Asian Indices:

- Australia's ASX 200 index rose by 6.7 points (0.09%) and currently trades at 7,103.20

- Japan's Nikkei 225 index has fallen by -514.73 points (-1.92%) and currently trades at 26,329.99

- Hong Kong's Hang Seng index has fallen by -243.53 points (-1.07%) and currently trades at 22,518.18

- China's A50 Index has fallen by -165.29 points (-1.11%) and currently trades at 14,763.16

UK and Europe:

- UK's FTSE 100 futures are currently up 5 points (0.07%), the cash market is currently estimated to open at 7,335.20

- Euro STOXX 50 futures are currently down -11 points (-0.29%), the cash market is currently estimated to open at 3,754.85

- Germany's DAX futures are currently down -54 points (-0.39%), the cash market is currently estimated to open at 13,850.85

US Futures:

- DJI futures are currently up 83 points (0.25%)

- S&P 500 futures are currently up 32 points (0.23%)

- Nasdaq 100 futures are currently up 7.75 points (0.18%)

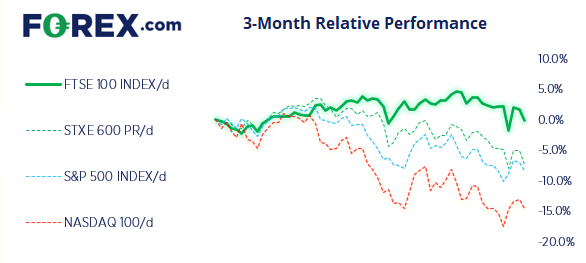

Asian equity markets mostly tracked Wall Street lower, although the ASX was the exception having recouped earlier losses following stronger-then-expected GDP in Q4. But we’re not seeing the negative vibes in Asia mirrored in US futures which remain in tight ranges and effectively flat.

The latest on the Ukraine crisis

Reports continued to show heavy shelling of Ukraine cities and rural areas, with claims that bombing is ‘indiscriminate’. Russian Paratroopers have also landed in Ukraine’s second largest city and in combat with Ukraine’s soldiers (and volunteers) on the ground.

- President Biden said “Putin’s war was premeditated and unprovoked” during his prepared speech for his State of the Union, although deviated off-script and said that Putin has “no idea what’s coming”.

- Exxon mobile are the latest Western company to pull out of Russia, waking away from a $4 billion investment. This follows on from BP ad Shell.

- Biden has banned Russian aircrafts over US airspace, following the steps of Canada and Europe.

- In another effort to support the ruble, Putin has banned Russian’s from leaving the country with more than $10k in foreign currency.

The rouble shows early signs of stabilising

The March contract for ruble futures closed at 0.0088 – which means it now takes 113.63 rubles to purchase a single US dollar. The ruble has fallen around 40% since November, back when satellite images first revealed Russian troops were building up along the border of Ukraine. Although a large chunk of that depreciation came on Monday once the severity of Western sanctions on Russia became apparent.

Since the shock and awe of Monday’s ruble crash prices have shown signs of stability. Clearly, there seems little reason to bid the currency with Western companies severing ties Russia. But at the same time, we question how much more downside there could be for the ruble. Rates have been hiked to an eye-watering level of 20%, companies have been ordered to dump their foreign reserves and the West have already dealt the heavy blow of removing key banks from SWIFT. And with Biden now targeting oligarchs and their private yachts, it is difficult to see how we’ll see another significant depreciation of the ruble with the element of surprise now behind us.

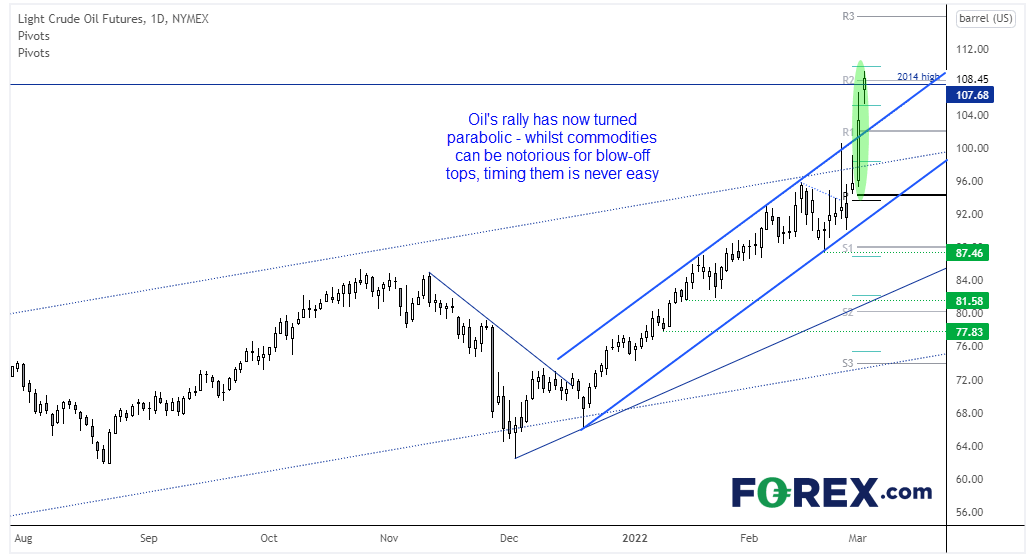

Crude rises to an 8-year high

The rise in oil prices has now reached a parabolic stage. This could be the beginning of a blow off top – where bulls eventually ruin out of traders to buy from before printing a sharp reversal. Or this could simply be the early days of a stronger move. Timing such tops on commodities is not an easy feat, but over the near-term how prices react around the 2014 high is likely key for its next directional move.

BOC up next, EUR/CAD in the crossfire

Elsewhere in currencies AUD and NZD were the strongest majors, with GDP helping the Aussie take the top spot. Whilst CHF and JPY are the weakest, volatility levels stop short of labelling it a ‘risk-on’ session overnight.

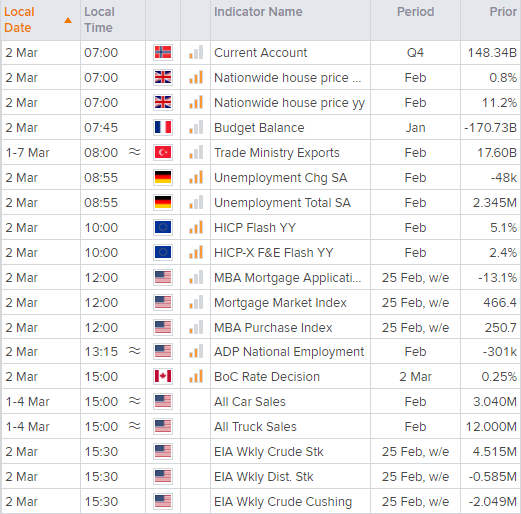

The Bank of Canada (BOC) announce their monetary policy decision at 15:00 GMT, and is the main economic event (unless OPEC surprise us with a faster increase of production than the +400 bpd increase).

Whilst the Bank of Canada surprised traders by not raising rates in January, all economists polled by Reuters points towards a 25-bps hike today and take the base rate to 50 bps. Calls for a 50 bps hike seem long forgotten, although we should see rates at 0.75% if the 3-month OIS is correct.

Given Europe’s proximity to Russia, a (potentially hawkish) hike from BOC in the pipeline and rising oil prices, EUR/CAD could remain of interest to bears. Its hourly trend remains bearish and prices fell yesterday on rising trading activity, which suggests initiative selling. We see the potential for it to continue south and retest 1.4000. Although threats to this bias include positive headlines from the Ukraine crisis (which seems unlikely at present), lower oil prices or a surprise hold from BOC.

FTSE 350: Market Internals

FTSE 350: 4108.78 (-1.72%) 01 March 2022

- 46 (13.11%) stocks advanced and 299 (85.19%) declined

- 8 stocks rose to a new 52-week high, 33 fell to new lows

- 24.22% of stocks closed above their 200-day average

- 15.67% of stocks closed above their 50-day average

- 18.23% of stocks closed above their 20-day average

Outperformers:

- + 4.69% - Centamin PLC (CEY.L)

- + 3.75% - Darktrace PLC (DARK.L)

- + 3.70% - BAE Systems PLC (BAES.L)

Underperformers:

- -37.88% - Petropavlovsk PLC (POG.L)

- -28.95% - EVRAZ plc (EVRE.L)

- -26.28% - Polymetal International PLC (POLYP.L)

Up Next (Times in GMT)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.