As my colleague Joe Perry eloquently noted this morning, we’ve seen a dose of strong US data this morning, boosting the US dollar. Meanwhile, the euro is one of the day’s weakest major currencies on the back of a weak construction report and downbeat economic comments from new Italian PM Mario Draghi.

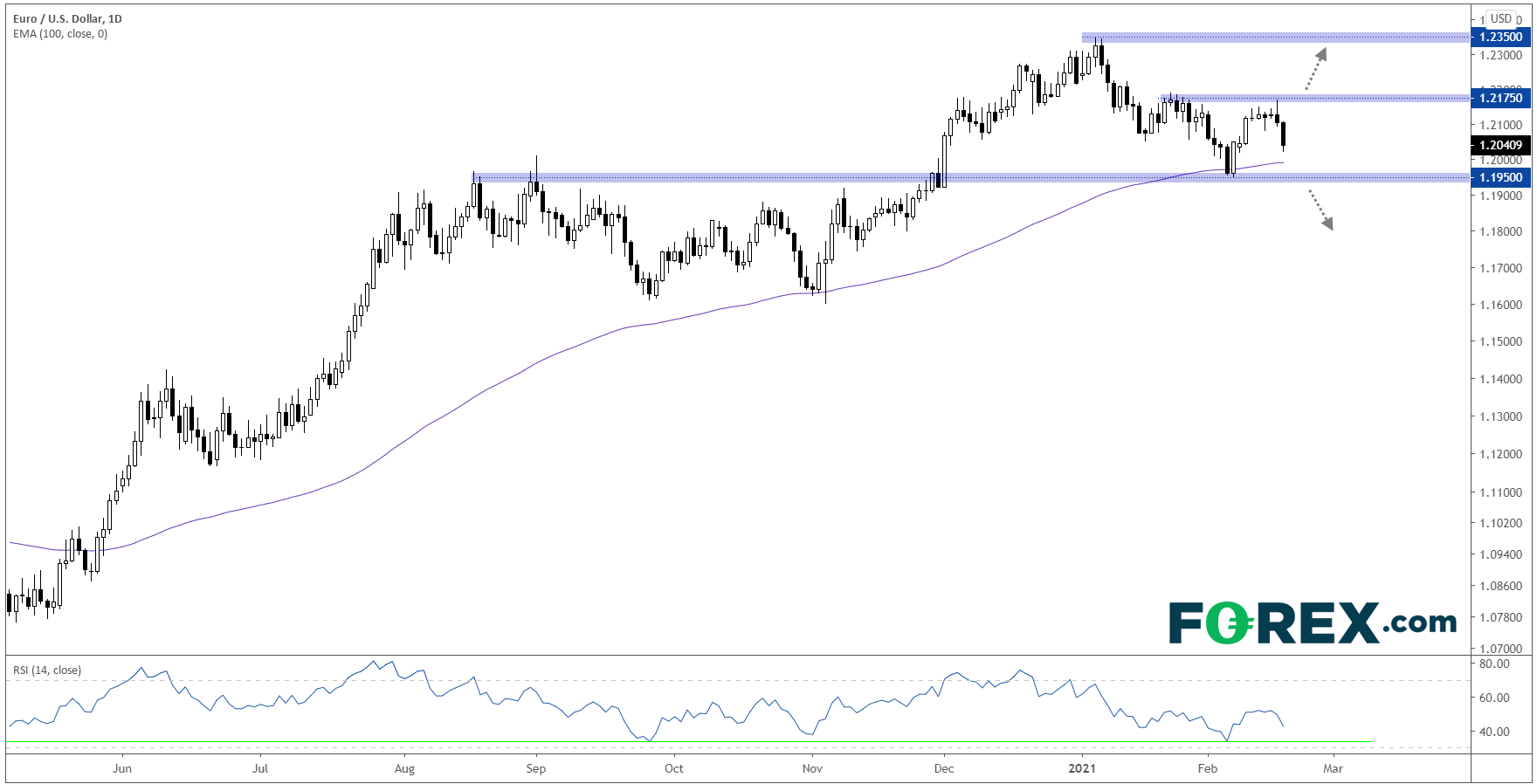

Looking at the chart of EUR/USD, rates are trading back near the psychologically-significant 1.20 level after putting in a series of lower highs and lower lows so far this year; rates have only closed below the widely-watched 1.20 handle once since November. Taking a longer-term perspective, the world’s most widely traded pair is also approaching its 100-day EMA, which has provided strong support since last June:

Source: TradingView, GAIN Capital

In other words, the longer-term EUR/USD uptrend is at risk, with a potential break and close below the 3-month low at 1.1950 (if seen) signaling that the momentum has shifted in favor of the bears and hint at a move toward 1.18 or lower next. One sign that astute readers may want to watch as a possible leading indicator is the 14-day RSI. The indicator hasn’t dipped into “oversold” territory (< 30) since February, so a breakdown in that oscillator could serve as an early signal that the exchange rate itself is vulnerable to a breakdown.

Of course, we never want to become too focused on just one outcome. For bulls to regain the upper hand, we’d need to see EUR/USD break above its one-month high near 1.2175, a development that could pave the way for a continuation up toward 1.2350 resistance in the coming weeks.

Learn more about forex trading opportunities.