Euro technical outlook: EUR/USD short-term trade levels

- Euro post-Fed rally falters at resistance- ECB rate decision, US Non-Farm Payrolls on tap

- EUR/USD holding just below uptrend resistance- multi-week range-break pending

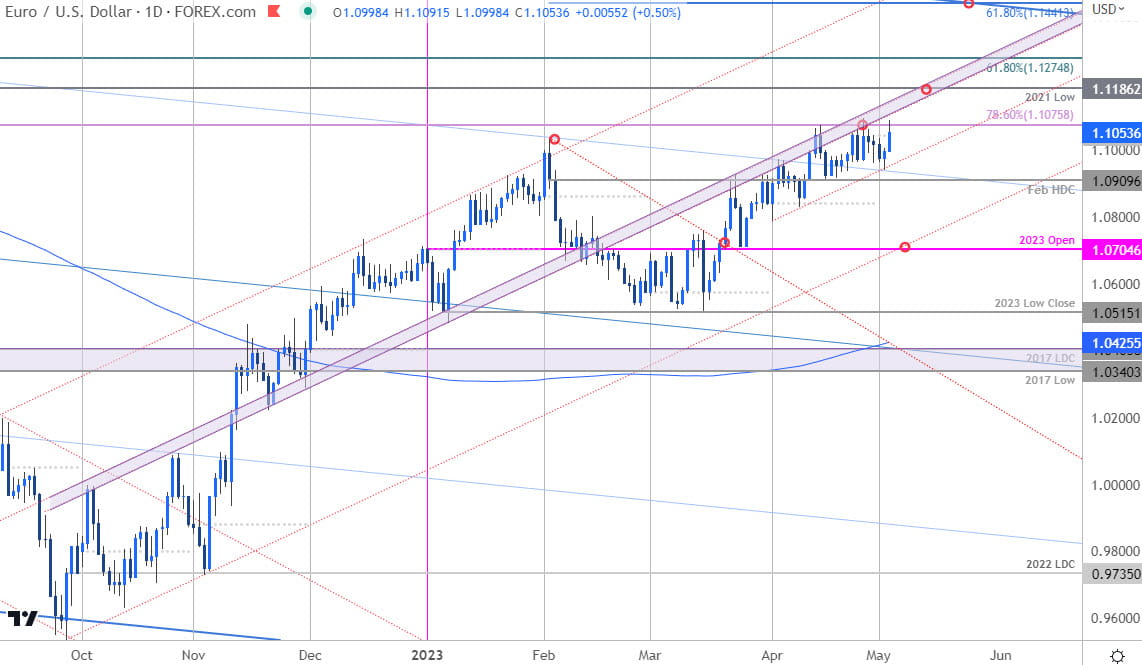

- Resistance 1.1075/95, 1.1186, 1.1275- support 1.0909, 1.0843, 1.0705/37 (critical)

Euro rallied more than 1.3% off the weekly lows with today’s post-FOMC rally faltering just pips ahead of the yearly highs. The advance takes EUR/USD back into a key inflection zone ahead of the European Central Bank (ECB) interest rate decision tomorrow and the battle-lines have been drawn. These are the updated targets and invalidation levels that matter on the EUR/USD short-term technical charts.

Discuss this Euro setup and more in the Weekly Strategy Webinars on Monday’s at 8:30am EST.

Euro Price Chart – EUR/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

Technical Outlook: In last month’s Euro Short-term Technical Outlook we noted that EUR/USD had rallied into resistance at the 78.6% retracement at 1.1075 with key support eyed at, “the weekly open / February high-day close at 1.0907/09 – losses should be limited by this zone IF price is heading higher on this stretch.” Euro registered a low at 1.0909 the following day before rebounding with price failing a third attempt to breach resistance today on the heels of the Fed rate decision. The focus remains on a breakout of the 1.0909-1.11 range for guidance here with the bulls still vulnerable while below uptrend resistance (shaded slope).

Euro Price Chart – EUR/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

Notes: A closer look at Euro price action shows EUR/USD continuing to probe uptrend resistance with a parallel extending off the late-March swing low catching every subsequent pullback. Look for initial support along that slope (currently ~1.0960s) backed once again by 1.0909 and the April open at 1.0843. Key support / bullish invalidation rests at 1.0705/37- a region defined by the convergence of the 2022 uptrend, the objective yearly open and the 61.8% retracement of the March rally.

Initial resistance remains steady at 1.1075/95- a breach / close above this threshold is needed to mark resumption off the broader uptrend towards the 2021 low at 1.1186 and the 61.8% Fibonacci retracement of the 2021 decline at 1.1275 (look for a larger reaction there IF reached).

Bottom line: The post-FOMC rally was halted at resistance for a third time with the ECB interest rate decision on tap tomorrow. From a trading standpoint, I’m looking for a more meaningful inflection off this resistance zone with either a final failed attempt, or a break below uptrend support to threaten a larger pullback. Ultimately, a close above uptrend resistance would threaten another accelerated rally towards 1.12- stay nimble into the ECB tomorrow with US non-farm payrolls still on tap Friday. Review my latest Euro weekly technical forecast for a closer look at the longer-term EUR/USD trade levels.

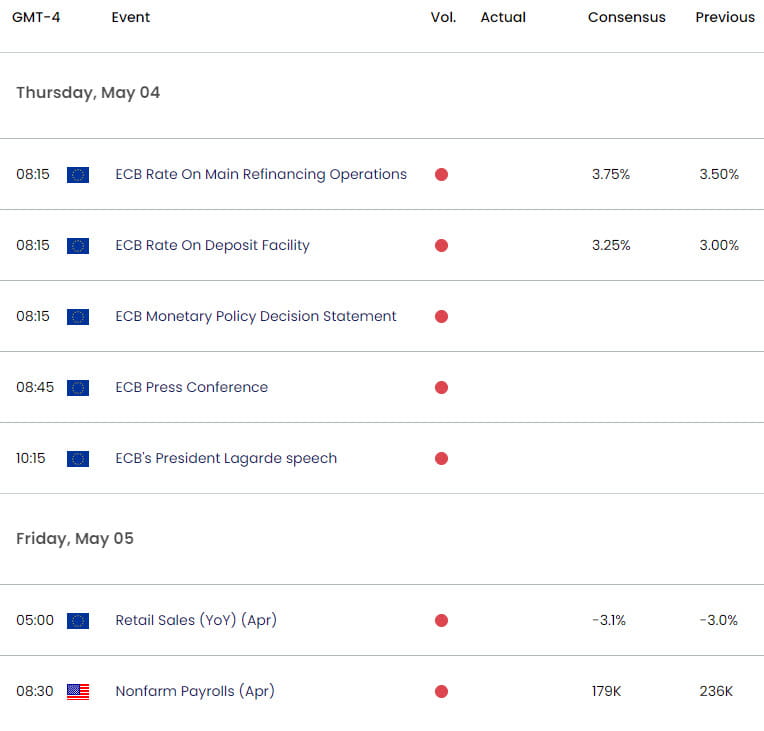

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- US Dollar short-term outlook: USD battle-lines drawn ahead of Fed

- Gold short-term price outlook: XAU/USD vulnerable to larger setback

- Australian Dollar short-term outlook: AUD/USD bears emerge

- Japanese Yen short-term outlook: USD/JPY bulls blocked by 135

- Canadian Dollar short-term outlook: USD/CAD bulls emerge at support

- British Pound short-term outlook: GBP/USD threatens correction

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com