Asian Indices:

- Australia's ASX 200 index rose by 20.9 points (0.31%) and currently trades at 6,849.50

- Japan's Nikkei 225 index has risen by 47.06 points (0.17%) and currently trades at 27,865.68

- Hong Kong's Hang Seng index has risen by 87.4 points (0.46%) and currently trades at 18,934.50

- China's A50 Index has risen by 11.8 points (0.09%) and currently trades at 13,389.23

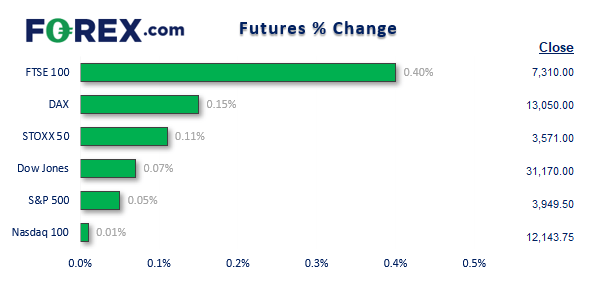

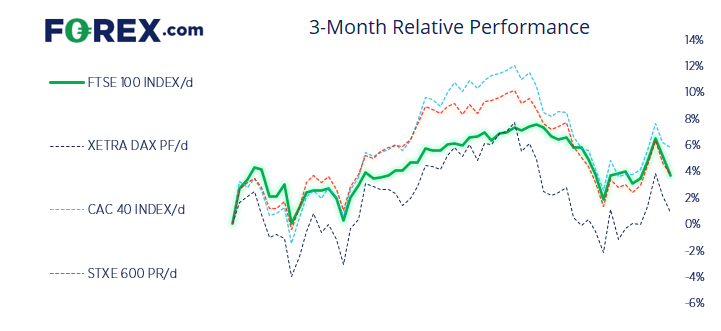

UK and Europe:

- UK's FTSE 100 futures are currently up 30 points (0.41%), the cash market is currently estimated to open at 7,307.30

- Euro STOXX 50 futures are currently up 3 points (0.08%), the cash market is currently estimated to open at 3,570.56

- Germany's DAX futures are currently up 17 points (0.13%), the cash market is currently estimated to open at 13,045.00

US Futures:

- DJI futures are currently up 11 points (0.04%)

- S&P 500 futures are currently up 2.5 points (0.02%)

- Nasdaq 100 futures are currently up 2.25 points (0.06%)

- The Hang Seng was the strongest Asian index overnight as China’s big four banks cut their 3-year deposit rate by -15bp and shaved -10bp from the 3-month, 6-month, 1year and 5-year rate.

- Equity performance was mixed overall with modest gains seen across China, Japan and Australia.

- AUD and NZD were the strongest FX majors overnight after NZ’s Q2 GDP beat expectations and avoided a technical recession (measured as two consecutive quarters of negative growth).

- US futures have opened flag and European are a touch higher, suggesting caution in the air after heavy selling these past two days.

Japan’s trade deficit reached a record -¥2.8 trillion in August thanks to the significantly weaker yen, with imports surging 49.9% y/y compared to imports of 22.1% y/y. Separately Japan’s PM said that the country lacks the tools battle the yen’s steep decline, and that a solo FX intervention is unlikely to change its trend. This is in stark contrast to comment made by a BOJ official yesterday, who insinuated the central bank would throw the kitchen sink at the problem to fix it. In fact the BOJ said yesterday they intend to increase their bond purchases which will effectively help throw a level of support under then yen, and just the treat of doing so has seen USD/JPY continue to pull back.

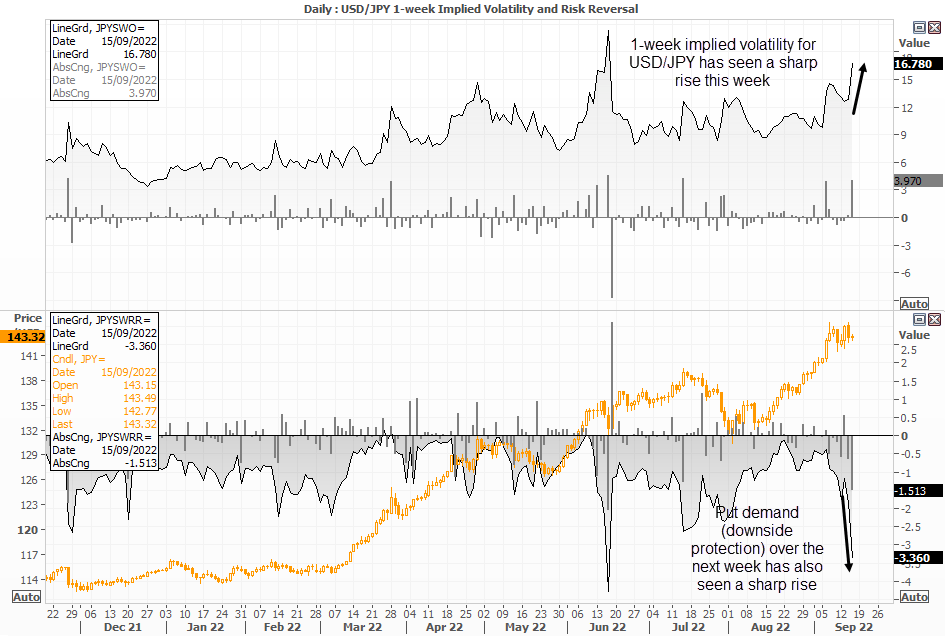

Options traders seem concerned as 1-week put demand (downside protection) has seen a sharp rise this week, as has 1-week implied volatility. One way to look at this is that USD/JPY might continue to move lower in line with put demand. Yet with increased expectations that the Fed will send rates above 4% whilst the BOJ remain as dovish as ever, perhaps puts are being used as a hedge alongside their bullish USD/JPY bets – in preparation for if the BOJ actively intervene to strengthen their currency.

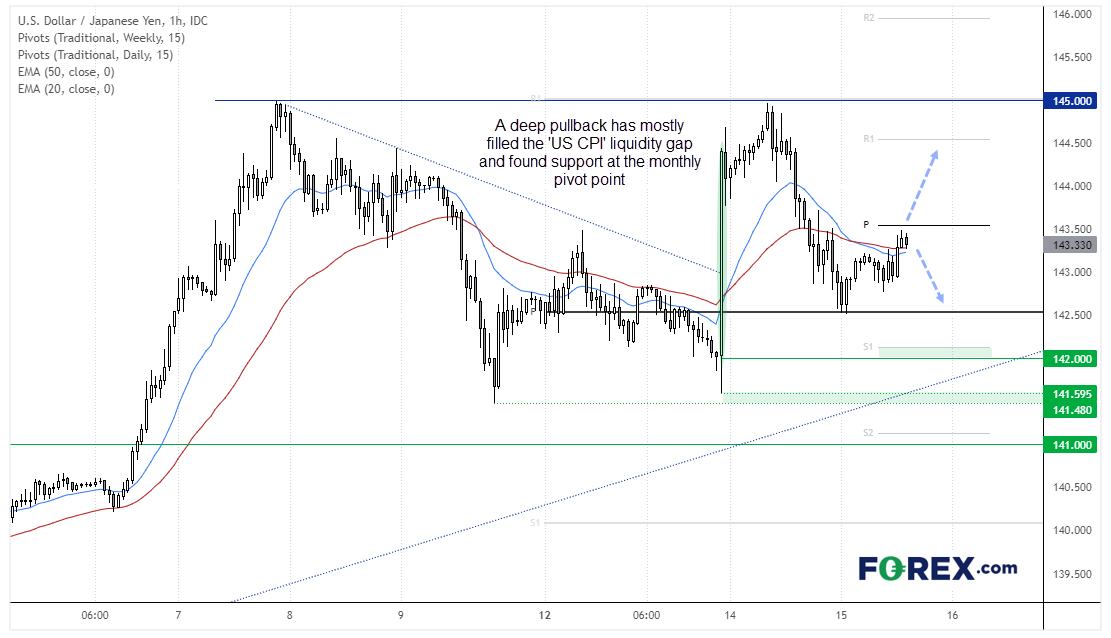

USD/JPY 1-hour chart:

USD/JPY has risen today on the back of the PM’s comments, yet a little hesitant to rally too hard ahead of the European open. Notice how the deep pullback from 145 has mostly filled the US CPI liquidity gap (large bullish candle) and found support at the monthly pivot point. It is now trying to trend higher and found support above the 20 and 50-bar EMA’s on the hourly chart, although the daily pivot point is currently acting as resistance.

A break above the pivot point places a bullish bias for the day, whilst any signs of a swing high around it would have us seeking bearish opportunities below the pivot point. So yes, the pivot point can be seen as today’s pivotal level!

Everything you should know about the Japanese yen

FTSE 350 – Market Internals:

FTSE 350 Outperformers:

- +9.43% - Network International Holdings PLC (NETW.L)

- +3.96% - Dunelm Group PLC (DNLM.L)

- +3.05% - Scottish Mortgage Investment Trust PLC (SMT.L)

FTSE 350 Underperformers:

- -15.04% - Ocado Group PLC (OCDO.L)

- -8.64% - Future PLC (FUTR.L)

- -5.62% - Kainos Group PLC (KNOS.L)

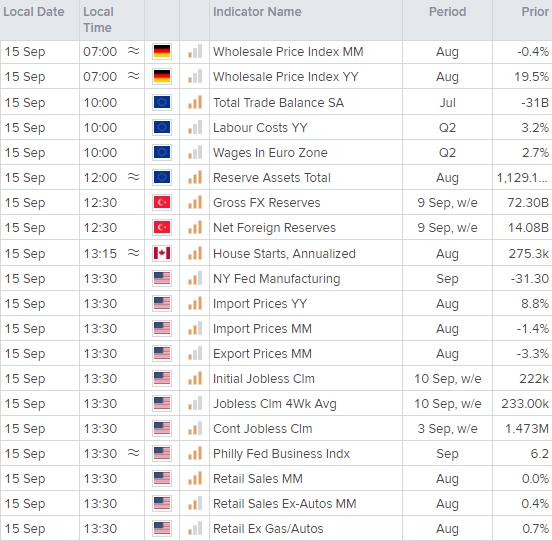

Economic events up next (Times in BST)

German wholesale prices are released at 07L:00, and we’re sure they’ll be depressingly high. In the US session we have a couple of forward looking surveys such as the NY Fed manufacturing and Philly Fed business index. US Import prices will warrant a look, being a key input for inflation, as will jobless claims to see if they continue to trend higher. And as retail sales are released alongside employment data then it could make for a lively time for volatility at 13:30 BST today.

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.