Asian Indices:

- Australia's ASX 200 index rose by 9.2 points (0.13%) and currently trades at 7,272.50

- Japan's Nikkei 225 index has risen by 278.47 points (0.9%) and currently trades at 31,086.82

- Hong Kong's Hang Seng index has fallen by -114.58 points (-0.58%) and currently trades at 19,563.59

- China's A50 Index has fallen by -96.41 points (-0.74%) and currently trades at 13,019.12

UK and Europe:

- UK's FTSE 100 futures are currently up 4 points (0.05%), the cash market is currently estimated to open at 7,774.99

- Euro STOXX 50 futures are currently up 1 points (0.02%), the cash market is currently estimated to open at 4,386.63

- Germany's DAX futures are currently up 3 points (0.02%), the cash market is currently estimated to open at 16,226.99

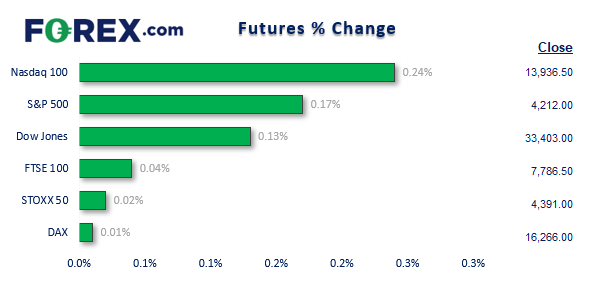

US Futures:

- DJI futures are currently up 43 points (0.13%)

- S&P 500 futures are currently up 7 points (0.17%)

- Nasdaq 100 futures are currently up 32.75 points (0.24%)

- Whilst the highly anticipated debt ceiling negotiations failed to end in an agreement, both parties called their discussions productive and vowed to continue pressing ahead to avert a US default

- As we’ve said before, this will likely go on for some time as both parties are seemingly happy to run down the clock in a big game of chicken, before the debt ceiling will likely be lifted anyway

- Right now it is about who can score the most concessions before we hit that moment of panic

- This has seen volatility for currencies on the low side and equity performance mixed

- Japan’s manufacturing PMI rose to its highest rate of expansion in even months, initially seeing USD/JPY pull back from its highs before making a half-hearted attempt to reach a new cycle high

- The Nikkei extended its lead to a 33-year high thanks to a weaker yen and hopes of a debt ceiling resolution, before handing back the day’s gains near the end of the session

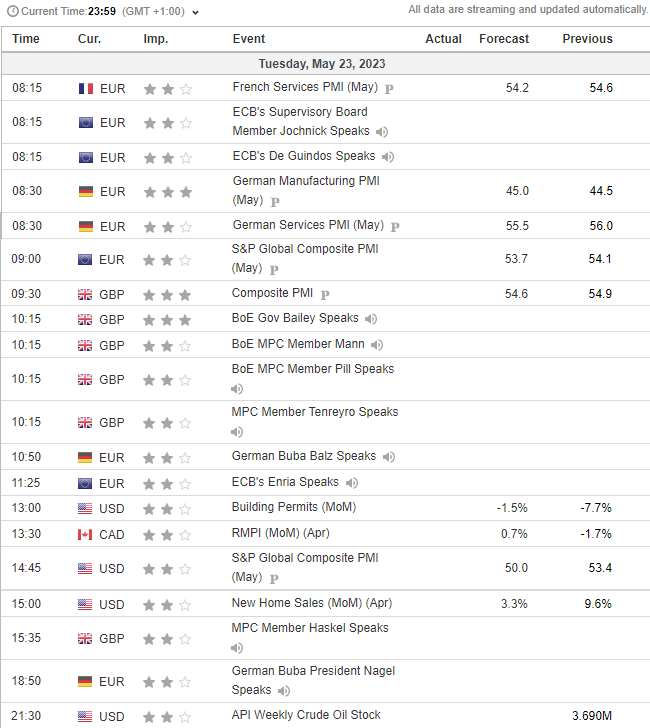

- BOE’s Andrew Bailey, Huw Pill, Silvana Tenreyro and Catherine L Mann are set to speak at the Treasury Selecting Hearings on the May Monetary Policy Report, from 10:15 BST

- Flash PMI data for the UK, Europe and US are the main economic repots today, with France and Germany kicking off at 08:15, the eurozone at 08:30 and the UK at 09:30

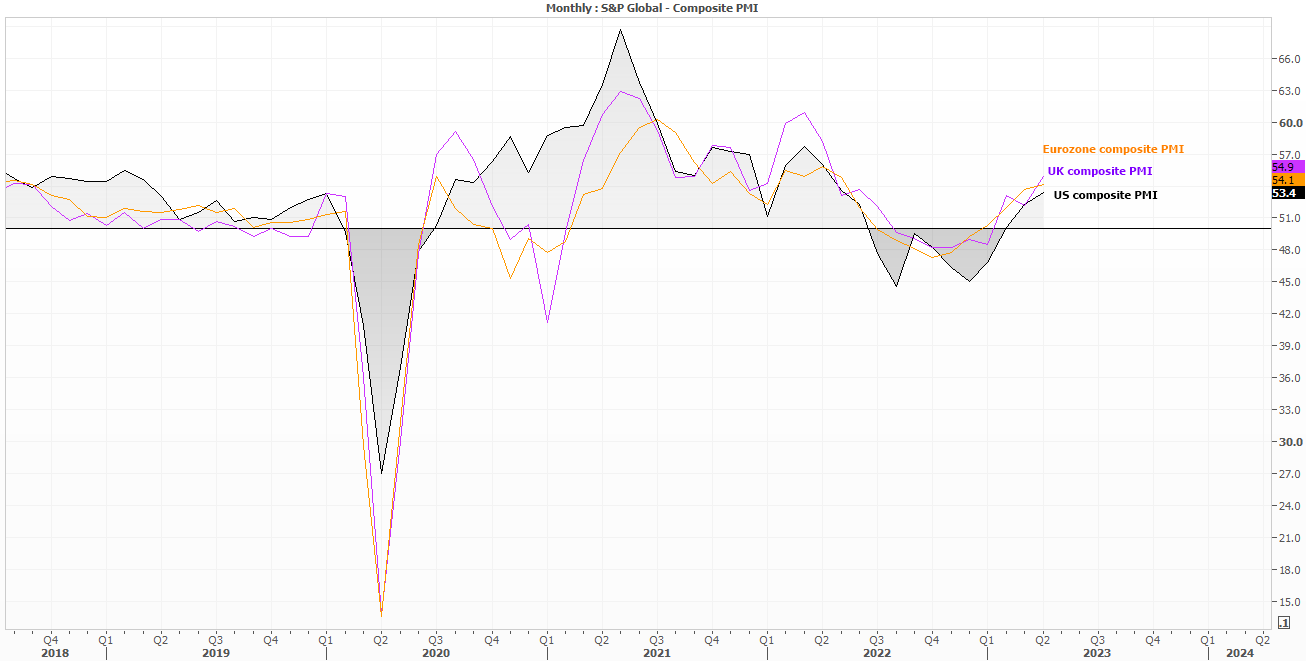

Flash PMI data for May is released today

We can see that the composite PMIs for the UK, Europe and US are all trending higher which shows the economies have growth potential in the months ahead. However, it is the services sectors which are doing all of the heavily lifting in a post-Covid world with manufacturing sectors continuing to contract across the globe. But perhaps we’ll see an upside surprise, given Australia’s manufacturing contracted at a slower pace and Japan’s manufacturing sector threw in a cheeky expansion.

But what we’d really like to see is a divergence between the numbers to help prompt a suitable currency pair reaction. Given business sentiment for Germany and the broader eurozone are falling, perhaps it will also show up in today’s PMI figures. And if that were to be coupled with better-than-expected US data and a debt-ceiling deal, EUR/USD could find itself under some selling pressure.

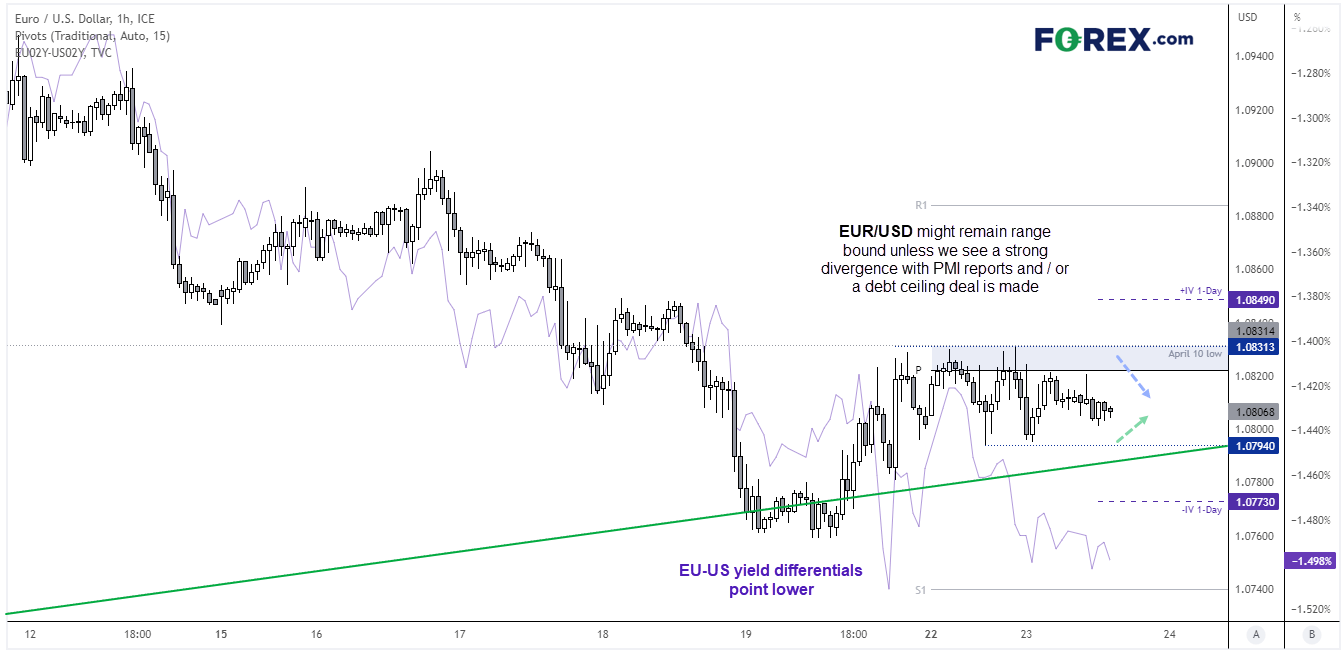

EUR/USD 1-hour chart

EUR/USD finds itself between a rock and a hard place having flicked through the timeframes. Whilst a bearish trend has formed on the 1-hour chart, prices fid themselves within a choppy consolidation just above 1.0800. Last week’s low also formed around a key trendline from the 2022 low yet, at the same time, this week’s highs have met resistance at the weekly pivot point and April 10 low.

Unless we see a clear divergence in today’s PMI reports, we run the risk of lower volatility and for prices to remain in its choppy range. But if it can break out of range, take note that the 1-day implied volatility band sits around 1.0773 – 1.0850. A break above 1.0835 suggest a bullish breakout of the current consolidation.

Economic events up next (Times in GMT+1)

Follow Matt on Twitter @cLeverEdge

European market open FAQs

What is the European market open time?

The European market opens at 08:00 (UTC) when the London Stock Exchange starts trading. The Euronext group exchange – which includes Amsterdam, Paris, Lisbon, Dublin, Oslo and Brussels – opens later at 09:00 (UTC).

See our stock trading hoursWhat time do European stock markets close?

European stock markets close at 17:40 (UTC), when the Amsterdam session of the Euronext concludes. All other European exchanges finish trading earlier – the London Stock Exchange closes at 16:30 (UTC), while the other Euronext locations close at 17:30 (UTC).

What is the European stock market called?

The European stock market is the Euronext, which is made up of several different exchanges across Europe. Euronext operates exchanges in Paris, Amsterdam, Brussels, Lisbon, Dublin, Oslo, and Milan. As of 2023, Euronext is the largest exchange in Europe and the fourth largest in the world by market capitalisation of listed companies.

Learn how the stock market worksWhat is the main European stock index?

The main European stock indices to track are the DAX (Germany 40), CAC 40 (France 40) and the STOXX Europe 50 index (EU Stocks 50).

The FTSE 100 is also a popular European index to monitor – although the UK is no longer part of the EU, it remains economically linked to its European neighbours.

Discover how to trade indices