EUR/USD rises as the mood improves and ahead of US PPI

- Reports of gradual US trade tariffs lift the mood

- USD eases after strong gains

- US PPI and Fed speakers are in focus

- EUR/USD formed a hammer reversal pattern

EUR/USD is rising, recovering from a fresh 2-year low yesterday amid an improved market mood.

Reports that the Trump administration could adopt a more gradual approach to trade tariffs have improved the mood. This would strengthen its negotiating power and avoid spiking US inflation.

As a result, the US dollar is taking a breather after its recent run higher, and yields are slipping. Attention is now turning to US PPI data and speeches from Fed policymakers, including John Williams and Jeffrey Schmidt, for fresh clues on the central bank's interest rate path.

PPI is expected to increase to 3.7% year on year up from 3.4%. The data comes ahead of tomorrow's US inflation figures, which are expected to show a rise of 2.9%, and could fuel concerns over the revival in inflation and more hawkish Fed.

According to the CME Fed watch tool, the market is pricing in 29 basis points of cuts this year, with the first rate cut not expected until the end of the year.

The EUR rising; however, gains could also be limited given the ECB—Federal Reserve policy outlook diversion. The ECB is expected to cut interest rates by 25 basis points in the January meeting and by around 100 basis points throughout this year.

Yesterday, ECB chief economist Philip Lane warned that if interest rates remain too high, inflation will be too low. His dovish comments helped send the euro to a two-year low.

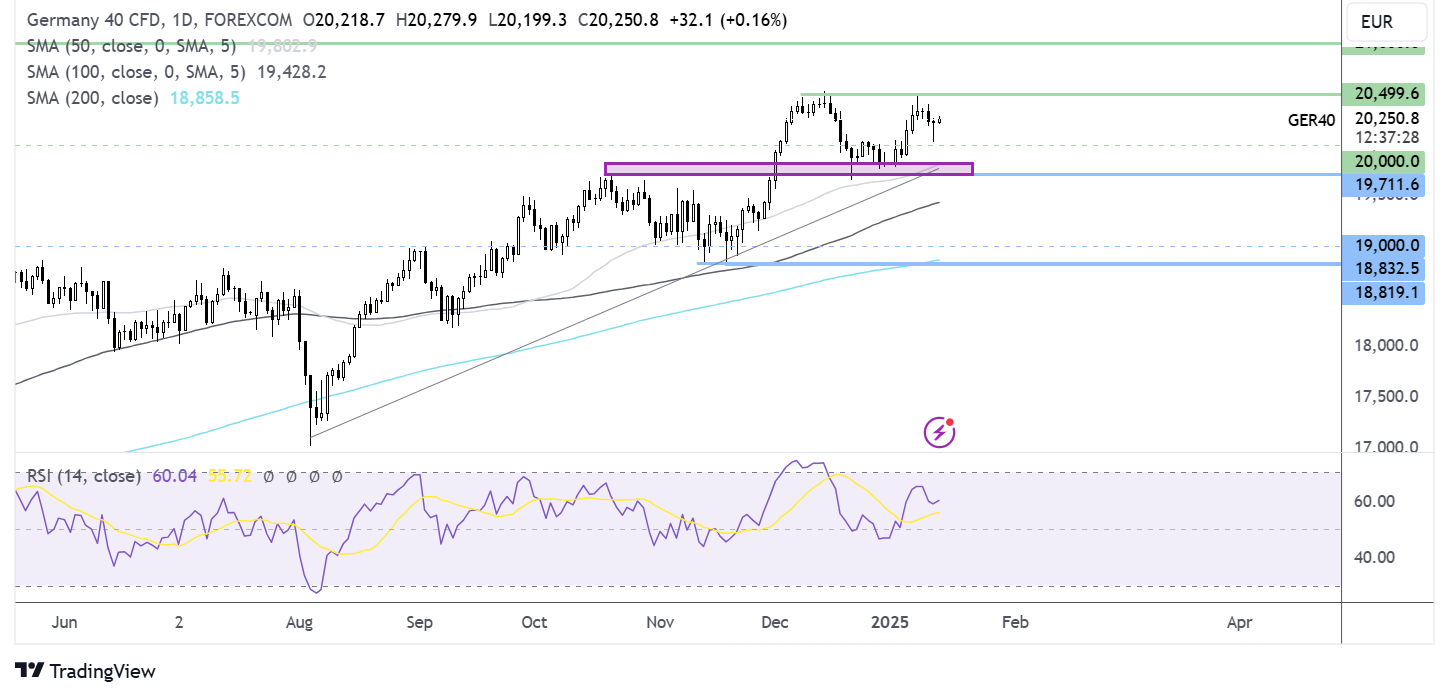

EUR/USD forecast – technical analysis

EUR/USD has trended lower from 1.12 in October, forming a series of lower lows and lower highs. Yesterday, the pair fell to a fresh two-year low of 1.020 before recovering to close back above 1.0225, the early January low.

The hammer candlestick pattern points to a bullish reversal at the end of the downtrend. The long lower wick suggests little selling demand at the lower levels.

Buyers will look to extend gains above 1.03 and 1.350 to negate the near-term downtrend. A rise above 1.0450 creates a higher high.

On the downside, sellers would need to take out 1.02 to create a lower low and head towards 1.00

DAX rises on hopes of gradual trade tariffs

- Trump’s team are considering gradual trade tariffs

- Treasury yields are easing & German automobile stocks are rising

- DAX recovered from 20k and heads towards 20,500

The DAX and European shares are heading higher on Tuesday, recouping some losses after falling for two straight sessions. The automobile sector is leading gains in early trade, and government bonds yields are easing across the board.

Reports that Trump’s team are considering slowly ramping up tariffs month by month in a more gradual approach is soothing the market mood. This could boost negotiating leverage and help to avoid a spike in inflation.

Across the election campaign Trump floated the idea of minimum tariffs of 10% to 20% on all imported goods and 60% on shipments from China. Since winning the election, multiple reports have shown how aggressively these tariffs could be implemented.

The uncertainty has left investors in a cautious mood and worried about inflation. Investors have been selling out of treasuries on fears that inflation could remain stubborn, partly because of new tariffs.

The latest reports are helping treasuries and risk sentiment recover modestly, as well as German automobile makers who stand to be punished under a trade tariff regime.

With just a week until inauguration, the market is still getting over how trump trade wars could influence the economy which is leaving a complicated picture for the Federal Reserve and other central banks and governments across the globe.

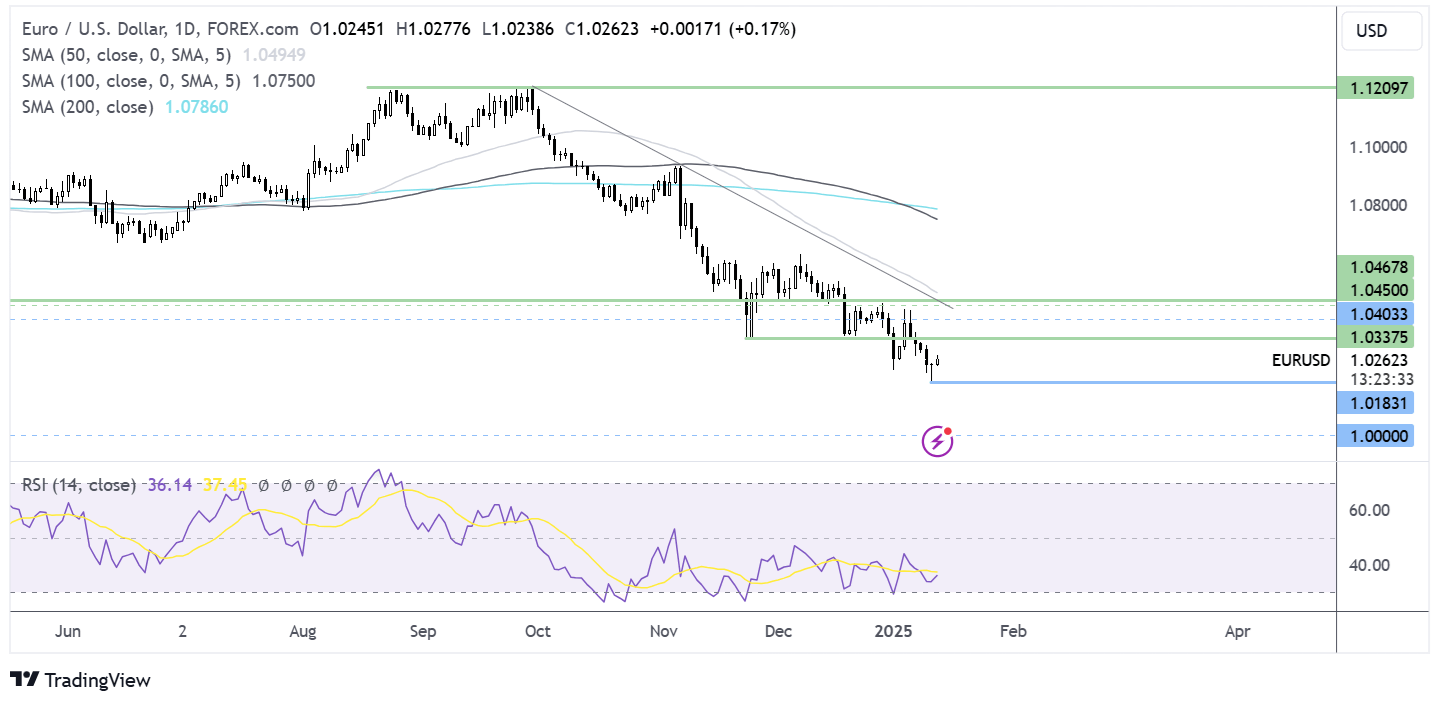

DAX forecast – technical analysis

The DAX continues to trade within a familiar range, caught between 20,500 on the upside and 19,800 support zone on the downside.

The price re tested 20,500 last week before spiking lower to test 20k. Currently the price trades at 20,250.

Buyers supported by the RSI above 50 and the long lower wick on yesterday’s candle will look to retest 20,500.