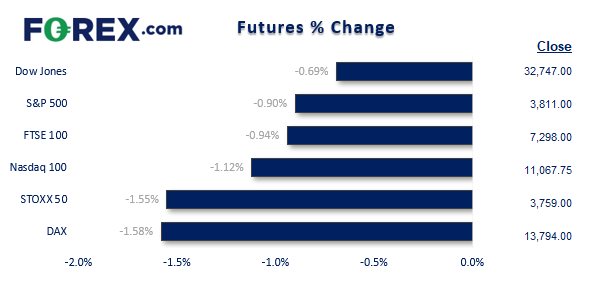

Asian Indices:

- Australia's ASX 200 index fell by -109.6 points (-1.54%) and currently trades at 7,024.30

- Japan's Nikkei 225 index has fallen by -669.61 points (-2.46%) and currently trades at 26,568.03

- Hong Kong's Hang Seng index has fallen by -345.45 points (-1.79%) and currently trades at 19,007.36

- China's A50 Index has fallen by -282.9 points (-2.17%) and currently trades at 12,780.27

UK and Europe:

- UK'sFTSE 100 futures are currently down -70 points (-0.95%), the cash market is currently estimated to open at 7,291.31

- Euro STOXX 50 futures are currently down -58 points (-1.52%), the cash market is currently estimated to open at 3,753.24

- Germany's DAX futures are currently down -219 points (-1.56%), the cash market is currently estimated to open at 13,723.87

US Futures:

- DJI futures are currently down -224 points (-0.68%)

- S&P 500 futures are currently down -125 points (-1.12%)

- Nasdaq 100 futures are currently down -33.75 points (-0.88%)

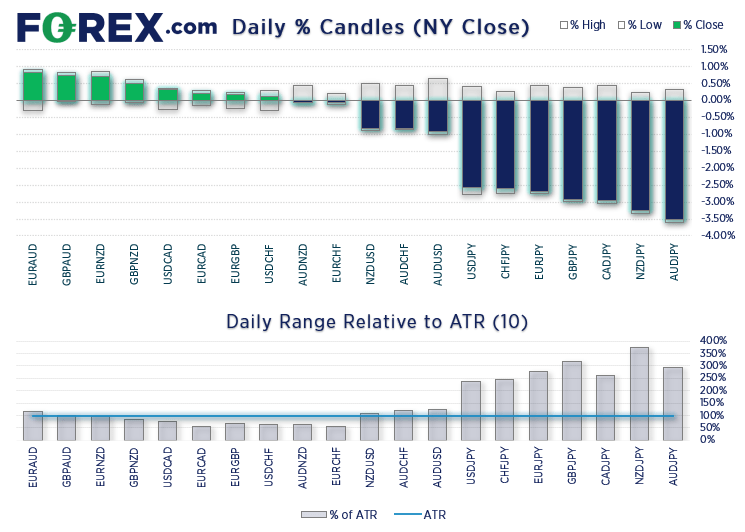

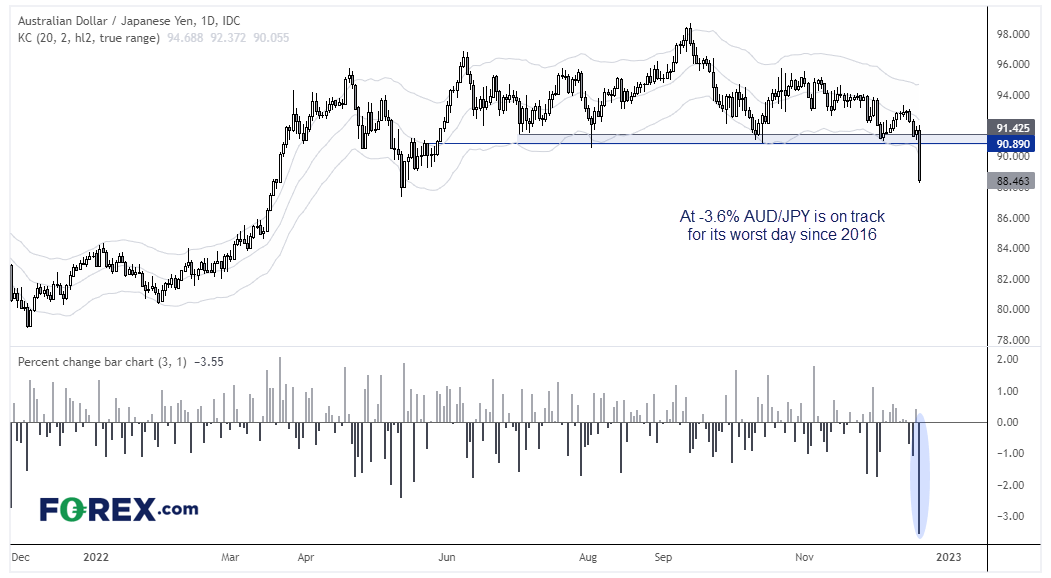

The surprise move by the BOJ to (finally) adjust their yield target for the 10-year JGB certainly made its mark across markets overnight. Volatility for yen pairs and Japan’s bond markets exploded higher as investors scrambled to price in the possibility of an end of the BOJ’s ultra loose policy. A recent poll in Reuters noted over half of economists favoured an end to ultra-easy policy between March to October next year – likely because Kuroda’s term would have come to an end. So to see the BOJ switch tact at the end of 2022 surprised many, in what was ultimately a sleepy session ahead of the festive break.

- The yen has continued to strengthen and push AUD/JPY (a barometer of risk) down -3.5% during its worst session since Brexit (June 2016)

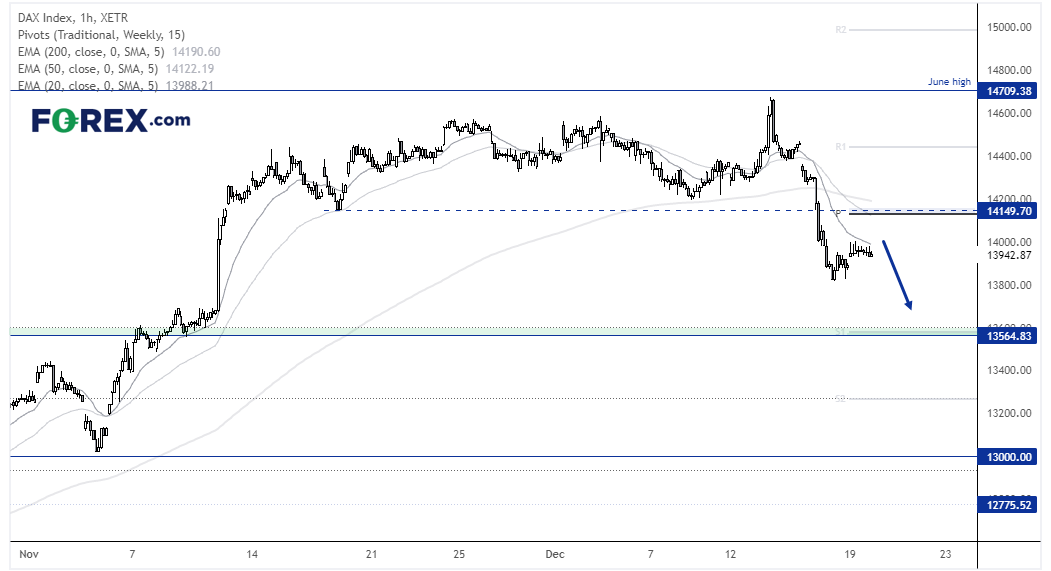

- Index futures are broadly lower led by the DAX ahead of the European open

- We could be in for a rocky ride today given traders across Europe and the US are yet to react to the BOJ, and the considerably lower AUD/JPY does not bode well for the equity market

RBA considered a pause but opted for 25bp hike, as per minutes

The RBA had generated some excitement that they would soon be considering a pause in tightening – but I see no such case in their minutes. They noted that inflation is still expected to take ‘several years to return to target range’ even with ‘further increases in the cash rate’ and that no other central bank ‘had paused yet’. That doesn’t sound very pausey to me – so I suspect they’re on track for a 25bp in February and March.

DAX 4-hour chart:

We outlined the potential for the DAX to retrace higher yesterday and, whilst it did track higher, its retracement was underwhelming and remained below 14k. Index futures point to a gap lower and there is a reasonable chance to assume equities will face further selling pressure today. Perhaps the bigger question is whether any gap we are given still provides and adequate reward/risk ratio for bears to consider for short setups. Next major support is around 13,600.

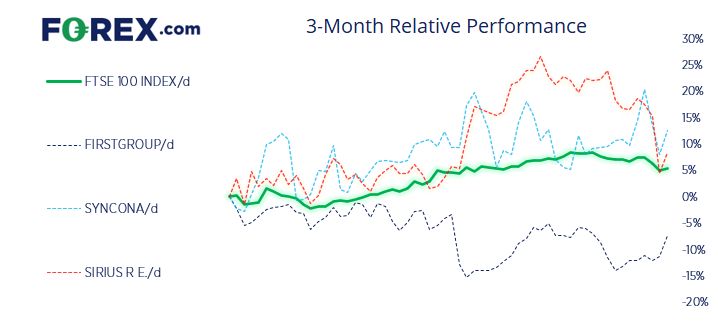

FTSE 350 market internals:

FTSE 350: 4064.64 (0.66%) 19 December 2022:

- 229 (65.43%) stocks advanced and 112 (32.00%) declined

- 0 stocks rose to a new 52-week high, 7 fell to new lows

- 12.57% of stocks closed above their 200-day average

- 50.57% of stocks closed above their 50-day average

- 5.43% of stocks closed above their 20-day average

Outperformers:

- + 4.38% - FirstGroup PLC (FGP.L)

- + 4.18% - Syncona Ltd (SYNCS.L)

- + 3.84% - Sirius Real Estate Ltd (SRET.L)

Underperformers:

- -4.44% - A G Barr PLC (BAG.L)

- -4.31% - Currys PLC (CURY.L)

- -4.24% - Carnival PLC (CCL.L)

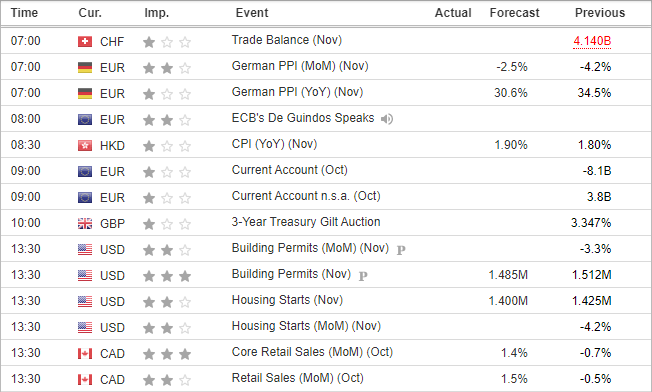

Economic events up next (Times in GMT)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade