Article Outline

- Key Events: German Prelim CPI, ISM Services PMI, and U.S. Non-Farm Payrolls

- EUR/USD Trend Scenarios: Bullish reversal bias vs. primary downtrend (3-day and monthly timeframes)

- Technical Analysis (TA) Tip: Forecasting with channels

Key Events

Eurozone Inflation The EUR/USD ended 2024 on a bearish note, driven by the strength of the U.S. dollar, ECB rate cuts, and persistent challenges in the services inflation sector. The final ISM Services PMI of December 2024 edged up in December to 51.6. With the Federal Reserve adopting a more hawkish than expected tone in 2025, alongside policy implications of a Trump presidency, the anticipated trajectory of ECB rate cuts may slow, reflecting caution over inflation risks.

US Non-Farm Payrolls

The key market catalyst this week, alongside anticipations of Eurozone monetary policy, is the U.S. Non-Farm Payrolls report due Friday. Market expectations point to a decline in payroll figures, from 227K to 154K, which could stabilize the EUR/USD above the 1.02 level this week, at least temporarily, until the results are confirmed.

Technical Analysis: Quantifying Uncertainties

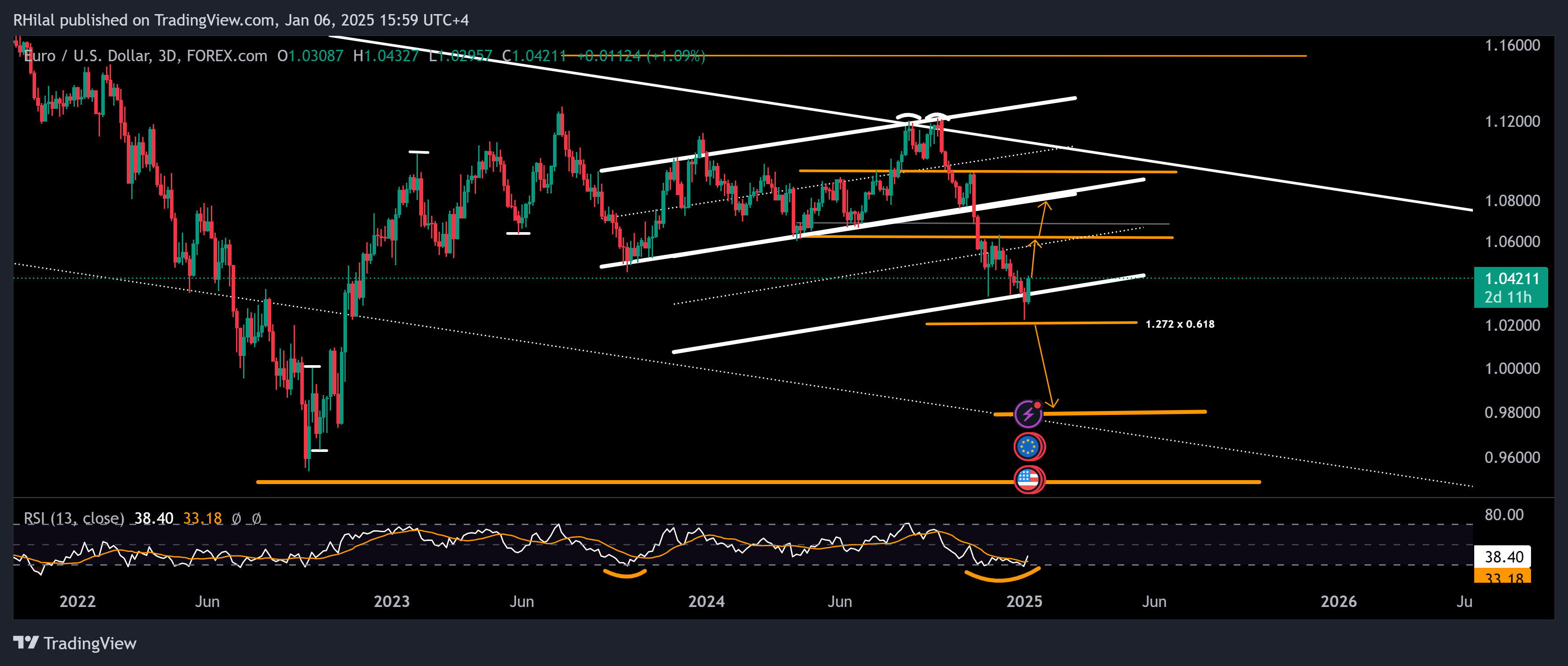

EURUSD Forecast: 3 Day Time Frame – Log Scale

Source: Tradingview

From a 3-day timeframe perspective, a bullish engulfing pattern has emerged between the 1.022 low and the current 1.0430 high, reinforcing a bullish bias. Additionally, the rebound in the Relative Strength Index (RSI) from oversold levels, last observed in October 2023, supports this view.

The current price zone also aligns with the lower boundary of a duplicated parallel channel extending between October 2023 and November 2024. A bullish reversal could potentially target resistance levels at 1.0630, 1.07, and 1.0840.

However, a decline below the recent 1.022 low could signal a deeper bearish move, with downside targets at dollar parity (1.00) and further extensions to 0.98 and 0.95.

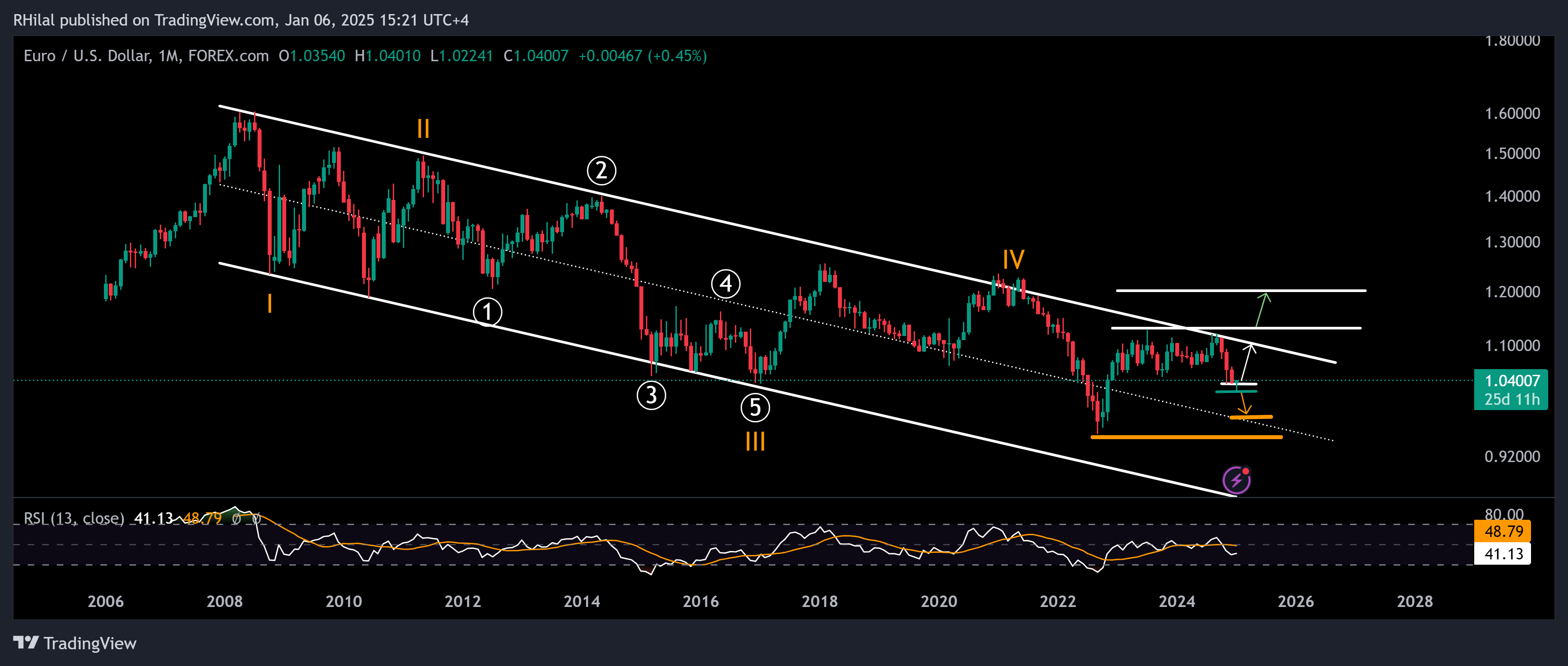

EURUSD Forecast: Monthly Time Frame – Log Scale

Source: Tradingview

On a monthly scale, the EUR/USD remains under pressure within a long-term downtrend channel established since 2008. A decisive break above the upper boundary of this channel is crucial to confirm a sustained bullish reversal.

Key levels to monitor:

- Long-term resistance: 1.12, 1.13, and 1.15

- Support levels: 1.02, 1.00, 0.98, and 0.95

Technical Analysis (TA) Tips

When forecasting trends using channels, duplication of the established channel in the direction of the breakout can provide insights into potential target levels. For accurate analysis, the channel must clearly encapsulate at least two reversals at both ends to ensure validity. The upper boundary, midline, and lower boundary of the duplicated channel can serve as key support and resistance levels.

--- Written by Razan Hilal, CMT on X: @Rh_waves and Forex.com You Tube