Asian Indices:

- Australia's ASX 200 index fell by -12.7 points (-0.17%) and currently trades at 7,338.80

- Japan's Nikkei 225 index has fallen by -37.31 points (-0.14%) and currently trades at 27,494.63

- Hong Kong's Hang Seng index has fallen by -207.23 points (-0.99%) and currently trades at 20,679.73

- China's A50 Index has fallen by -31.48 points (-0.23%) and currently trades at 13,679.43

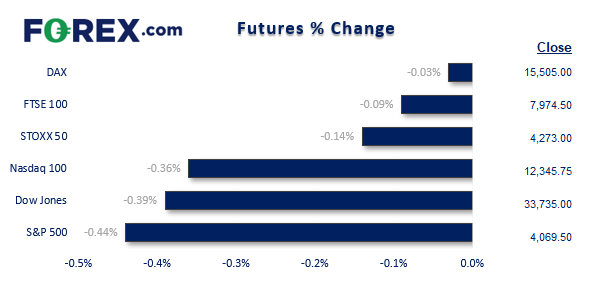

UK and Europe:

- UK's FTSE 100 futures are currently down -6.5 points (-0.08%), the cash market is currently estimated to open at 8,007.81

- Euro STOXX 50 futures are currently down -6 points (-0.14%), the cash market is currently estimated to open at 4,265.18

- Germany's DAX futures are currently down -5 points (-0.03%), the cash market is currently estimated to open at 15,472.55

US Futures:

- DJI futures are currently down -130 points (-0.38%)

- S&P 500 futures are currently down -44.75 points (-0.36%)

- Nasdaq 100 futures are currently down -17.75 points (-0.43%)

- The RBA minutes firmly backed a 25bp over a 50bp, which suggests aggressive hikes are most likely in the past – although there is still room for at least two more hike(s)

- Australia’s private sector contracted for a fifth consecutive month according to the latest PMI report, with services mostly weighing on the broader economy

- Japan’s flash manufacturing PMI contracted at its fastest pace in 30 months

- NZ producer prices (both input and output) were much softer than expected, which plays further into a 50bp RBNZ hike over a 75bp

- View our RBNZ cash rate preview livestream recording for a complete rundown

Flash PMI’s and Canada inflation report in focus:

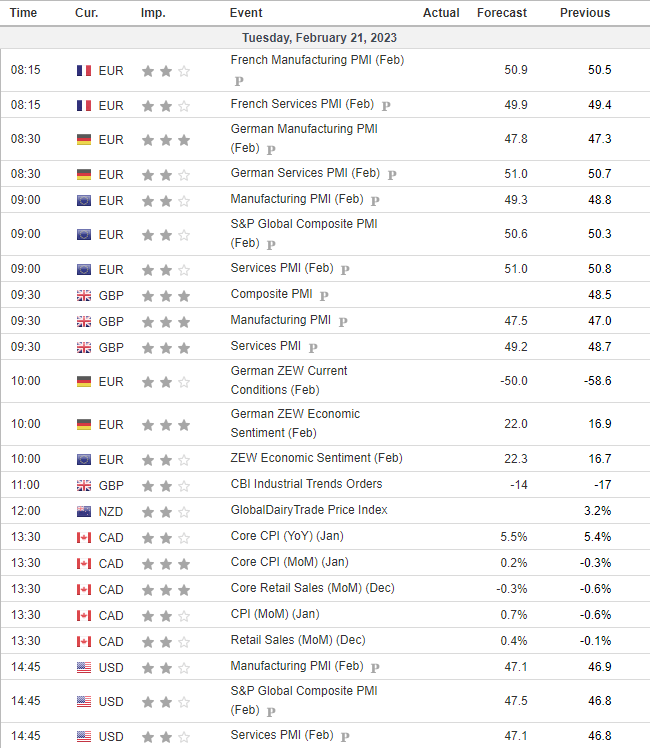

Flash PMI data for Europe take up the baulk of the data in the early European session, with a ZEW economic report also scheduled for 10:00 GMT. Canada’s inflation and retail sales report is the main event at 13:30, ahead of US PMI data at 14:45. Given trading floors across the US and Canada reopen today after a long weekend, we’re hopeful volatility will pick up.

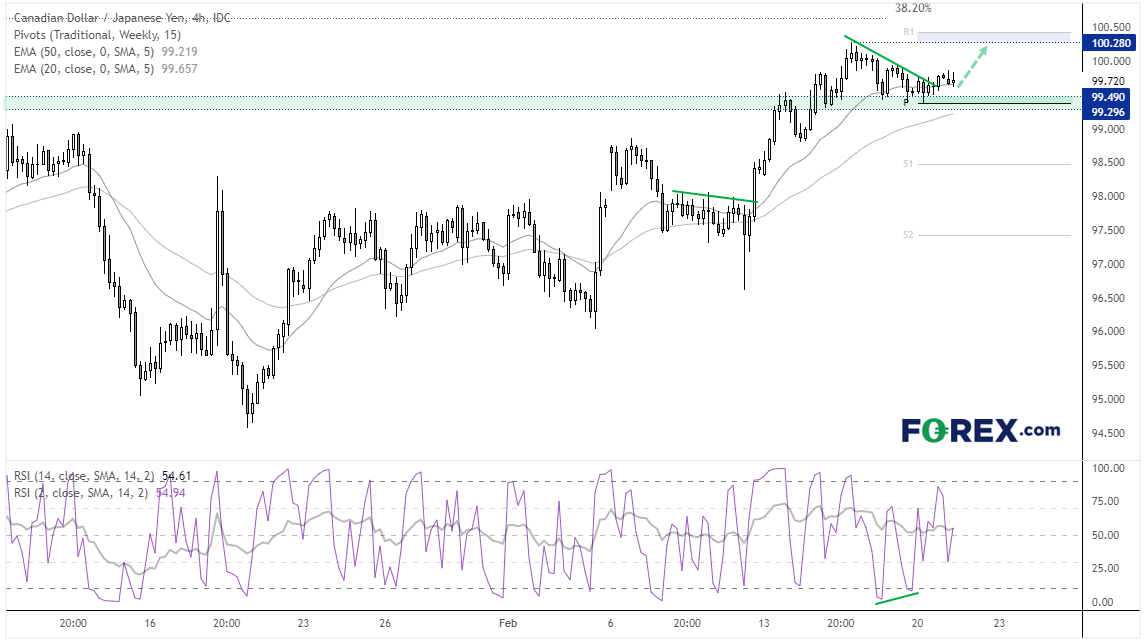

CAD/JPY 4-hour chart

With a Canadian inflation and retail sales report on tap, CAD pairs are in focus – and one of the more interesting pairs is CAD/JPY. The 4-hout chart remains within an uptrend but is trying to revert to its trend after a brief pullback and consolidation. Strong inflation and retail sales should keep bets alive for another BOC hike and likely send CAD pairs higher, and even more so if oil prices remain under pressure.

The pullback found support around the early December lows / late December highs and weekly pivot point, and we’re keen to seek bullish setups with any low-volatility retracement towards the said support zone. 100 is likely to provide resistance along the way, a break above which brings the 100.28 highs and weekly Q into focus.

Economic events up next (Times in GMT)