EUR/USD falls ahead of FOMC minutes

The euro is under pressure against a stronger U.S. dollar as investors see the Fed cutting rates at a slower pace. All eyes are on the FOMC minutes later today and the US inflation data tomorrow.

USD is rising Wednesday back towards a seven-week high versus its major peers after comments from Federal Reserve officials pointed to a gradual approach to rate cuts

Atlanta Fed president Raphael Bostic said he saw little sign of weakness in the US jobs market and noted that inflation is still above the Fed's 2% target.

The market will look to the minutes of the September meeting, during which the central bank cut rates by 50 basis points to begin its rate-cutting cycle. Markets will scrutinise the minutes for further clues about why policymakers opted for an outsized cut and what the Fed’s next move could be.

The minutes come ahead of US inflation data, which is due tomorrow and is expected to cool back to 2.3% YoY.

The market is currently pricing in an 85% probability of the Fed cutting rates by 25 basis points in November and a 15% chance that the Fed could leave interest rates unchanged this month.

Meanwhile, the euro is struggling despite stronger-than-expected German trade data and industrial production figures yesterday. The data doesn’t detract from a weak outlook for the eurozone’s largest economy and, more broadly, for the region.

The ECB is expected to cut interest rates in October as growth in the region slows and inflation has fallen below 1.8%.

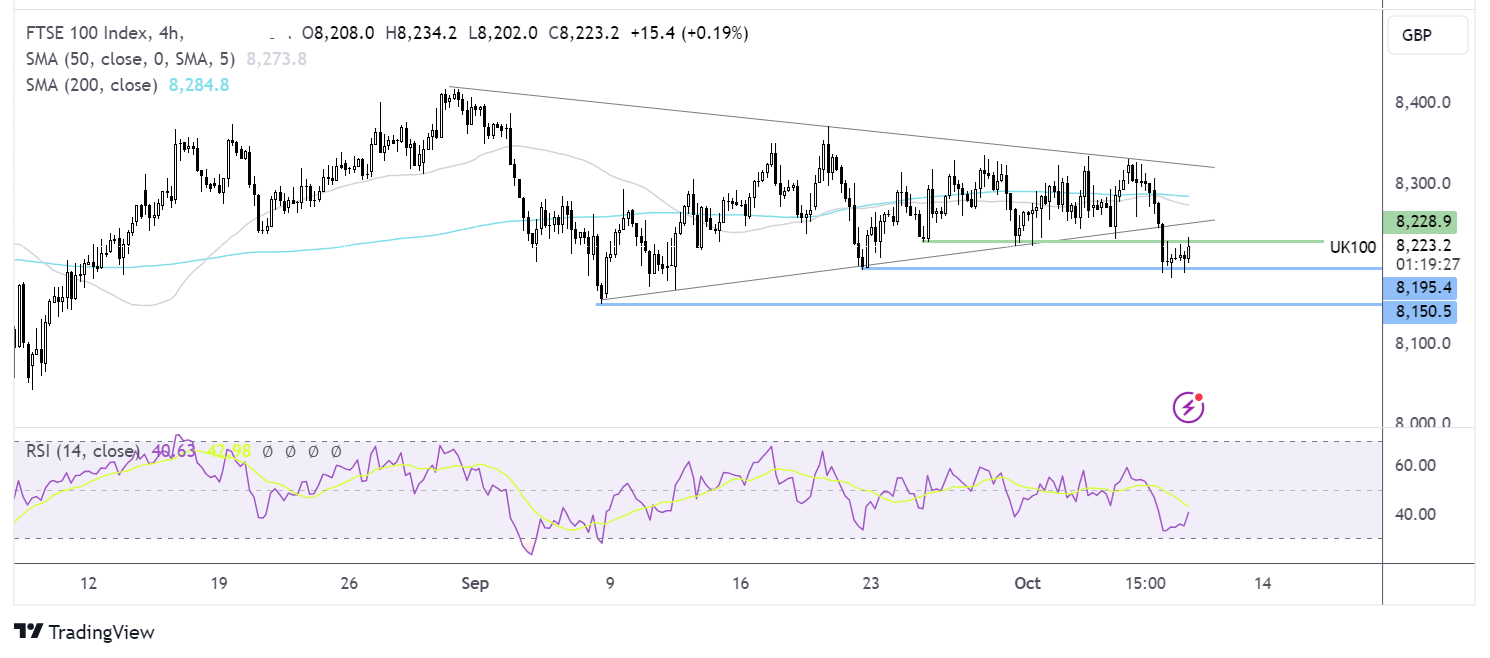

EUR/USD forecast – technical analysis

EUR/USD formed a double top at 1.12 and fell sharply lower, taking out the falling trendline and 1.10 supports. This, combined with the RSI below 50, keeps sellers hopeful of further losses.

Sellers will look to break below 1.0950 to extend the selloff to 1.09 and 1.0870 the 200 SMA.

Should 1.0950 support hold, any recovery would first need to retake 1.10. Above here, the 50 SMA at 1.1050 comes into play ahead of 1.11.

FTSE 100 rebounds after yesterday's drop

The FTSE 100 is rebounding on Wednesday from a one-month low reached in the previous session, With all sectors moving higher.

The UK index suffered a grim day on Tuesday, dropping 1% as a lack of new stimulus measures to buoy China disappointed market sentiment, pulling resource stocks and Asian exposed banks sharply lower.

Today's news that Chinese consumer spending fell during the latest golden week has further damaged confidence. The Chinese CSI300 dropped 6.5%, while the Hang Seng fell 2.5% after dropping 9.5% yesterday. The weakness in Asia suggests that the stimulus announced so far may not be enough to sustain a long-term pickup in domestic demand and economic growth.

Despite the weakness in China, miners and resource stocks have steadied.

The UK economic calendar is quiet today. Attention will be on the FOMC minutes, which are due to be released later today. The minutes could provide more clues on why the Fed opted for an outsized cut and where it sees the path for rate cuts going.

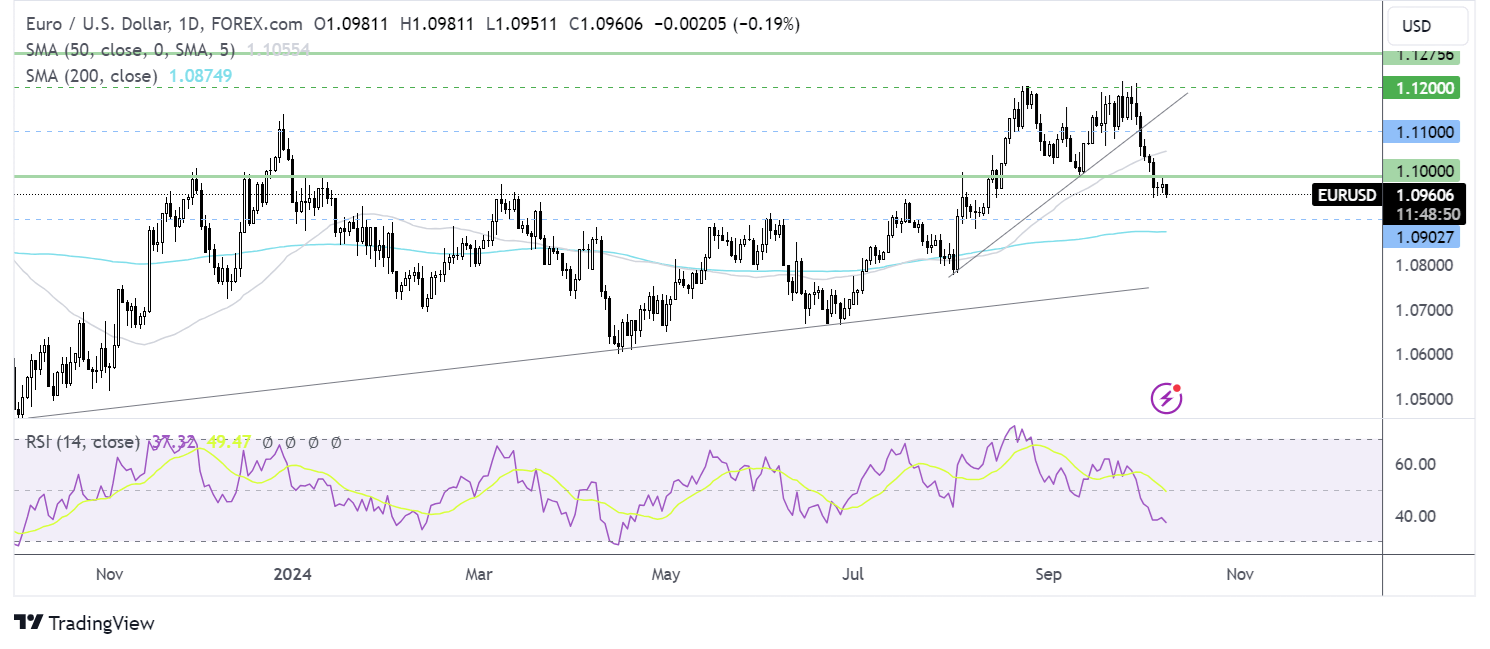

FTSE 100 forecast - technical analysis

The FTSE broke out of the symmetrical triangle, falling to support at 8200. The price is consolidating between 8230 and 8200.

Sellers will look to extend the bearish move below 8200 to 8150, the September low. Below here, 8050, the August low comes into play.

Buyers will look to rise above 8230 to bring the rising trendline resistance into focus at 8250. A rise above here exposes the 200 SMA at 8275. Buyers could gain momentum above this level.