Asian Indices:

- Australia's ASX 200 index rose by 63.2 points (0.91%) and currently trades at 7,018.60

- Japan's Nikkei 225 index has risen by 572.9 points (2.13%) and currently trades at 27,518.57

- Hong Kong's Hang Seng index has risen by 370.45 points (1.92%) and currently trades at 19,629.21

- China's A50 Index has risen by 59.13 points (0.45%) and currently trades at 13,074.83

UK and Europe:

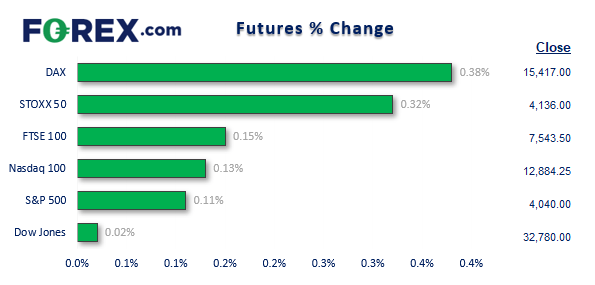

- UK's FTSE 100 futures are currently up 11 points (0.15%), the cash market is currently estimated to open at 7,547.22

- Euro STOXX 50 futures are currently up 12 points (0.29%), the cash market is currently estimated to open at 4,193.60

- Germany's DAX futures are currently up 57 points (0.37%), the cash market is currently estimated to open at 15,252.34

US Futures:

- DJI futures are currently up 5 points (0.02%)

- S&P 500 futures are currently up 3.75 points (0.09%)

- Nasdaq 100 futures are currently up 16.25 points (0.13%)

- Asian indices tracked Wall Street higher following Wall Street’s slight risk-on session, which saw all three major indices rally (led by regional banks) and US yields also move higher

- Japan’s share markets led the way higher with the Nikkei up ~2%, the S&P 500 up 0.9% and the China A50 up 0.5%

- WTI is hovering just below $70 – a likely pivotal level today, having printed a bullish hammer on Monday and rising to a two-day high yesterday

- The US dollar index touched a 5-week low yesterday, yet bearish momentum is waning with a small-range Doji day and a bullish divergence is forming on the RSI (2)

- EUR/USD has risen for four consecutive days, but it my suspicion of a less dovish (or more hawkish) FOMC meeting materialises then there’s a decent chance it will break below 1.0700 by tomorrow

- US futures are slightly higher but effectively flat, DAX futures are up ~0.4% to suggest a positive tone at the start of the session

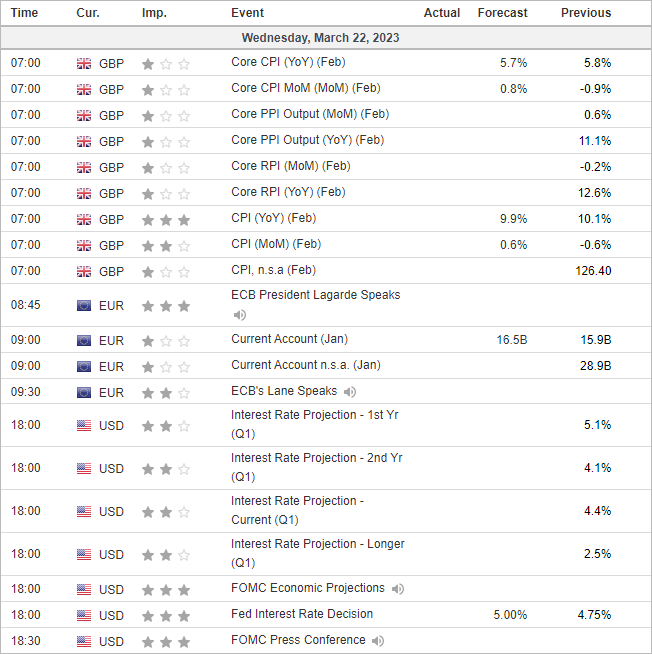

- Outside of GBP pairs (which are vulnerable to UK inflation volatility) we could be in for a quiet session leading into the FOMC meeting

Read my take on the Fed meeting: What if the Fed Fund Futures curve is too dovish?

Read Matt Weller’s FOMC preview: Dollar Index at 1-month lows ahead of tight decision

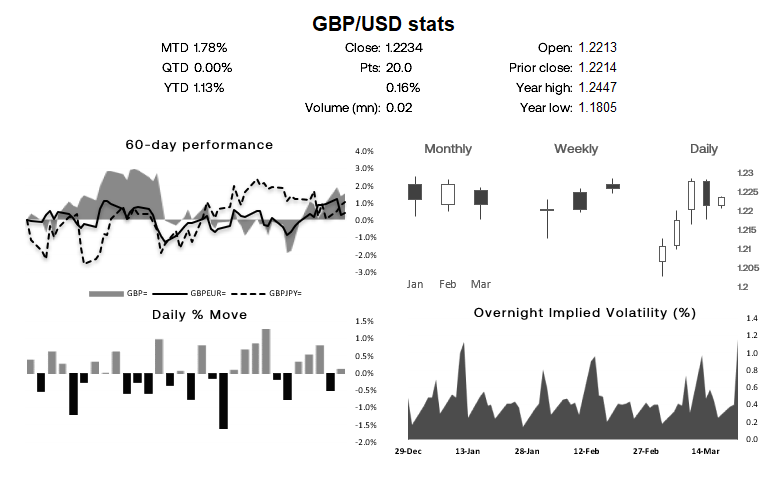

GBP/USD daily chart and dashboard:

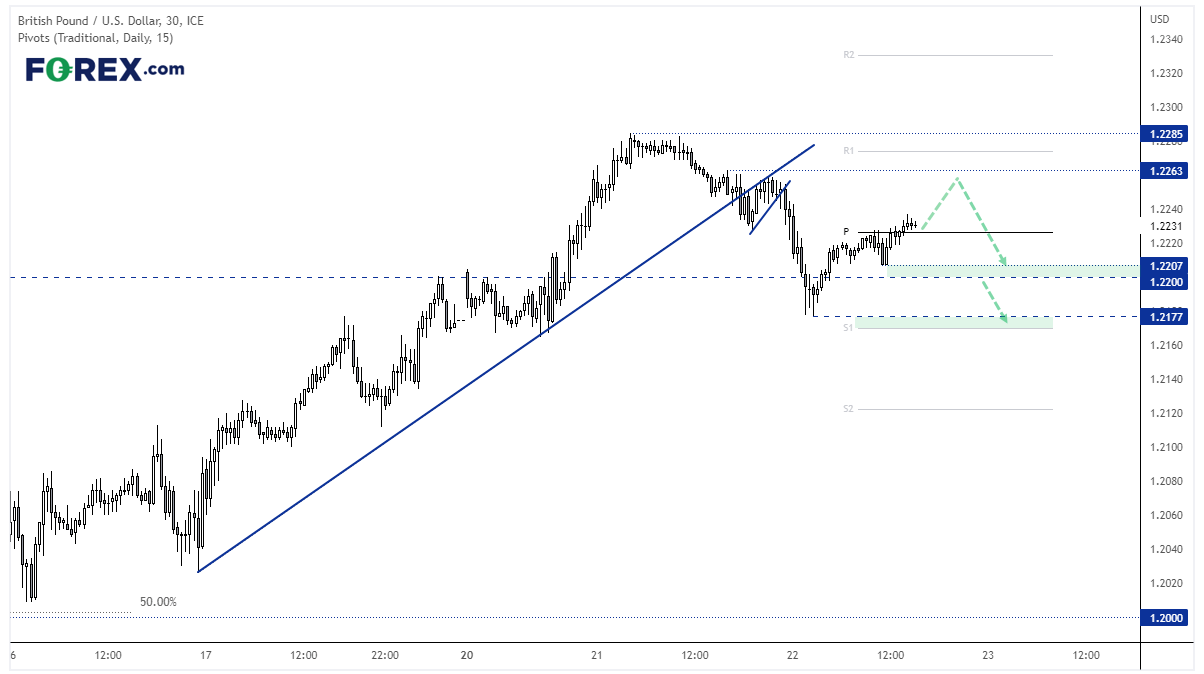

Today’s UK inflation print could be the difference between a final 25bp hike from the BOE tomorrow, or a pause. Given that data since Bailey’s last speech has been skewed towards better than expected, and he said that data ahead of the meeting could tip the scales (or words to the effect of), then another hot print today likely cements a pause. Moreover, we have since seen the ECB hike by 25bp and are likely to see the Fed hike by 25bp later, so perhaps the bigger surprise would be if we see a soft UK inflation print which could weigh on GBP pairs, and if we’re treated to a less-dovish than expected FOMC meeting – watch out below!

GBP/USD broke trend support earlier this week but has since recovered back above 1.2200. It’s also above the daily pivot point, and a hot CPI report could send it higher ahead of today’s FOMC meeting. But with a US dollar bullish bias, we’d then be seeking evidence of a top following the meeting and for a move back towards (and possible below) 1.2200. Of course, the counter move would be for a break to new highs if the Fed surprise with a dovish meeting.

Economic events up next (Times in GMT)

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge