Euro Outlook: EUR/USD

EUR/USD extends the advance from the start of the week as the Euro Area Gross Domestic Product (GDP) report shows a larger-than-expected rise in the growth rate, and the exchange rate may further retrace the decline from the start of the month as the Relative Strength Index (RSI) continues to recover from oversold territory.

Euro Forecast: EUR/USD Recovery Persists Ahead of Euro Area CPI Report

EUR/USD trades to a fresh weekly high (1.0871) as the Euro Area expands 0.4% in the third quarter of 2024 versus forecasts for a 0.2% print, and little signs of an imminent recession may encourage the European Central Bank (ECB) to the keep interest rates on hold following the 25bp rate cut at the October meeting.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

In turn, the ECB may continue to unwind its restrictive policy at a gradual pace as the central bank is ‘determined to ensure that inflation returns to our two per cent medium-term target in a timely manner,’ but the update to the Euro Area Consumer Price Index (CPI) may put pressure on the central bank to achieve a neutral policy sooner rather than later as the report is anticipated to show another slowdown in core inflation.

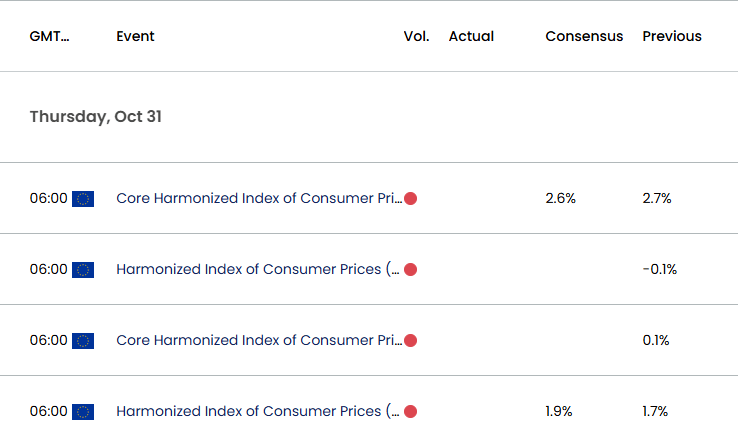

Euro Economic Calendar

Even though the headline CPI is expected to increase to 1.9% in October from 1.7% per annum the month prior, the core reading is seen narrowing to 2.6% from 2.7% during the same period.

With that said, signs of easing price growth may curb the recent recovery in EUR/USD as it fuels speculation for another rate cut at the next ECB meeting on December 12, but an uptick in both the headline and core CPI may generate a bullish reaction in the Euro as it raises the central bank’s scope to further combat inflation.

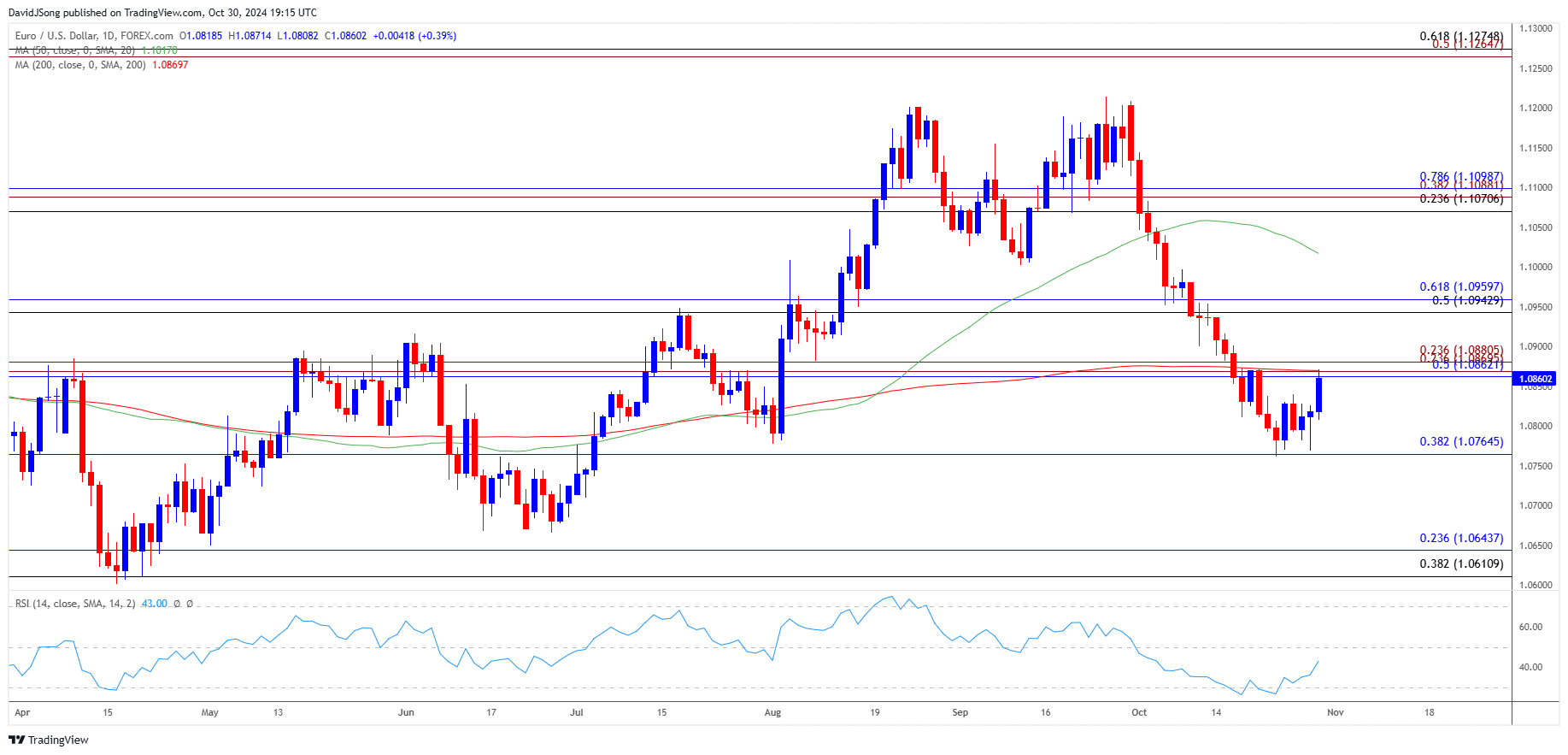

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD rises after defending the monthly low (1.0761) earlier this week, and the Relative Strength Index (RSI) may continue to show the bearish momentum abating as it moves away from oversold territory.

- A break/close above the 1.0860 (50% Fibonacci retracement) and 1.0880 (23.6% Fibonacci extension) region brings the 1.0940 (50% Fibonacci retracement) to 1.0960 (61.8% Fibonacci retracement) zone back on the radar.

- However, failure to break/close above the 1.0860 (50% Fibonacci retracement) and 1.0880 (23.6% Fibonacci extension) region may push EUR/USD back towards the monthly low (1.0761), with a close below 1.0770 (38.2% Fibonacci retracement) open up the June low (1.0666).

Additional Market Outlooks

Monetary vs Fiscal Policy: Implications for FX Markets

US Personal Consumption Expenditure (PCE) Report Preview (SEP 2024)

British Pound Outlook: GBP/USD Recovery Emerges Ahead of UK Budget

USD/CAD Eyes August High as RSI Holds in Overbought Territory

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong