Euro Technical Outlook: EUR/USD Short-term Trade Levels

- Euro surges more than 3.1% off the May lows

- EUR/USD breach of June opening-range now testing first major resistance hurdle

- Resistance ~1.0955/80, 1.1041, 1.1075/95 (key)- support 1.0909, 1.0842, 1.08

Euro is trading just below technical resistance after a breach of the monthly opening-range and while the near-term EUR/USD outlook remains constructive, the threat rises for possible topside exhaustion into this key slope. These are the updated targets and invalidation levels that matter on the Euro short-term technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this EUR/USD technical setup and more. Join live on Monday’s at 8:30am EST.

Euro Price Chart – EUR/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

Technical Outlook: In last month’s Euro Short-term Technical Outlook we noted that EUR/USD was, “testing a major support confluence at 1.0705/17- a region defined by the objective yearly open and the 61.8% Fibonacci retracement of the yearly range. Looking for possible price inflection into this threshold.” Price straddled this zone into the June open with a breakout of the monthly opening-range last week fueling a rally of more than 3.1% off the lows.

The rally is now testing former slope support as resistance around the 200% ext of the late-May advance around 1.0955/80- we’re looking for possible inflection off this mark with the broader advance vulnerable while below this slope.

Euro Price Chart – EUR/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

Notes: A closer look at Euro price action shows EUR/USD trading within the confines of an ascending channel formation with the weekly opening-range preserved just below resistance. Initial support rests with the February high-day close at 1.0909 – a break below this channel would threaten a larger pullback towards subsequent support objectives at 1.0842 and the 1.08-handle. Key support now extends to include the June-open at 1.0689-1.0716.

A topside breach / close above this slope would expose subsequent objectives at the yearly high-day close at 1.1041 and 1.1075/95- a region defined by the 78.6% retracement of the 2022 range and the objective yearly high (look for a larger reaction there IF reached for guidance).

It’s worth noting that form an Elliot-wave perspective, the threat remains for a stretch into wave-5 / exhaustion high before a larger correction within the monthly advance. Put simply, don’t chase up here.

Bottom line: The Euro recovery is now testing technical uptrend resistance. From at trading standpoint, a good spot to reduce portions of long-exposure / raise protective stops – the broader monthly advance may be vulnerable while below this key slop. Ultimately, losses should be limited to the 1.08-handle IF price is heading higher on this stretch with a close above this slope keeping the focus on a possible re-test of the yearly highs. Review my latest Euro Weekly Technical Forecast for a closer look at the longer-term EUR/USD trade levels.

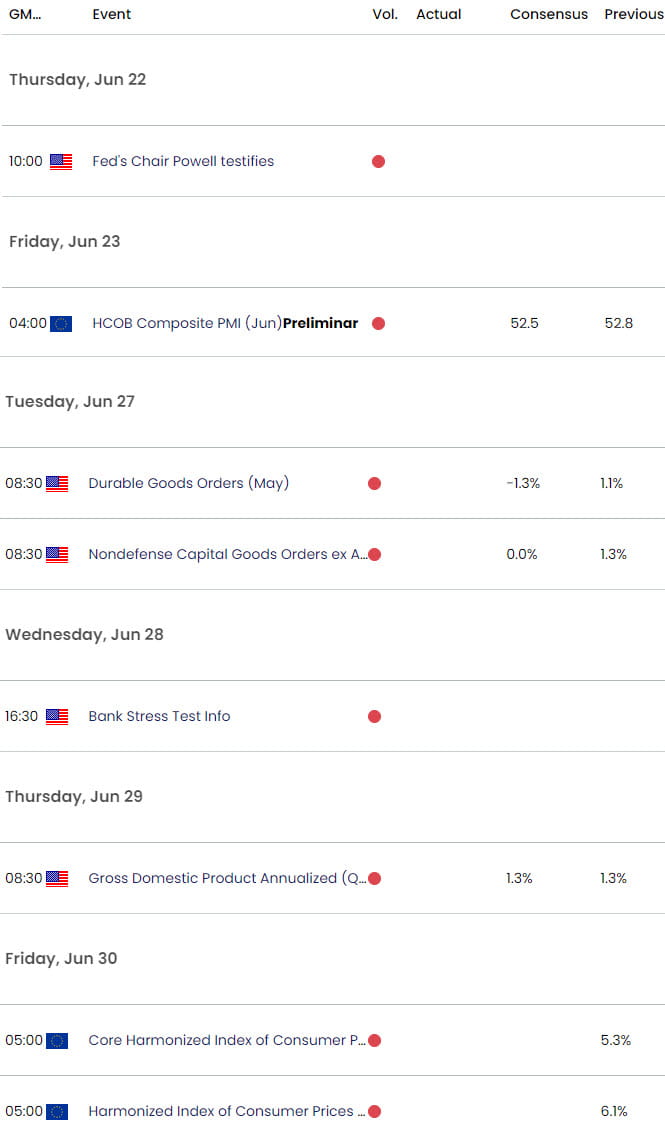

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Australian Dollar Short-term Outlook: AUD/USD Plunges Back Down Under

- Gold Short-term Price Outlook: XAU/USD Breakout Setup- FOMC on Tap

- Japanese Yen Short-Term Outlook: USD/JPY Eyes Breakout on FOMC / BoJ

- Canadian Dollar Short-term Outlook: USD/CAD Plunge Halted at Support

- British Pound Short-Term Outlook: GBP/USD Coils Above Uptrend Support

- US Dollar Short-term Outlook: USD Rips into Make-or-Break Resistance

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex