Asian Indices:

- Australia's ASX 200 index rose by 5.8 points (0.08%) and currently trades at 7,352.60

- Japan's Nikkei 225 index has risen by 7.74 points (0.03%) and currently trades at 27,521.46

- Hong Kong's Hang Seng index has risen by 167.35 points (0.81%) and currently trades at 20,887.16

- China's A50 Index has risen by 128.93 points (0.96%) and currently trades at 13,530.69

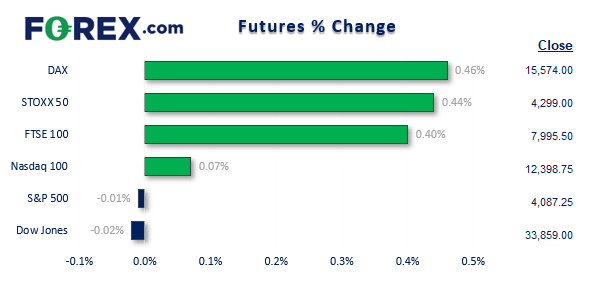

UK and Europe:

- UK's FTSE 100 futures are currently up 32 points (0.4%), the cash market is currently estimated to open at 8,036.36

- Euro STOXX 50 futures are currently up 19 points (0.44%), the cash market is currently estimated to open at 4,293.92

- Germany's DAX futures are currently up 71 points (0.46%), the cash market is currently estimated to open at 15,553.00

US Futures:

- DJI futures are currently down -5 points (-0.01%)

- S&P 500 futures are currently down 0 points (0%)

- Nasdaq 100 futures are currently up 9.75 points (0.08%)

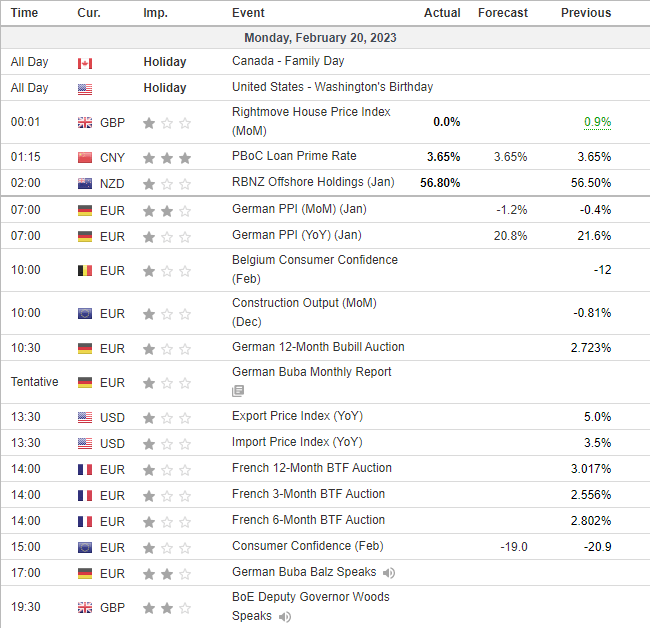

- Trading volumes are expected to be lower after lunch due to the US and Canada having public holidays

- Geopolitical tensions were on the rise as North Korea fired two more ballistic missiles off its east coast

- The PBOC kept their LPR (loan prime rate) unchanged at 3.65%

- The US dollar handed back most of its weekly gains on Friday ahead of the 3-day weekend, which saw a bullish hammer form on EUR/USD and gold daily charts

- There may be some mean reversion (against the US dollar) heading into Wednesday’s FOMC minutes

- A bullish engulfing week formed on copper futures, which suggests an important swing low has formed just below $4.00

- Oil prices and US stocks were lower on Friday as export prices rose 0.8% m/m – wel; above the -0.2% expected

- German producer prices are in focus at 07:00 GMT, although no top-tier economic data is scheduled for today

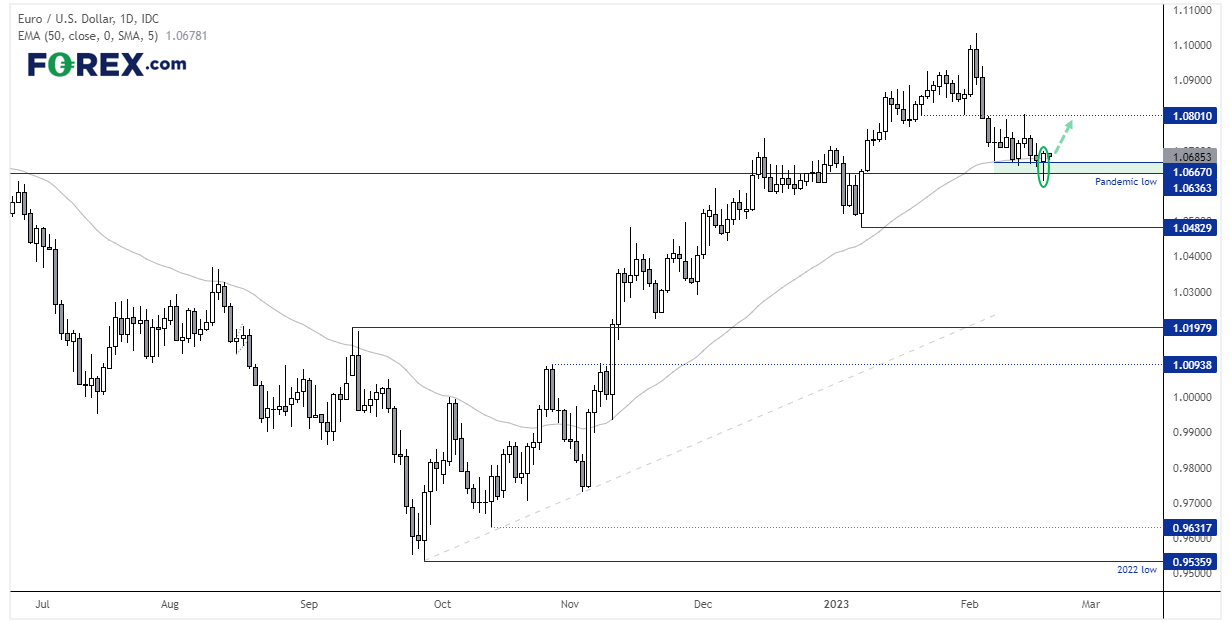

EUR/USD daily chart

On Friday the euro tried (but failed) to close below the ‘pandemic low’, instead closing the day with a bullish hammer candle. It also closed back above the 50-day EMA and has continued to hold above it during Asian trade. Given the fact the US is on a public holiday and data is light, we see the potential for range trading – which means bulls may be tempted to enter around the range lows and see if it can get back up to 1.800.

Economic events up next (Times in GMT)

Latest market news

Today 07:15 PM

Today 04:10 PM

Today 12:30 PM