Asian Indices:

- Australia's ASX 200 index fell by -132.4 points (-1.9%) and currently trades at 6,829.20

- Japan's Nikkei 225 index has fallen by -778.65 points (-2.88%) and currently trades at 26,232.68

- Hong Kong's Hang Seng index has fallen by -625.1 points (-2.57%) and currently trades at 23,664.80

- China's A50 Index has fallen by -67.95 points (-0.45%) and currently trades at 15,158.36

UK and Europe:

- UK's FTSE 100 futures are currently down -138.5 points (-1.87%), the cash market is currently estimated to open at 7,331.28

- Euro STOXX 50 futures are currently down -111 points (-2.67%), the cash market is currently estimated to open at 4,053.60

- Germany's DAX futures are currently down -359 points (-2.32%), the cash market is currently estimated to open at 15,100.39

US Futures:

- DJI futures are currently down -398 points (-1.17%)

- S&P 500 futures are currently down -222.5 points (-1.57%)

- Nasdaq 100 futures are currently down -59.25 points (-1.36%)

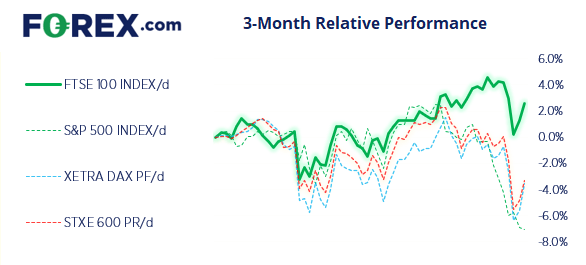

Equity markets continued to sell off overnight with traders having to quickly adjust to their red monitors. The majority of benchmarks fell over -1% with some indices in China and Japan falling over -2%. The Nikkei is a clear underperformer as it also has the stronger yen to contend with.

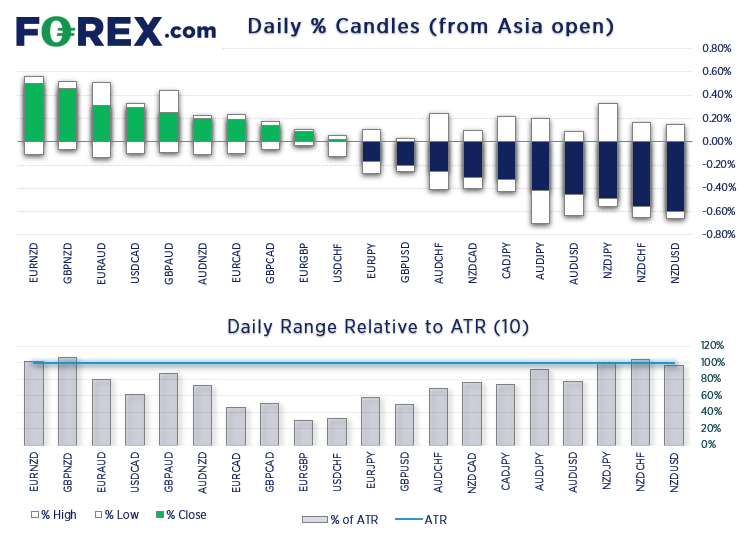

The short end of the yield curve continued to rise in the US overnight, with the 2-year hitting a fresh high of 1.196%. The Fed signalled they’re on track to move ahead with hikes, with some now speculating five hikes this year. The US dollar moved higher against all expect the yen, driving NZD/USD to a fresh 14-month low and now trades just above 0.6600. New Zealand’s inflation report was overshadowed by the risk-off tone which has continued to sweep its way across global markets. NZD was broadly lower against all majors and the Australian dollar was down against al except the Kiwi.

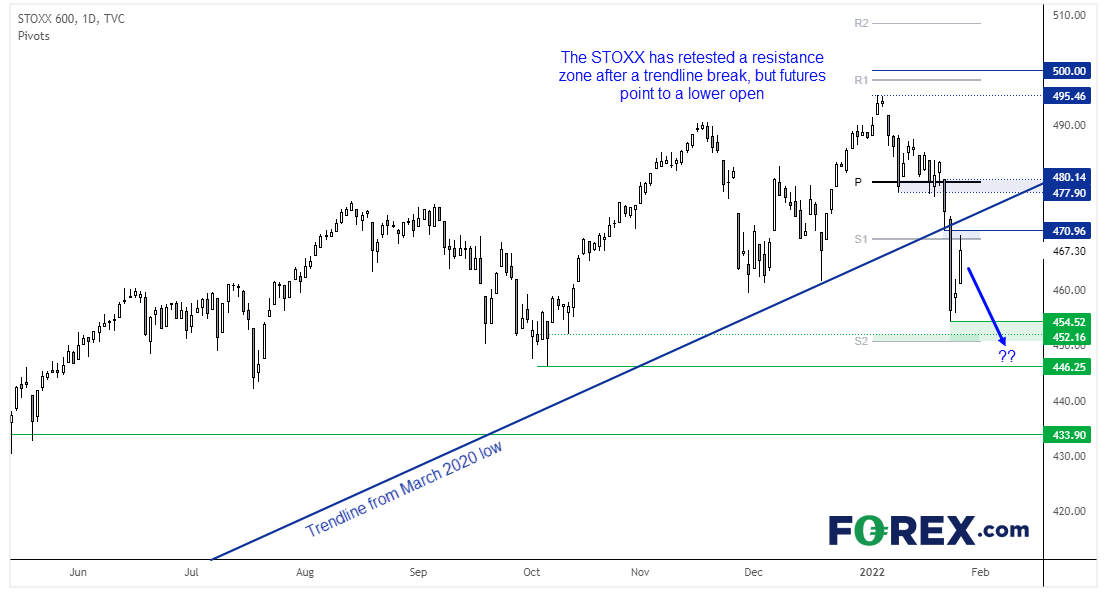

STOXX 600 – corrective bounce complete?

We noted in a video on Monday that prices were on the cusp of breaking trend support. It fell hard and fast, found support around 455 and a two-day countertrend rally stalled around the monthly S1, just below the broken trendline. Given futures markets are pointing lower then we suspect its two-day bounce has complete its move and prices are now poised to break to new lows.

Metals feel the weight of FOMC

Gold suffered its worst session in 18 yesterday, and extended losses overnight. Currently trading around 1815 it looks like bears want to drive this back to 1800, near its 200-day eMA. Silver is currently lower for a fifth consecutive day and trades around 23.30.

Elsewhere in commodities, WTI has pulled back to 86.50 after reaching a high of 88.00 yesterday. Its daily trend structure remains bullish above 82.0

FTSE 350: Market Internals

FTSE 350: 4218.37 (1.33%) 26 January 2022

- 266 (75.78%) stocks advanced and 81 (23.08%) declined

- 5 stocks rose to a new 52-week high, 6 fell to new lows

- 36.18% of stocks closed above their 200-day average

- 28.49% of stocks closed above their 50-day average

- 7.69% of stocks closed above their 20-day average

Outperformers:

- + 8.60% - 4imprint Group PLC (FOUR.L)

- + 7.39% - International Consolidated Airlines Group SA (ICAG.L)

- + 6.35% - Baillie Gifford US Growth Trust PLC (USAB.L)

Underperformers:

- -14.5% - Fresnillo PLC (FRES.L)

- -9.39% - Quilter PLC (QLT.L)

- -6.86% - Playtech PLC (PTEC.L)

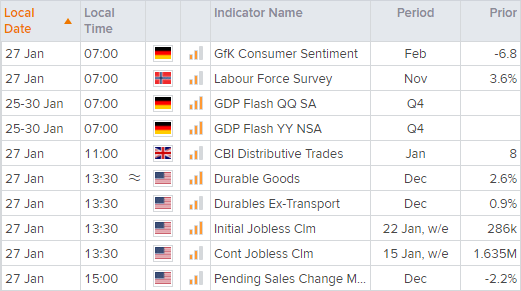

Up Next (Times in GMT)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.