Asian Indices:

- Australia's ASX 200 index fell by -103.4 points (-1.46%) and currently trades at 6,965.50

- Japan's Nikkei 225 index has fallen by -237.23 points (-0.87%) and currently trades at 26,990.39

- Hong Kong's Hang Seng index has fallen by -260.69 points (-1.33%) and currently trades at 19,279.18

- China's A50 Index has fallen by -1.17 points (-0.01%) and currently trades at 12,996.87

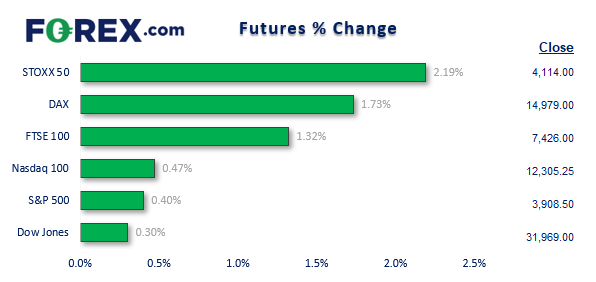

UK and Europe:

- UK's FTSE 100 futures are currently up 96.5 points (1.32%), the cash market is currently estimated to open at 7,440.95

- Euro STOXX 50 futures are currently up 84 points (2.09%), the cash market is currently estimated to open at 4,118.92

- Germany's DAX futures are currently up 246 points (1.67%), the cash market is currently estimated to open at 14,981.26

US Futures:

- DJI futures are currently up 99 points (0.31%)

- S&P 500 futures are currently up 16 points (0.41%)

- Nasdaq 100 futures are currently up 57.5 points (0.47%)

SNB come to the rescue

Credit Suisse (CS) was the latest bank to hit the headlines and weigh on sentiment yesterday, when it main back said it would not provide any more regulatory funds. This saw European banking shares led bourses lower and the DAX endured its worst day this year, the SMI (Swiss Market Index) hit its lowest level since October.

However, the Swiss National Bank stepped in to plug that gap and provide liquidity to CS to the tune of $54 billion. The SNB doesn’t mess around amidst a crisis, and that should stimmy some fears of the bank’s collapse. Besides, like Deutsche Bank, Credit Suisse have been a ‘failing bank’ as long as I can remember yet both remain in business. So ultimately, I think this is a good thing for market as a whole. I’m just not sure if or when investors will draw the same conclusion with all the emotion in the air. There’s still very much a feeling of react first, think later. And that’s not always compatible for logic. SO the bigger question is will there be any others to follow? And that could continue to cloud sentiment over the foreseeable future.

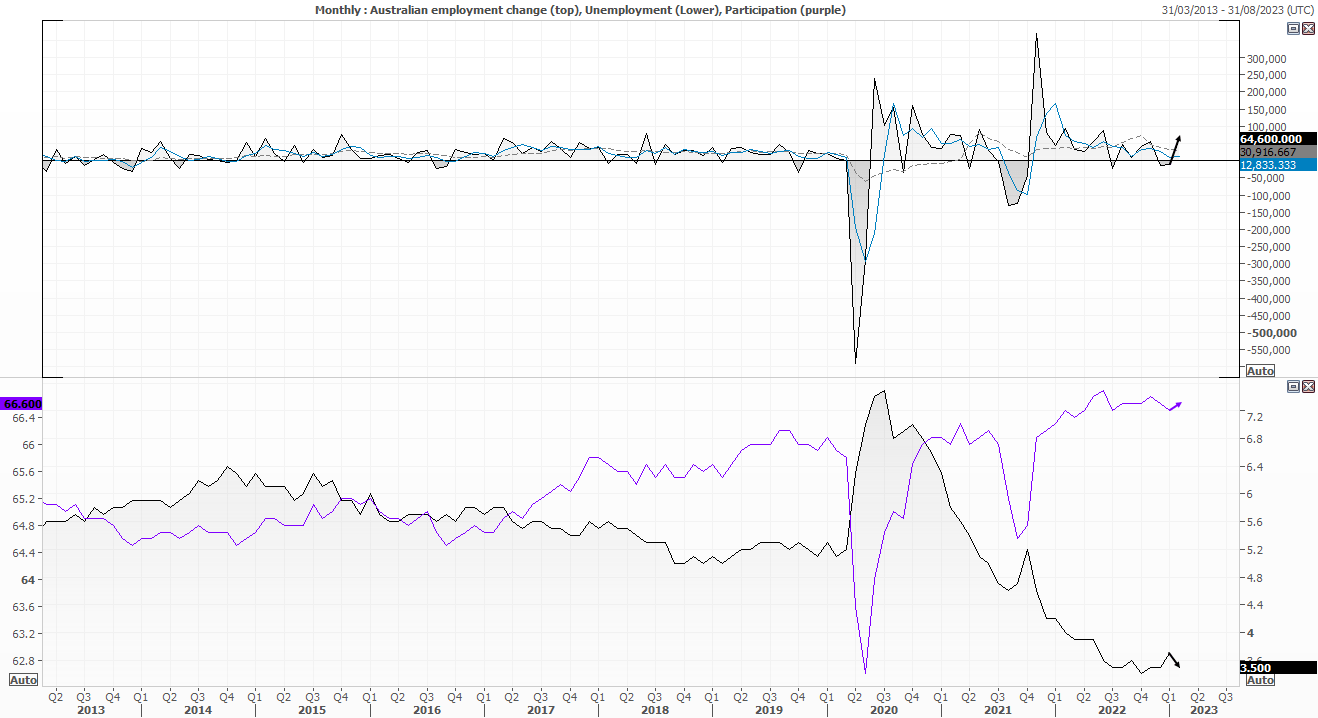

AU employment remains surprisingly resilient

Australia’s employment report was surprisingly good, with job growth at an 8-month high, employment back down to 3.5% (3.7% prior and 3.6% expected) and the participation rate also ticked higher. These numbers hardly scream imminent recession, so if inflation comes in hot (and fears of a financial meltdown die down) then a hike in April could be back on the cards – despite RBA’s dovish pivot just last week.

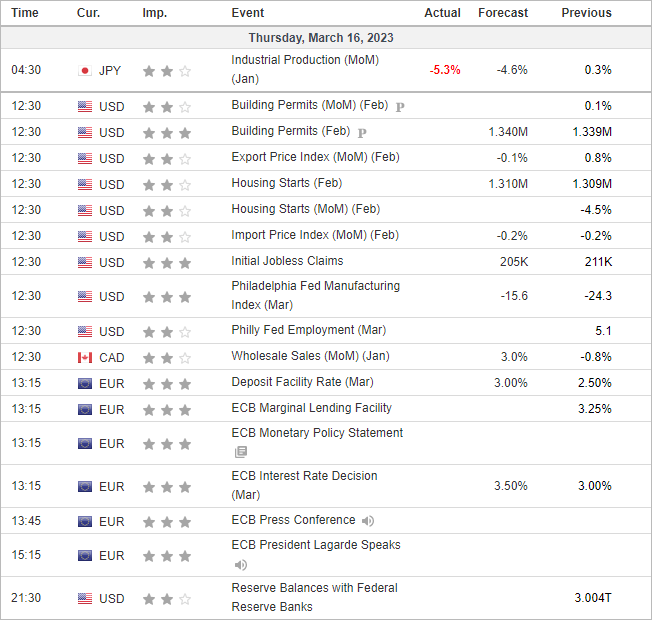

ECB meeting up next:

It’s been a volatile week for markets which has seen expectations for an ECB hike waver and then be restored. Prior to this, the expectation was for a 50bp hike today and probably one next month, but what traders wanted to hear was clarity of future hikes. Some are calling for a 25bp hike today, and perhaps that may be the case. But in either case, I imagine there will be a cautious tone from the central bank, and we may not get the clarity we seek for future hikes.

With inflation remaining too hot and the SNB coming to the rescue, I suspect it will be a 50bp hike with a cautious tone.

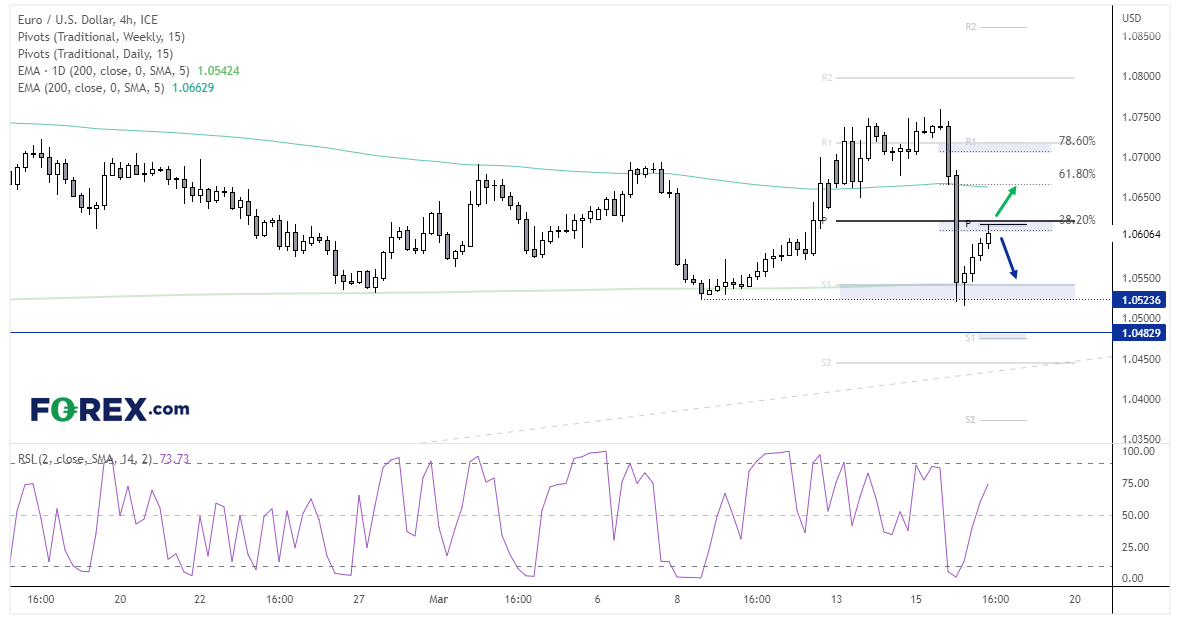

EUR/USD 4-hour chart:

EUR/USD has drifted into a key resistance zone around 1.0620 which includes the daily and weekly pivot points and 38.2% Fibonacci level, making it a pivotal level for the day. Also note how the 200-day EMA sits around a 61.8% level, and the 200-week EMA sits lower around the weekly S1. And today’s direction is likely to be down to how hawkish or dovish the meeting is deemed to be.

- A surprise pause would likely be the most bearish scenario for EUR/USD

- A cautious 25bp hike might be slightly bearish

- A cautious 50bp hike could be slightly bullish

- A 50bp hike with more to follow would likely be the most bullish scenario

Economic events up next (Times in GMT)

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge