Asian Indices:

- Australia's ASX 200 index fell by -92.5 points (-1.31%) and currently trades at 6,946.20

- Hong Kong's Hang Seng index has risen by 257.88 points (1.3%) and currently trades at 20,039.29

- China's A50 Index has fallen by -55.7 points (-0.43%) and currently trades at 12,948.41

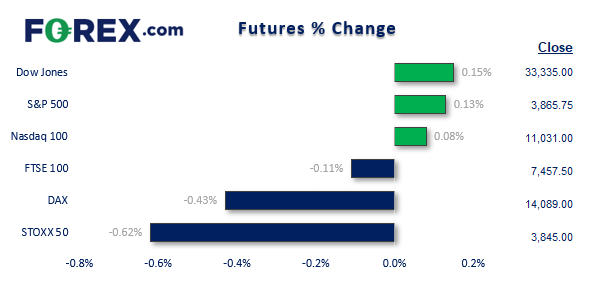

UK and Europe:

- UK's FTSE 100 futures are currently down -8.5 points (-0.11%), the cash market is currently estimated to open at 7,443.24

- Euro STOXX 50 futures are currently down -24 points (-0.62%), the cash market is currently estimated to open at 3,832.09

- Germany's DAX futures are currently down -61 points (-0.43%), the cash market is currently estimated to open at 14,008.26

US Futures:

- DJI futures are currently up 53 points (0.16%)

- S&P 500 futures are currently up 9.25 points (0.08%)

- Nasdaq 100 futures are currently up 5 points (0.13%)

Weak PMI data from China over the weekend and today weighed on equity market sentiment across Asia. The ASX 200 fell to an 8-week low during its worst session in seven, and now trades below 7,000. However, China’s equity markets went on to rally despite initially gapping lower, as recovery hopes from their reopening countered the negative sentiment. European index futures point to a weak open for the first trading day of the year.

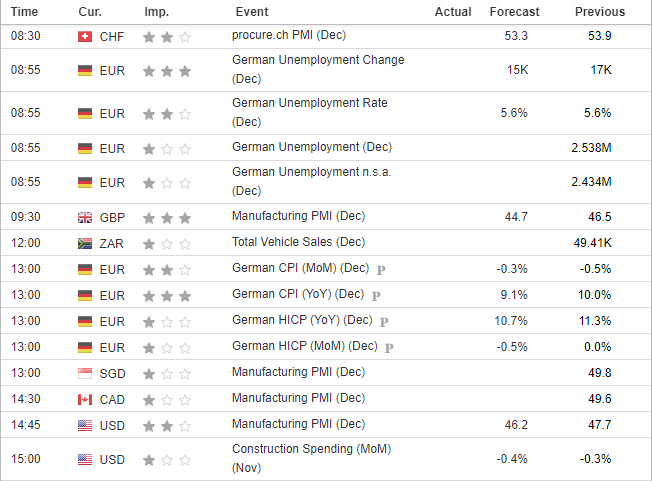

The baulk of today’s economic data is from Germany, with employment data at 08:55 GMT then inflation at 13:00. UK manufacturing PMI is scheduled for 09:30, then manufacturing PMI data is then released for Canada and the US at 14:30 and 14:45 respectively.

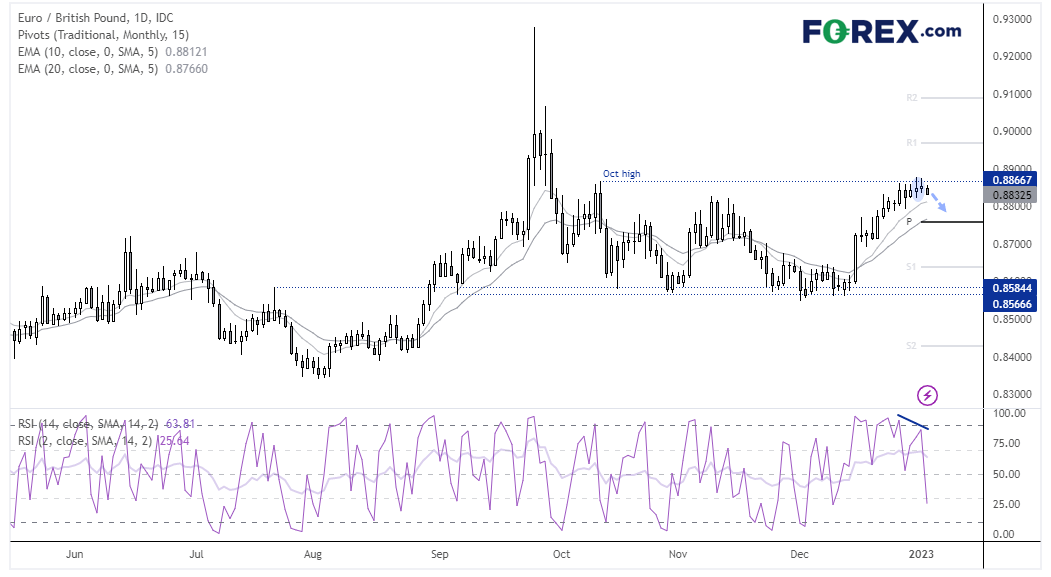

EUR/GBP daily chart:

EUR/GBP has been rising along with GBP-EUR yield differentials as traders price in a more hawkish ECB in 2023. However, the rally lost steam as it approached the October highs and produced a couple of low liquidity Doji’s below that key level. Momentum ha turned lower today so we suspect an interim top has formed and prices are due to pull back towards 0.8800. Also take note that the 20-day EMA is near the monthly pivot point around 0.8760 which makes it a potential target for a deeper pullback.

Economic events up next (Times in GMT)