Euro Technical Outlook: EUR/USD Short-term Trade Levels

- Euro surges more than 6% off the May lows to fresh yearly highs

- EUR/USD eight-day rally now testing uptrend resistance- risk for exhaustion

- Resistance 1.1275 (key), 1.1378, 1.1441- support 1.1186, 1.1.1075/95, 1.1002

Euro is struggling to mark a ninth-consecutive daily advance with the EUR/USD rally now testing uptrend resistance at fresh yearly highs. While the broader outlook remains constructive, the immediate push may be vulnerable here and we’re on the lookout for possible topside exhaustion in the days ahead. These are the updated targets and invalidation levels that matter on the Euro short-term technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this EUR/USD technical setup and more. Join live on Monday’s at 8:30am EST.

Euro Price Chart – EUR/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

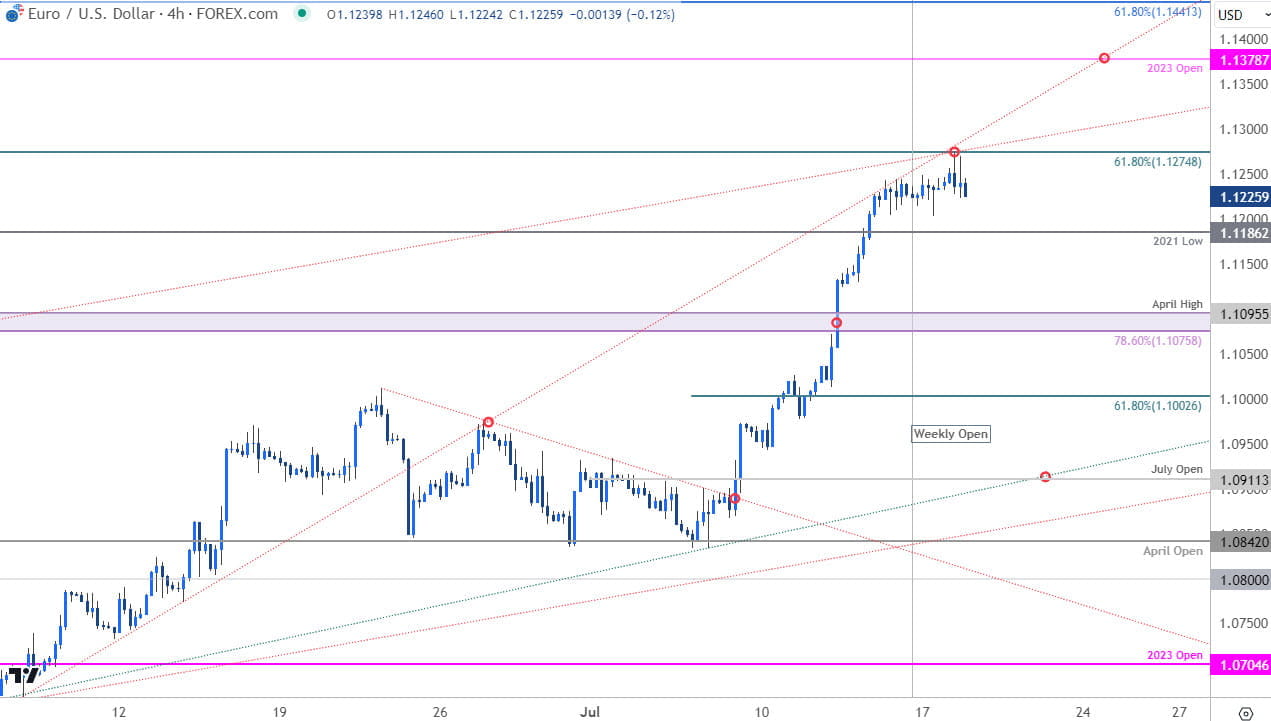

Technical Outlook: In last month’s Euro Short-term Technical Outlook we noted that the EUR/USD rally was vulnerable into the close of June but that, “Ultimately, losses should be limited to the 1.08-handle IF price is heading higher on this stretch. . .” The resistance zone in focus was at, “1.1075/95- a region defined by the 78.6% retracement of the 2022 range and the objective yearly high (look for a larger reaction there IF reached for guidance).”

Euro indeed turned lower in the following weeks with a pullback of more than 1.5% registering a low at 1.0833 into the July open before ripping higher. An impressive eight-day rally has now stretched more than 4% off the monthly low with daily momentum well in over-bought territory.

It’s worth noting that the last time Euro posted an eight-day rally was in June of 2020- in that instance another high was registered just four-days after before a more meaningful pullback of more than 2.2%. Bottom line- the threat for broader topside exhaustion is real as price approaches a key resistance confluence here with the FOMC & ECB interest rate decisions on tap next week. Buckle-up!

Euro Price Chart – EUR/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

Notes: A closer look at Euro price action shows EUR/USD rallying into a key resistance confluence at the 61.8% Fibonacci retracement of the 2021 decline at 1.1275- note that a pair of uptrend resistance slopes also converge on this threshold over the next few days and further highlight the threat for possible price inflection here.

Initial support rests with the 2021 swing low at 1.1186 backed by the 1.1075/95 pivot zone and the 61.8% retracement of the monthly range at 1.1002. Broader bullish invalidation is now raised to the monthly-open at 1.0911.

A topside breach / close above this threshold exposes subsequent resistance objectives at 2023 yearly open (1.1378) and the 61.8% extension of the 2022 advance at 1.1441- both significant pivot points from a technical standpoint.

Bottom line: The Euro rally may be vulnerable here as an eight-day rally approaches key technical resistance- we’re on the lookout for a possible exhaustion high into the uptrend in the days ahead. From at trading standpoint, a good zone to reduce portions of long-exposure / raise protective stops – losses should be limited by 1.1075 IF price is heading higher on this stretch. Review my latest Euro Weekly Technical Forecast for a closer look at the longer-term EUR/USD trade levels.

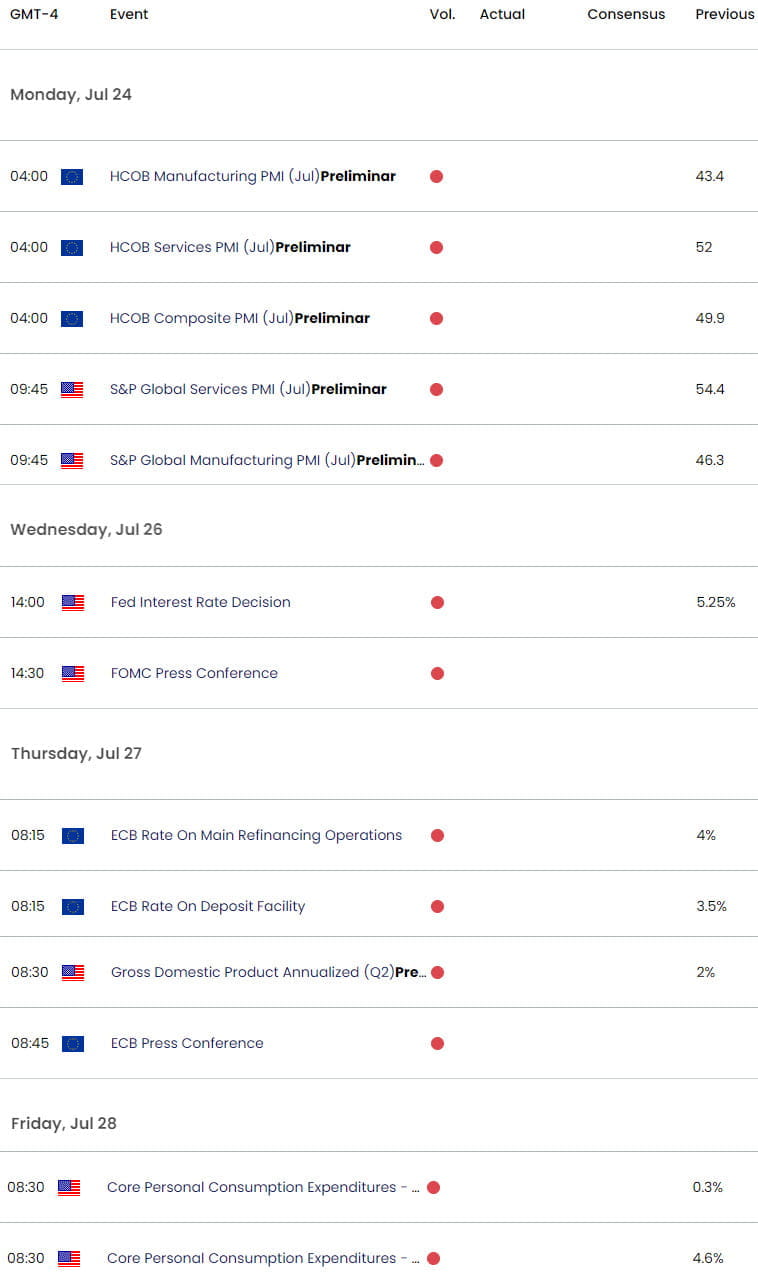

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Japanese Yen Short-Term Technical Outlook: USD/JPY Free-Falling

- Gold Short-term Price Outlook: XAU/USD Moment of Truth at Key Support

- Canadian Dollar Short-term Outlook: USD/CAD Grinds at Resistance into Q3

- US Dollar Short-term Outlook: USD Bulls Eye July Breakout

- Australian Dollar Short-term Outlook: AUD/USD Plunges Back Down Under

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex