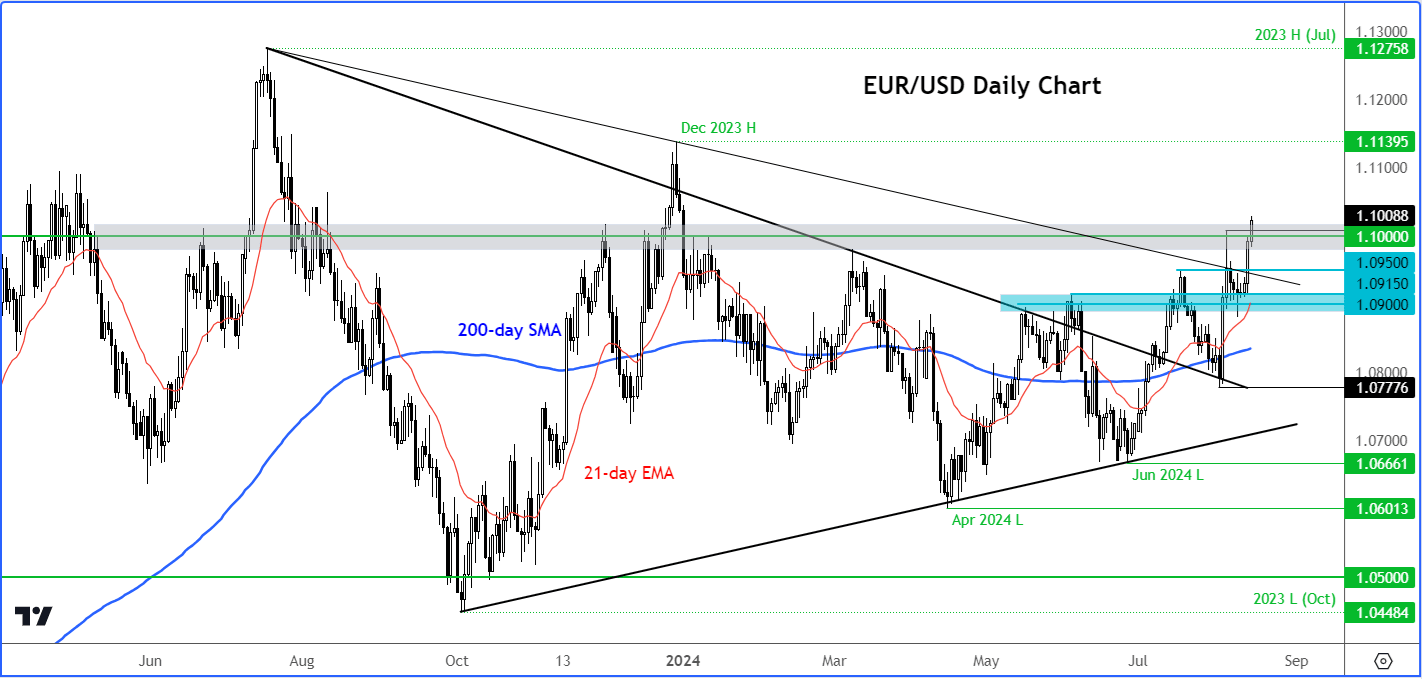

EUR/USD outlook: Technical analysis

Source: TradingView.com

The EUR/USD is now up for the second month and is at its highest levels since early January. It is about to turn positive on the year, in other words, CPI permitting. Last year, it ended a two-year losing streak. So, bullish momentum is building to align with a longer-term upward trend. Indeed, rates are now somewhat comfortably above the longer-term 200-day average and also the short-term 21-day exponential. The latter is above the former and this crossover of the moving averages is a non-objective way of telling what the trend is. Hint: it is not bearish. Therefore, unless we see a big reversal signal in the coming days, we will continue to favour bullish setups on the dips than bearish setups at resistance as the technical EUR/USD outlook is bullish. From here, a rise towards the December high of 1.1340 looks likely. Support comes in at the now broken 1.1000 handle, followed by the 1.0950ish area and finally 1.0900.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R