Asian Indices:

- Australia's ASX 200 index rose by 28.6 points (0.4%) and currently trades at 7,124.30

- Japan's Nikkei 225 index has risen by 236.36 points (0.85%) and currently trades at 28,180.31

- Hong Kong's Hang Seng index has risen by 355.75 points (1.65%) and currently trades at 21,887.42

- China's A50 Index has risen by 1.17 points (0.01%) and currently trades at 13,837.88

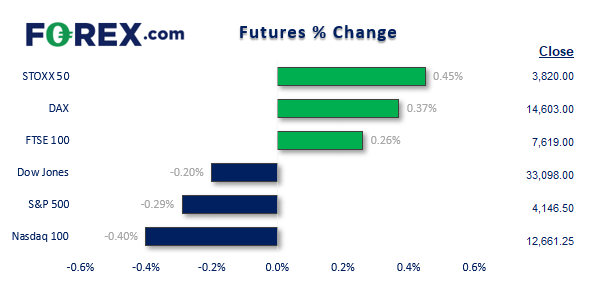

UK and Europe:

- UK's FTSE 100 futures are currently up 20 points (0.26%), the cash market is currently estimated to open at 7,618.93

- Euro STOXX 50 futures are currently up 18 points (0.47%), the cash market is currently estimated to open at 3,824.74

- Germany's DAX futures are currently up 54 points (0.37%), the cash market is currently estimated to open at 14,610.62

US Futures:

- DJI futures are currently down -66 points (-0.2%)

- S&P 500 futures are currently down -50.25 points (-0.4%)

- Nasdaq 100 futures are currently down -12.25 points (-0.29%)

FTSE 350: 4232.51 (-0.12%) 07 June 2022

- 91 (26.00%) stocks advanced and 242 (69.14%) declined

- 8 stocks rose to a new 52-week high, 5 fell to new lows

- 30% of stocks closed above their 200-day average

- 77.43% of stocks closed above their 50-day average

- 24.86% of stocks closed above their 20-day average

Outperformers:

- +9.43% - Biffa PLC (BIFF.L)

- +3.96% - Mitie Group PLC (MTO.L)

- +3.05% - Melrose Industries PLC (MRON.L)

Underperformers:

- -15.04% - National Express Group PLC (NEX.L)

- -8.64% - Ferrexpo PLC (FXPO.L)

- -5.62% - Future PLC (FUTR.L)

Asian shares were mixed overnight as investors absorbed the attest round of 50-bps hike from a central bank. That we have an ECB meeting and US inflation report over the next 48-hours simply adds confusion to the mix. On that note, we’ve observed that the S&P 500 (and Wall Street in general) has experienced a highly volatile period of indecision.

If you think back to all of the market moving headlines these past few months, it is quite intriguing that the S&P 500 futures contracts is effectively flat since February’s close. Over that time we have seen the market rally close to 13%, fall over 17% yet return back to the February close price and hug the 20-month eMA. That is indecision at its finest. And frustratingly, we may find the market hesitant to deviate too far from current levels until we get the data from Friday’s US inflation report. So if you must trade it, perhaps it’s best not to marry any positions and keep expectations for a sustainable move to the minimum.

Japan’s GDP upwardly revised (from bad to not good)

On the data front, growth in Japan was not as bad as originally feared. Q1 GDP contracted -0.5% y/y compared with the -1% originally estimated, or -0.1% q/q compared to -0.2%. It’s not likely to change anything for the BOJ policy wise, as Q2 data so far remains subpar and the BOJ are seemingly happy with a weaker yen. And that’s a good job because its once again the yen is weaker against all its major FX peers, with USD/JPY back above 133 and AUD/JPY briefly hitting a 7-year high.

Everything you should know about the Japanese yen

WTI finds demand at $117

I think we can now rule out the bull flag identified in yesterday’s report, given the volatility seen at the end of the session. But the inverted head and shoulders pattern remains in play (even if its neckline was breached). The false break of 117.87 left a lower spike / false break of support and momentum has turned higher. Prices are consolidating near yesterday’s high and around $120, but we like how demand appears to be around $117. Therefore, we’d consider longs with low volatility pullbacks above 118 and anticipated a break above 120, on route to the original $122 and $124 targets.

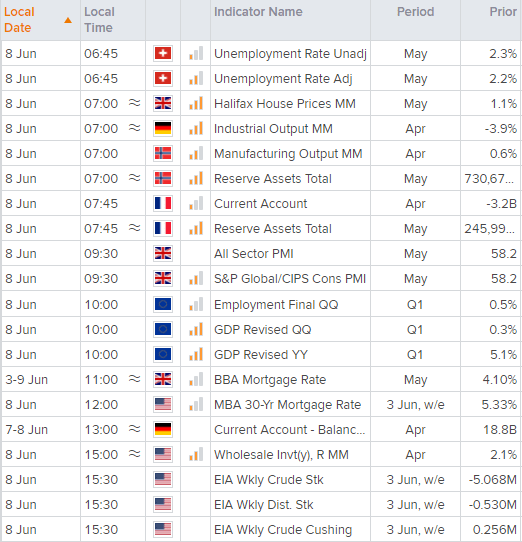

Economic events up next (Times in BST)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.