Euro technical forecast: EUR/USD weekly trade levels

- Euro fails second attempt to breach key resistance range

- EUR/USD bulls vulnerable heading into May trade- FOMC, NFPs on tap

- Resistance 1.1033/70, 1.1148, 1.1275– support 1.0793, 1.0705 (key), 1.05

Euro failed a second attempt at breaching key resistance around the yearly highs this week with and while the broader EUR/USD outlook remains constructive, the advance may be vulnerable to an exhaustion pullback heading into the May open. These are the updated targets and invalidation levels that matter on the EUR/USD weekly technical chart.

Discussing this Euro setup and more in the Weekly Strategy Webinars on Monday’s at 8:30am EST.

Euro Price Chart – EUR/USD Weekly

Chart Prepared by Michael Boutros, Technical Strategist; EUR/USD on TradingView

Technical Outlook: In my last Euro technical forecast, we noted that the EUR/USD advance may be vulnerable as price approached downtrend resistance and that, “a topside breach / weekly close above the yearly opening-range high at 1.1033 would be needed to mark resumption of the uptrend…” Euro has now made multiple attempts to breach this threshold with price now poised to mark yet another weekly close just below.

A longer-dated 23.6% retracement from the broader 2008 decline extends key resistance into 1.1033/70- a topside breach / close above this threshold is needed to mark uptrend resumption towards the January 2022 low-week close at 1.1148 and the 61.8% Fibonacci retracement of the 2021 decline at 1.2748- look for a larger reaction there IF reached.

Weekly support rests back with the January high-week close at 1.0793 with broader bullish invalidation steady at the objective yearly open at 1.0705- losses below this threshold would threaten another test of the yearly lows.

Bottom line: The Euro rally has extended into key resistance around the January highs with the advance still vulnerable while below 1.1033/70. From a trading standpoint, a good zone to reduce long-exposure / raise protective stops- be on the lookout for a possible test of slope support heading into the start of the month with a close above 1.01070 needed to mark uptrend resumption. Review my latest Euro short-term technical outlook for a closer look at the near-term EUR/USD technical trade levels.

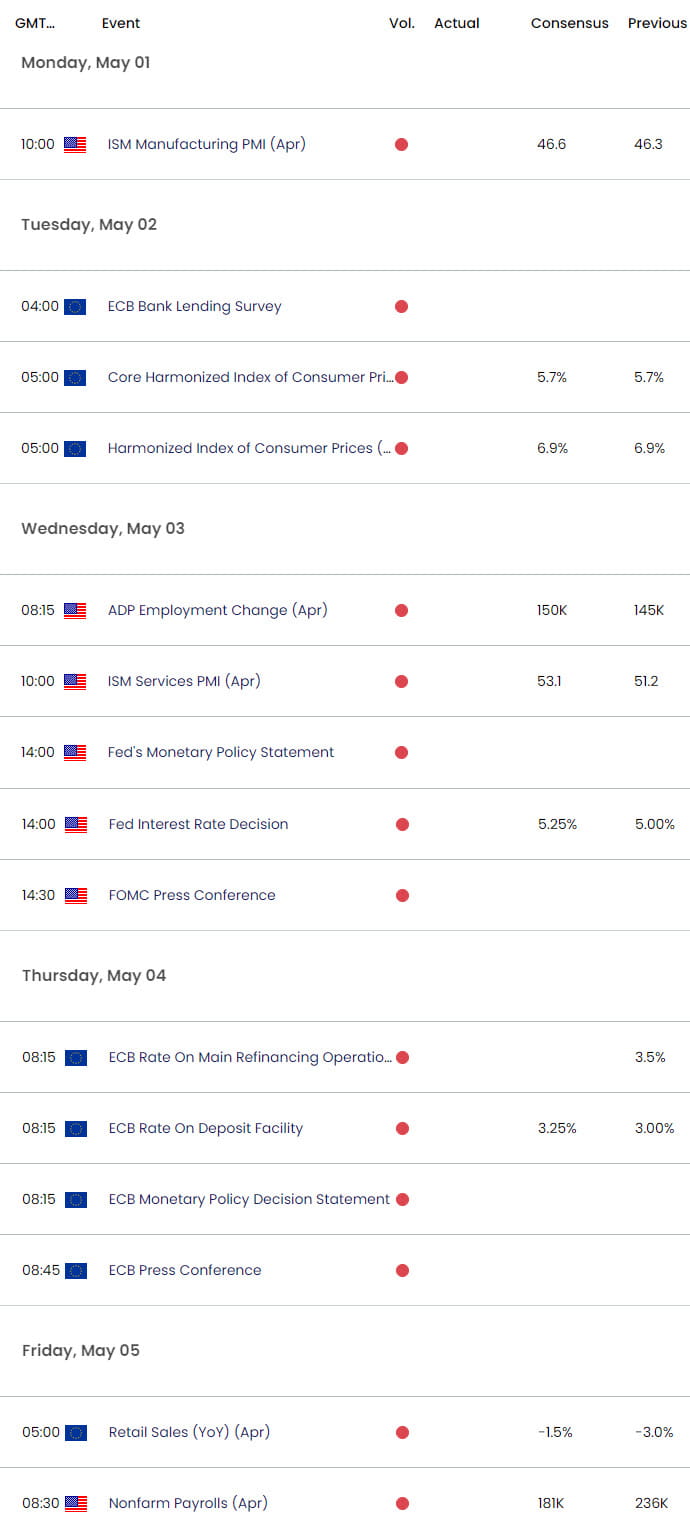

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- Canadian Dollar (USD/CAD)

- Gold (XAU/USD)

- Japanese Yen (USD/JPY)

- Australian Dollar (AUD/USD)

- US Dollar (DXY)

- Crude Oil (WTI)

- S&P 500 (SPX500)

- British Pound (GBP/USD)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com