Asian Indices:

- Australia's ASX 200 index rose by 40.8 points (0.58%) and currently trades at 7,105.10

- Japan's Nikkei 225 index has risen by 6.3 points (0.02%) and currently trades at 28,878.08

- Hong Kong's Hang Seng index has risen by 22.78 points (0.11%) and currently trades at 20,063.64

- China's A50 Index has risen by 39.63 points (0.29%) and currently trades at 13,698.64

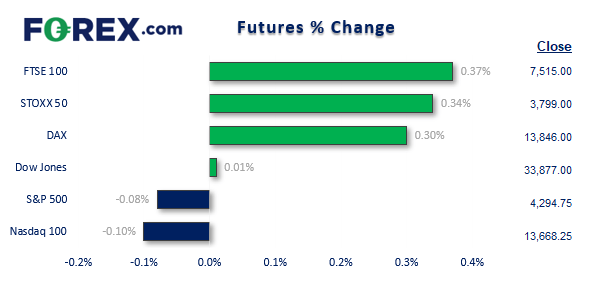

UK and Europe:

- UK's FTSE 100 futures are currently up 27.5 points (0.37%), the cash market is currently estimated to open at 7,536.65

- Euro STOXX 50 futures are currently up 13 points (0.34%), the cash market is currently estimated to open at 3,802.62

- Germany's DAX futures are currently up 41 points (0.3%), the cash market is currently estimated to open at 13,857.61

US Futures:

- DJI futures are currently up 4 points (0.01%)

- S&P 500 futures are currently down -13 points (-0.1%)

- Nasdaq 100 futures are currently down -3.75 points (-0.09%)

The RBA’s August minutes revealed little new, and basically reiterated that rate on not on a pre-set path. AUD/USD traded slightly higher overnight but – like all FX majors – remained in a tight range after a volatile risk-off session yesterday. And to highlight the underlying tone for currencies, AUD and NZD are the weakest of the past week whilst JPY and USD are the strongest.

Any concerns of a global slowdown were not immediately apparent across Asian indices, with the majority trading higher overnight. European futures are also higher which points to a positive open for cash markets, whilst US futures are slightly lower from yesterday’s close.

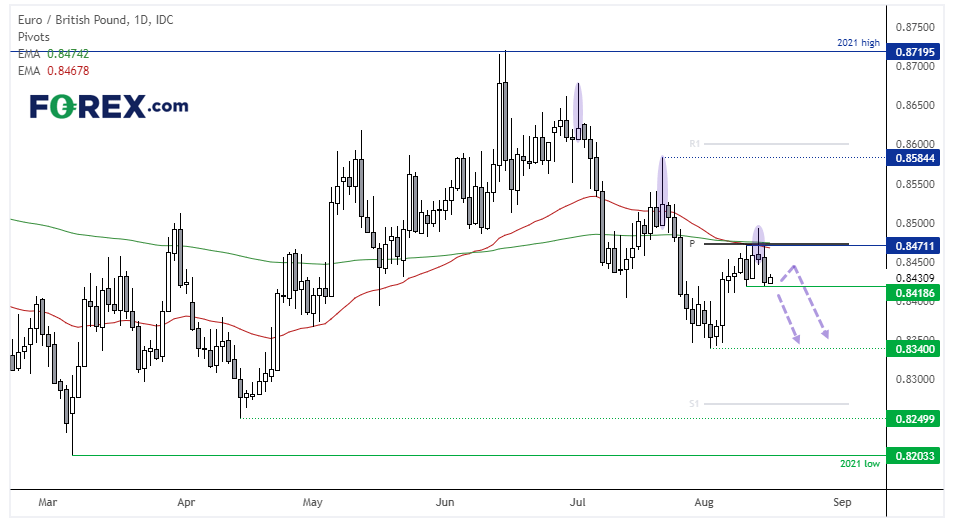

EUR/GBP daily chart:

It’s time to take another look at EUR/GBP now appears a swing high has formed. The intraday break above 0.8470 resistance on Friday quickly reversed, to leave a bearish hammer on the daily chart which closed beneath the 50/200-day eMA’s and monthly pivot point. Also note that the previous two legs lower in this downtrend began with a bearish hammer. Therefore a break beneath last week’s low assumes bearish continuation.

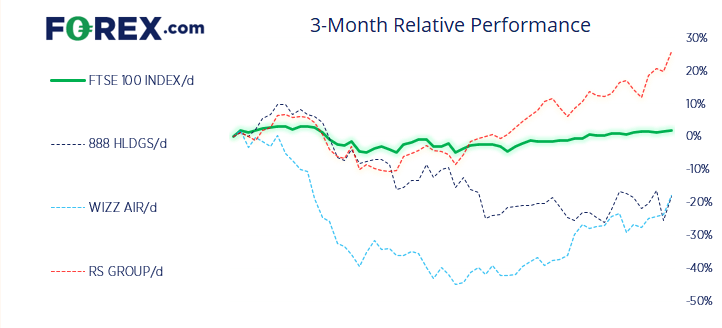

FTSE 350 – Market Internals:

FTSE 350: 4189.75 (0.11%) 15 August 2022

- 194 (55.43%) stocks advanced and 141 (40.29%) declined

- 9 stocks rose to a new 52-week high, 0 fell to new lows

- 40% of stocks closed above their 200-day average

- 82.86% of stocks closed above their 50-day average

- 18.29% of stocks closed above their 20-day average

Outperformers:

- + 9.74% - 888 Holdings PLC (888.L)

- + 7.47% - Wizz Air Holdings PLC (WIZZ.L)

- + 5.06% - RS Group PLC (RS1R.L)

Underperformers:

- -4.68% - Auction Technology Group PLC (ATG.L)

- -3.81% - Energean PLC (ENOG.L)

- -3.64% - Aston Martin Lagonda Global Holdings PLC (AML.L)

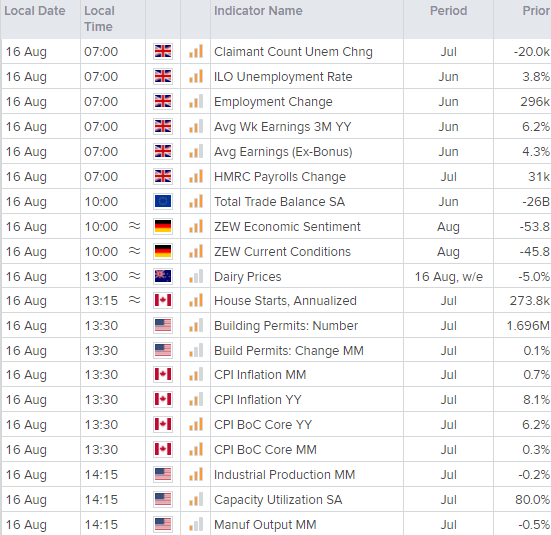

Economic events up next (Times in BST)

UK employment data is released at 07:00 and, like many of the major economies suffering from high inflation, it remains as robust as ever. Today’s data is therefore unlikely to be much of a game change for the BOE, who are favoured to raise rates by 50bp at their next meeting. Unless we see material evidence that the employment market has topped – but as it is lagging, it could take some time for this scenario to present itself.

German ZEW economic sentiment is at 10:00 BST and, if the sinking IFO survey is anything to go by, it could make for another grim data point. Both the IFO current climate and expectations indices sank to their lowest levels since the pandemic, so the ZEW expectations could easily fall to its lowest level since 2008 (given it is already at an 11-year low)

Canada’s inflation data is released at 13:30 where traders will be looking for further signs of it slowing. We noted in last month’s article that producer prices contracted in June for the first month in 10, whilst rate of change of core CPI m/m is pointing lower. So the early signs of disinflation are there. And with Canada’s inverted yield curve suggesting that investors expect a hard landing, a soft CPI print today could alleviate those concerns.

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.