Asian Indices:

- Australia's ASX 200 index fell by -7 points (-0.09%) and currently trades at 7,398.40

- Japan's Nikkei 225 index has risen by 424.11 points (1.49%) and currently trades at 28,880.66

- Hong Kong's Hang Seng index has risen by 213.15 points (0.89%) and currently trades at 24,210.02

- China's A50 Index has risen by 312.04 points (1.95%) and currently trades at 16,345.34

UK and Europe:

- UK's FTSE 100 futures are currently up 13.5 points (0.18%), the cash market is currently estimated to open at 7,350.55

- Euro STOXX 50 futures are currently up 4 points (0.09%), the cash market is currently estimated to open at 4,237.09

- Germany's DAX futures are currently up 20 points (0.13%), the cash market is currently estimated to open at 15,707.09

US Futures:

- DJI futures are currently up 35.32 points (0.1%)

- S&P 500 futures are currently down -24 points (-0.15%)

- Nasdaq 100 futures are currently down -6.25 points (-0.13%)

An article form the Wall Street Journal claims that Beijing has sent a ‘stern message’ to the PBOC (People’s Bank of China) that central bank independence will not be tolerated. Over a period of several weeks, Mr XI’s ‘discipline inspectors’ have been scrutinising PBOC members and going through documents to see if they have become too friendly with private firms or negligent in fending off risks (or not toeing the party line). If true, it would actually explain why the central bank reversed course and lowered their RRR (Reserve Ratio Requirements) last week.

Chinese equity markets performed a strong rally on the back of this report on the assumption that more easing is to come their way. The China A50 index is a top performer and risen around 2% this session and considering a break of key resistance, and the CSI is up around 1.8% to the Hang Seng’s 0.9%.

Read our guide on the PBOC (People's Bank of China) and inflation

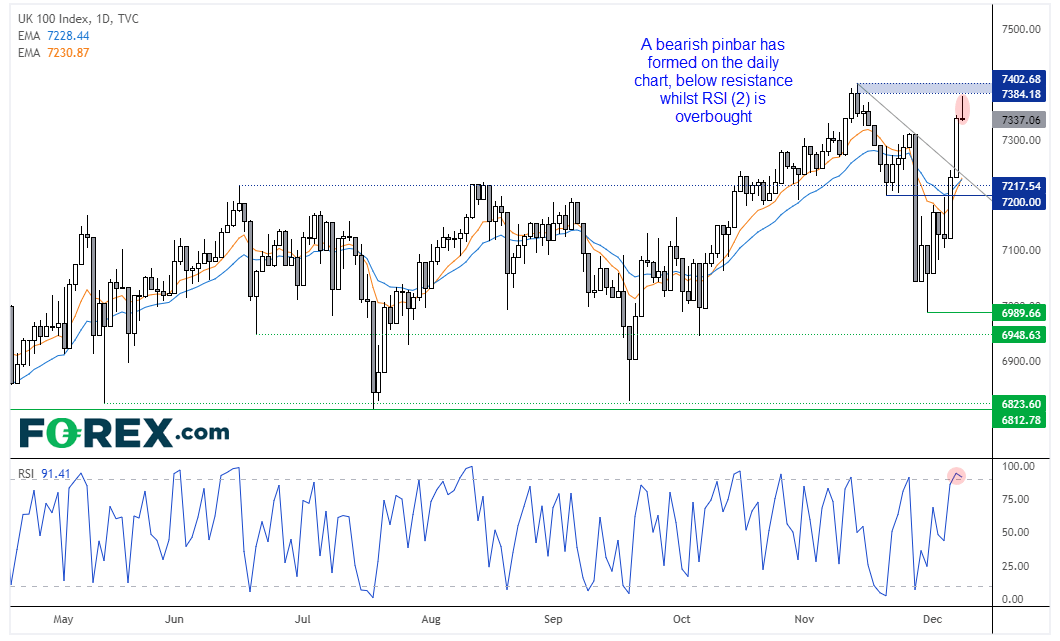

Futures markets point to a firmer open, reversal candle on FTSE

If China really are on an easing policy path then the positive sentiment in Asia may spill over to Europe to some degree. The Dax and STOXX 50 futures are up around 01% and the FTSE futures are up around 0.18%. However, we see the potential for the FTSE to mean revert judging from yesterday’s price action on the cash market.

The FTSE 100 closed with a bearish pinbar on the daily chart, and its high stopped just shy of the November highs around 7400. Given that RSI (2) is also overbought and price action is extended far above its 10 and 20-day eMA after a strong rally, we see the potential for some mean reversion.

EUR/GBP probes the November high

The British pound stabilised overnight after ‘plan B’ knocked it broadly lower yesterday. It’s possible that may not be the straw that breaks the pounds back (at least initially), but should hospitalisations rise markedly over the coming days and weeks then the UK is likely headed for a lockdown in the new year. And any signs of this scenario occurring could weigh on GBP ahead of the fact.

EUR/GBP finds itself at a technical juncture heading into today’s session. Yesterday’s 1% rally was its strongest day in 10-weeks although it has met resistance at the November high and 200-day eMA. A bearish divergence has formed with RSI (2) and prices are edging lower ahead of the open, and a retracement back to 0.8560 is not out of the question. But, beyond any minor pullback, we are on guard for a break above the November high and retest of 0.8650.

Up Next (Times in GMT)

German trade data is scheduled for 07:00, although there is no top-tier data where we can assume will create a burst of volatility. And as US CPI data is tomorrow it may be a quieter session unless we receive an unscheduled catalyst.

What are economic indicators?

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.