- EURUSD drops below 1.07

- France 40 drops near yearly lows

- ECB Lagarde Speech is next for an interest rate and economic outlook

- DXY vs EURUSD chart analysis

Following a more hawkish than expected stance by the FOMC projections and statements, coupled with political turmoil in France, the EURUSD reversed its gains from the 1.0852 high and dropped back below the 1.07 level, retesting the key 1.0670 level. Higher volatility is expected before the weekly close, driven by Christine Lagarde's upcoming speech later today and ongoing political developments in the EU.

EURUSD Forecast: DXY – Daily Time Frame - Logarithmic Scale

Soaring back to its yearly up trending channel, the DXY hit a potential resistance level at the 105.40 high as the EURUSD retested the 1.0670 low. With positive momentum, the 105.60 level is next in sight above the 105.40 high, followed by May 2024 highs near the 106-zone, which aligns with the mid-channel area. A reversal back below the 104.20 – 104 zone, below the yearly channel, can dominate a bearish sentiment on the chart.

Why is the 1.0670 la key level for the EURUSD?

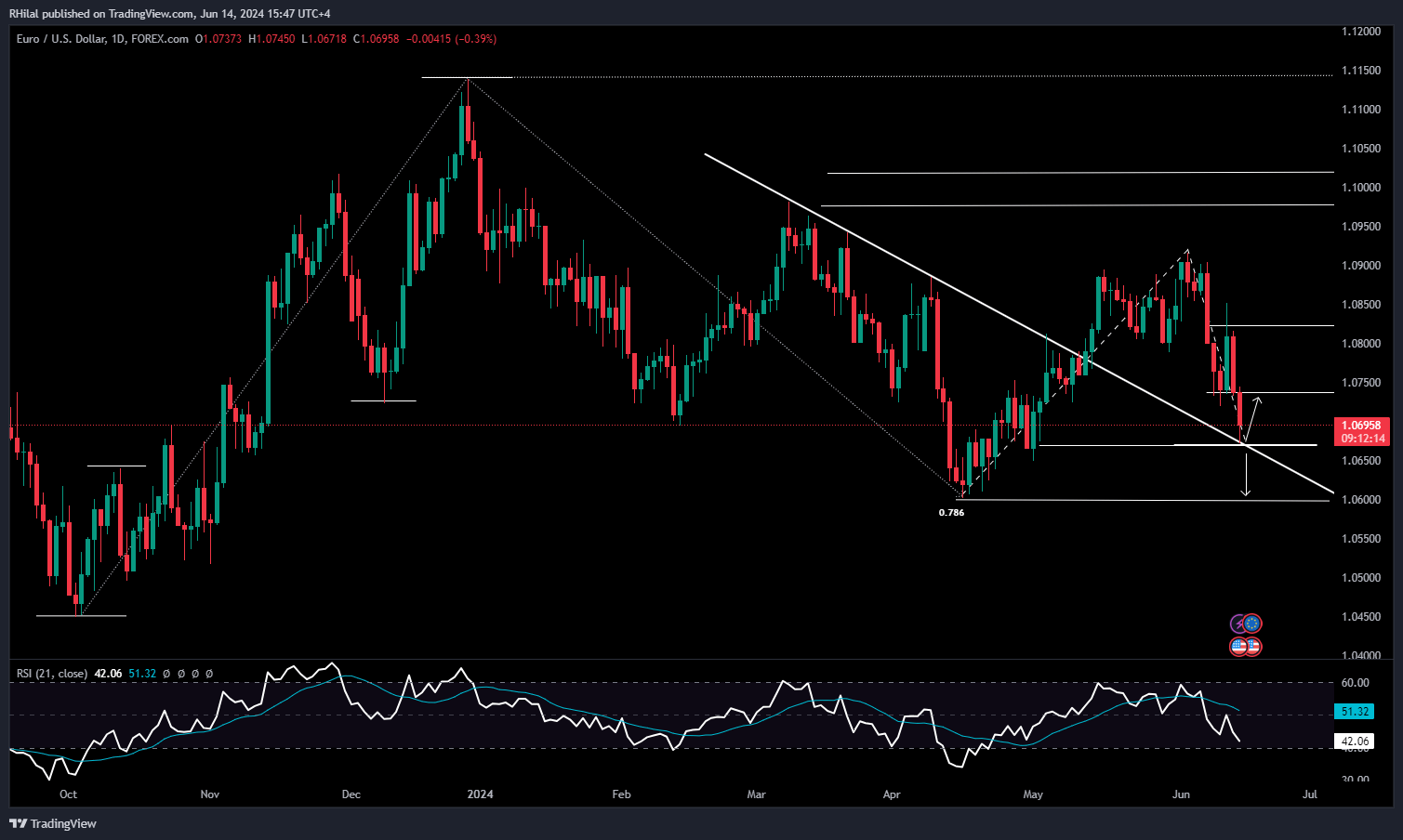

EURUSD Forecast: EURUSD – Daily Tile Frame - Logarithmic Scale

Dropping below 1.07, the EURUSD retested the upper border of the previous resistance connecting March, April, and May highs consecutively at 1.0670. The 1.0670 level aligns with the 0.786 retracement between April lows and June highs. With momentum still pointing lower a break below 1.0660 could push the trend back towards April lows near 1.06.

Proceeding with a reversal from the following down-trending resistance, confirmed by a reversal from momentum trends, the next potential levels to watch are 1.0740 and 1.0820.

--- Written by Razan Hilal, CMT