- Further declines in CPI figures add confidence towards rate cut bets

- US02Y momentum is dropping towards oversold levels retested in January 2024 and March 2023

- DXY vs EURUSD Analysis

With a streak of economic indicators cooling down, the chance of sustaining the disinflationary track towards the Fed’s inflation rate target is increasing.

US 02Y Bond Yields – Daily Time Frame

Source: Tradingview

The US02Y had dropped towards a trendline connecting the lows of March 2023 and January 2024. While the rate drops hint at potential interest rate cuts, the trend’s daily momentum has reached oversold Relative Strength Index levels previously seen in January 2024 and March 2023. From a momentum perspective, a reversal can be possible.

Rate Cut Bets

The latest CPI figures have fallen further below expectations, pushing rate cut expectations beyond 90% for September according to the CME Fed Watch Tool.

Upcoming Events

• US PPI: while not typically causing high volatility, short term fluctuations can be expected with the changes in inflation levels from the Producers’ perspective

• US Consumer Sentiment

• US Bank Earnings: elevated rates and a decline in economic growth metrics suggest a potential cool down in earning levels, unless resilient factors drive higher earnings

US Dollar Index and EURUSD Analysis

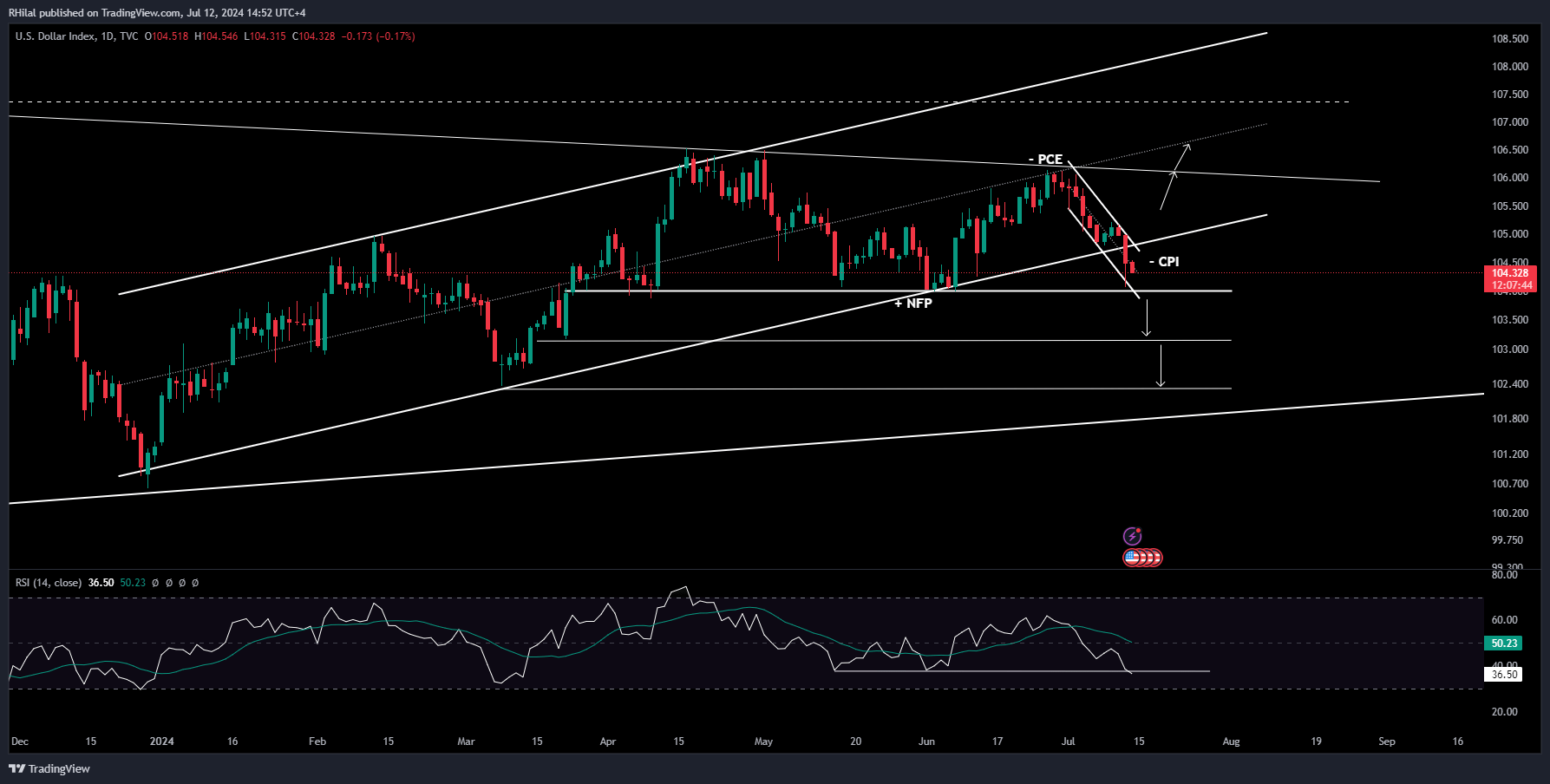

EURUSD, DXY Analysis: DXY – Daily Time Frame – Logarithmic Scale

Source: Tradingview

The recent downtrend in the US Dollar index has been driven by economic indicators consistently dropping below expectations. The latest Consumer Price Inflation figures pushed the DXY below its yearly up-trending channel, to retest a previously respected support zone at the lower end of the 104 range. A possible reversal back to the lower borders of the channel to test the 104.80 and 105.10 zone can be expected. On the downside, a break below the 104 border could lead to a retest of the 103.20 and 102.30 levels.

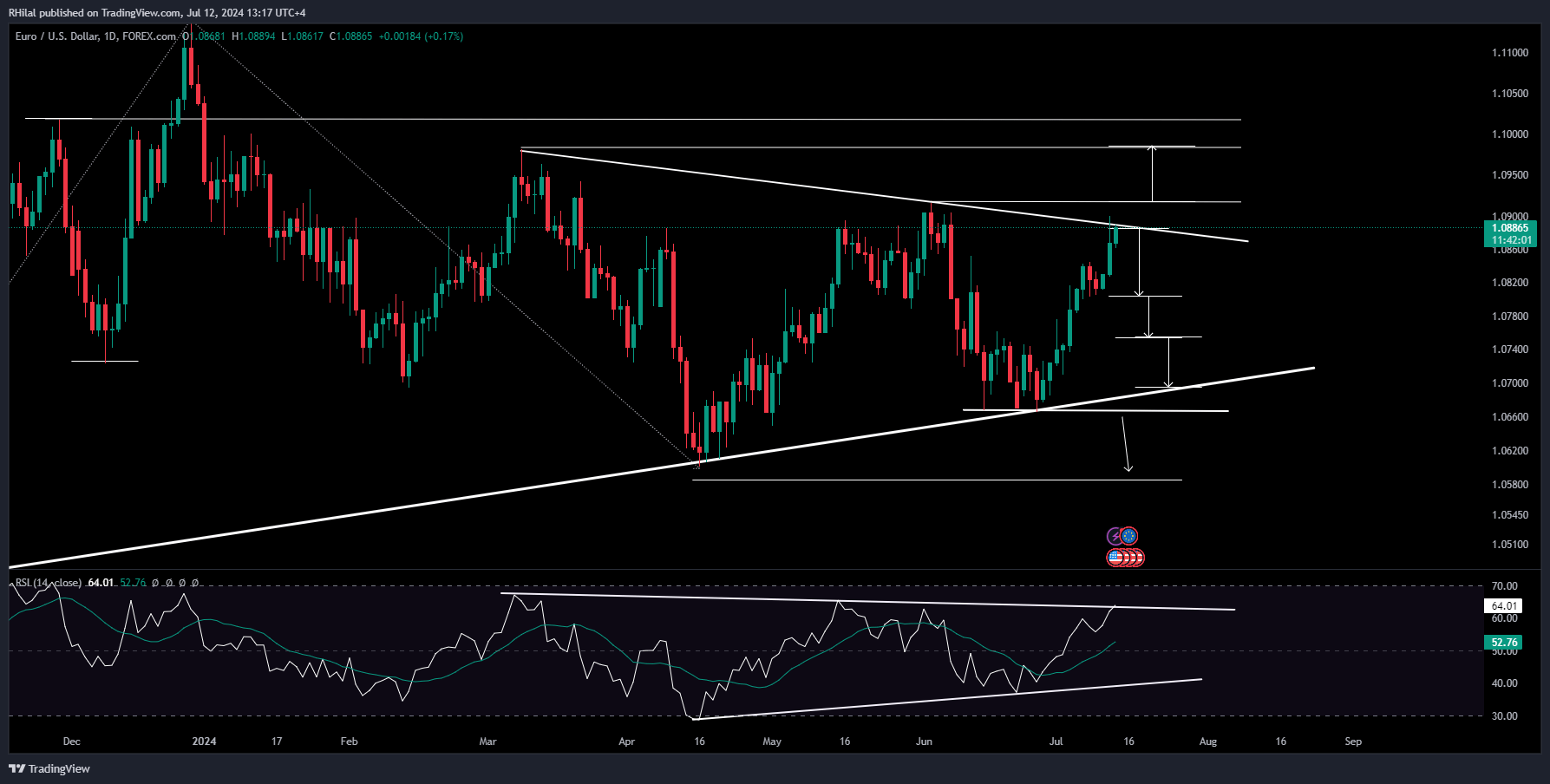

EURUSD, DXY Analysis: EURUSD – Daily Time Frame – Logarithmic Scale

Source: Tradingview

Climbing up to retest the upper border of the consolidation, from both a chart perspective and (RSI) perspective, the EURUSD faces the 1.09-1.0916 resistance zone before confirming the next uptrend towards 1.0990 and 1.1020. A reversal is possible due to stretched and diverging momentum indicators on the 4H time frame, along with the retest of the US dollar index to a previous strong support, paving the way for a possible retest to the 1.08, 1.0760, and 1.07 levels.

Overall, the market sentiment towards a rate cut, a bearish US dollar, and a bullish market, is being priced in with overstretched momentum indicators, indicating possible corrections or reversals prior to maintaining the trends of the potential rate cut bets.

--- Written by Razan Hilal, CMT