Asian Indices:

- Australia's ASX 200 index fell by -82.4 points (-1.14%) and currently trades at 7,123.20

- Japan's Nikkei 225 index has fallen by -609.26 points (-2.26%) and currently trades at 26,392.17

- Hong Kong's Hang Seng index has fallen by -791.44 points (-3.81%) and currently trades at 20,001.96

- China's A50 Index has fallen by -159.14 points (-1.21%) and currently trades at 12,944.84

UK and Europe:

- UK's FTSE 100 futures are currently down -53.5 points (-0.72%), the cash market is currently estimated to open at 7,334.44

- Euro STOXX 50 futures are currently down -52 points (-1.44%), the cash market is currently estimated to open at 3,577.17

- Germany's DAX futures are currently down -182 points (-1.33%), the cash market is currently estimated to open at 13,492.29

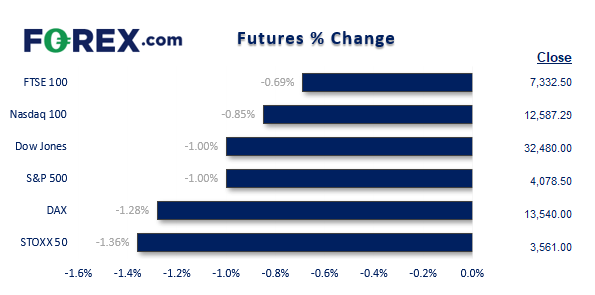

US Futures:

- DJI futures are currently down -330 points (-1.01%)

- S&P 500 futures are currently down -115 points (-0.91%)

- Nasdaq 100 futures are currently down -42 points (-1.02%)

Asian equity markets tracked Wall Street lower overnight as the week kicked off with a risk-off tone. The well-telegraphed series of 50-bps hikes leaves investors concerned that the Fed are chasing inflation and may fail to stimmy it. And with growth prospects continuing to falter then the odds of a global recession over the next 12-months is on the rise.

China’s HSCE fell over -4% and the Hang Seng was off by around -3.8%. The ASX 200 fell -1.2% in line with our bearish bias outlined in the Asian open report, and the majority of major benchmarks across Asia were in the red. This also saw bitcoin futures fall to their lowest level since January, and gold also trade lower as it failed to attract safe-haven flows.

AUD and NZD dragged lower with commodities

Prospects of weak global growth and lockdowns across China which are showing no signs of being eased has seen sentiment turn against key commodities such as copper and platinum. We noted in this weeks COT report that traders flipped to net-short exposure on copper and prices have since fallen to retest last week’s low.

AUD and NZD are the weakest majors with the Aussie falling to just 10-pips above 70c whilst NZD/USD has fallen to a 2-year low. AUD/JPY broken beneath the 92.26 low on Friday to confirm our bearish bias and has fallen to a 4-day low overnight. Our next target is the support zone around 90.50.

We’re also keeping an eye on NZD/JPY as it has broken above a key support level during Asian trade. Since breaking out of an ascending triangle at the top of its trend, a series of lower highs formed and then prices met resistance at the monthly pivot point. Our bias remains bearish beneath the Friday’s high and now looking for prices to fall to the support zone around 82.50.

FTSE: Market Internals

FTSE 350: 4114.56 (-1.51%), 09 May 2022

- 7 stocks rose to a new 52-week high, 74 fell to new lows

- 56 (16.00%) stocks advanced, 290 (82.86%) stocks declined

- 25.43% of stocks closed above their 200-day average

- 36.29% of stocks closed above their 50-day average

- 10.29% of stocks closed above their 20-day average

Outperformers:

- +18.4% - 4imprint Group PLC (FOUR.L)

- +5.9% - Hiscox Ltd (HSX.L)

- +5.9% - Beazley PLC (BEZG.L)

Underperformers:

- -8.3% - International Consolidated Airlines Group SA (ICAG.L)

- -7.5% - Rightmove PLC (RMV.L)

- -8.3% - SEGRO PLC (SGRO.L)

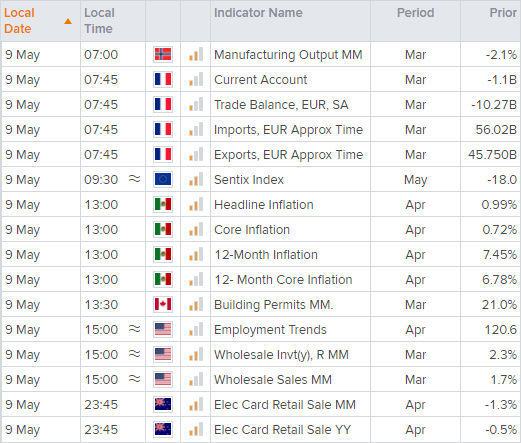

Up Next (Times in GMT)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.