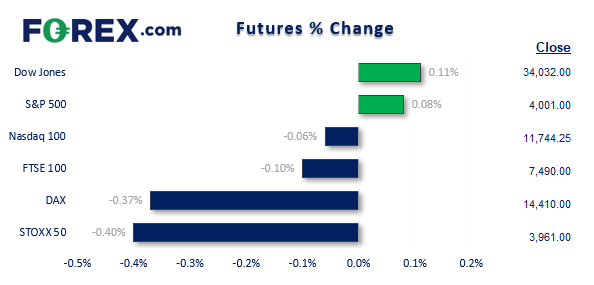

Asian Indices:

- Australia's ASX 200 index fell by -46.5 points (-0.64%) and currently trades at 7,204.80

- Japan's Nikkei 225 index has fallen by -115.89 points (-0.41%) and currently trades at 28,040.32

- Hong Kong's Hang Seng index has fallen by -244.33 points (-1.24%) and currently trades at 19,429.12

- China's A50 Index has fallen by -14.46 points (-0.11%) and currently trades at 13,170.21

UK and Europe:

- UK's FTSE 100 futures are currently down -7 points (-0.09%), the cash market is currently estimated to open at 7,488.93

- Euro STOXX 50 futures are currently down -16 points (-0.4%), the cash market is currently estimated to open at 3,959.26

- Germany's DAX futures are currently down -54 points (-0.37%), the cash market is currently estimated to open at 14,406.20

US Futures:

- DJI futures are currently up 43 points (0.13%)

- S&P 500 futures are currently down -4 points (-0.03%)

- Nasdaq 100 futures are currently up 3.75 points (0.09%)

- Asian equities tracked Wall Street lower following the Fed’s clear message that rates are going to be higher than previously thought.

- Gold is turning to find some stability around 1900, with a lower trendline of a potential bearish pattern on the weekly chart also providing support.

- WTI has also pulled back from yesterday’s 7-day high, although remains within the top third of yesterday’s range and seemingly happy above the 76.25 low.

- Currency markets entered their usual retracement phases after an FOMC event, with volatility levels a shadow of their former selves. AUD/ISD is back below its 200-day EMA and GBP/USD and EUR/USD have pulled back from their cycle highs.

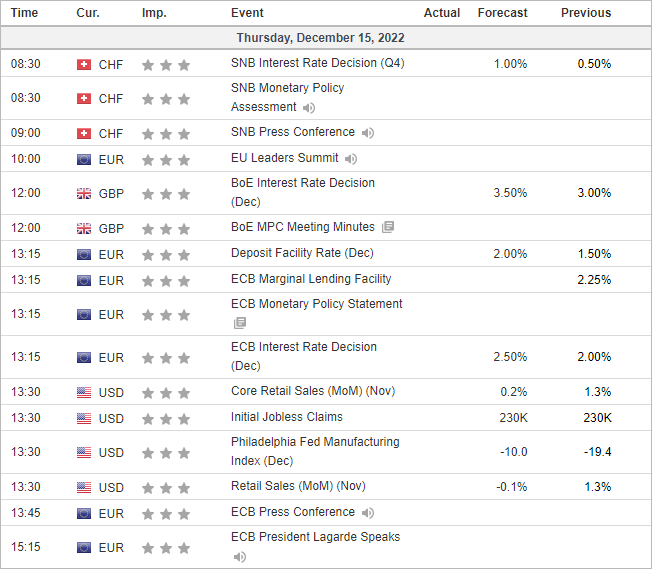

Amongst the currency majors we three central bank meetings just over a seven-hour period. The SNB (Swiss National Bank) kick off at 08:30 GMT followed by a press conference at 09:00 and they are expected to hike by 50bp. Things have clearly changed because traders were disappointed with their 75bp hike in September (100bp was expected) which resulted in its weakest day against the dollar in four months.

The BOE (Bank of England) are expected to hike rates by 50bp at 12:00 – and this is all but a given since inflation softened more than expected (and the first real sign that a peak may finally be here, even if it’s still early days). It

The ECB (European Central Bank) are then expected to hike by 50bp at 13:15.

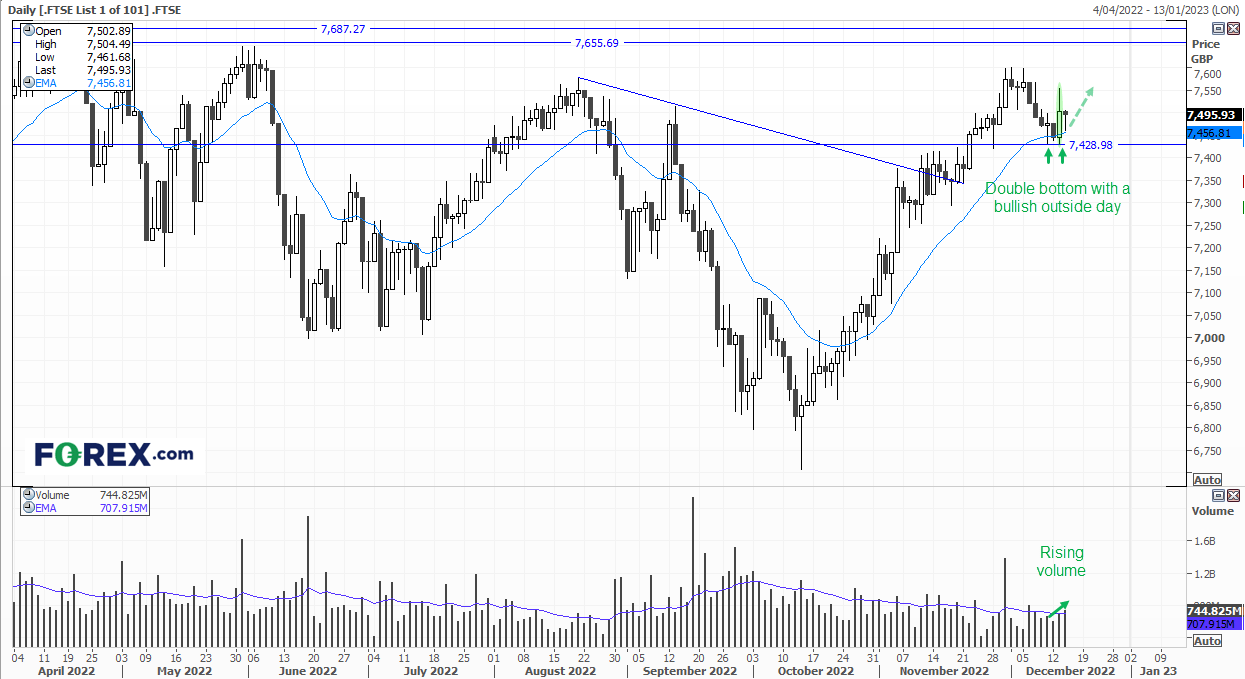

FTSE 100 daily chart:

The long bias for the FTSE 100 is playing out quite well – although it came very close to invalidating the bias with an initial drive lower. However, by the day’s close we saw a double bottom at 7428 support with a bullish engulfing candle. A small inside day formed yesterday and its lower spike respected the 20-day EMA, so we’re looking for the trend to continue higher. Keep in mind that the weak lead form Wall Street could result with a gap lower today, but the bias remains bullish above the double bottom.

FTSE 350 market internals:

FTSE 350: 4140.49 (0.66%) 14 December 2022

- 229 (65.43%) stocks advanced and 112 (32.00%) declined

- 1 stocks rose to a new 52-week high, 2 fell to new lows

- 12.57% of stocks closed above their 200-day average

- 50.57% of stocks closed above their 50-day average

- 5.43% of stocks closed above their 20-day average

Outperformers:

- + 5.12% - Syncona Ltd (SYNCS.L)

- + 4.07% - Hammerson PLC (HMSO.L)

- + 3.70% - Ferrexpo PLC (FXPO.L)

Underperformers:

- -7.99% - TUI AG (TUIGn.DE)

- -7.72% - Wizz Air Holdings PLC (WIZZ.L)

- -6.87% - Helios Towers PLC (HTWS.L)

Economic events up next (Times in GMT)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade