EUR/JPY, GBP/JPY Key Points

- Markets have already priced in the current projected path of interest rates from the ECB, BOE, and BOJ, so the main market driver moving forward will be how those expectations evolve.

- EUR/JPY’s coiling price action just below resistance could set the stage for a breakout above 164.00 to the highest level since July.

- GBP/JPY’s consistent series of “higher lows” suggests that buying pressure is growing beneath that horizontal resistance level.

From a basic fundamental perspective, the argument for potential weakness in crosses like EUR/JPY and GBP/JPY is fairly straightforward: Both the European Central Bank and the Bank of England are likely to cut interest rates in the coming months, whereas the Bank of Japan is one of the few major central banks considering interest rate hikes.

As ever though, markets have already priced in the current projected path of interest rates, so the main market driver moving forward will be how those expectations evolve. From that perspective, traders have been reducing their bets on meaningful interest rate hikes out of Japan looking out into 2025, leading to widespread yen weakness against most of its rivals over the last month. Against that backdrop, the technical setups on EUR/JPY and GBP/JPY could be particularly interesting for bulls to monitor.

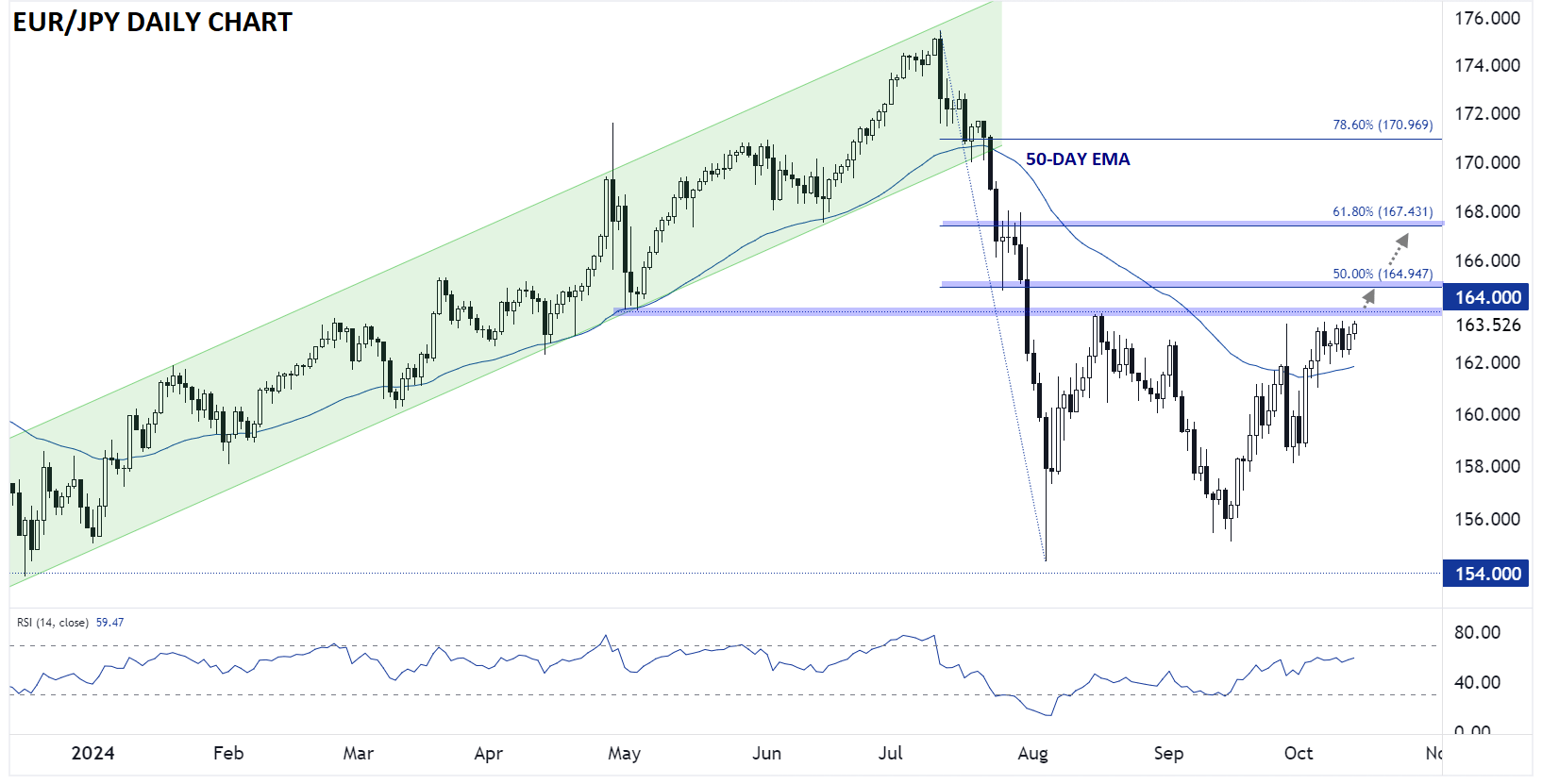

Japanese Yen Technical Analysis – EUR/JPY Daily Chart

Source: TradingView, StoneX

Looking first at EUR/JPY, the pair is consolidating near the top of its 2.5-month range between 155.00 and 164.00. Rates have regained the 50-day EMA, and last week’s coiling price action just below resistance could set the stage for a breakout above 164.00 to the highest level since July. In that scenario, EUR/JPY bulls would look to target the 50% and 61.8% Fibonacci retracement of the July swoon near 165.00 and 167.40 next. On the other hand, a break below the 50-day EMA near 162.00 would tip the scales toward a reversion to the middle of the range around 160.00 or lower.

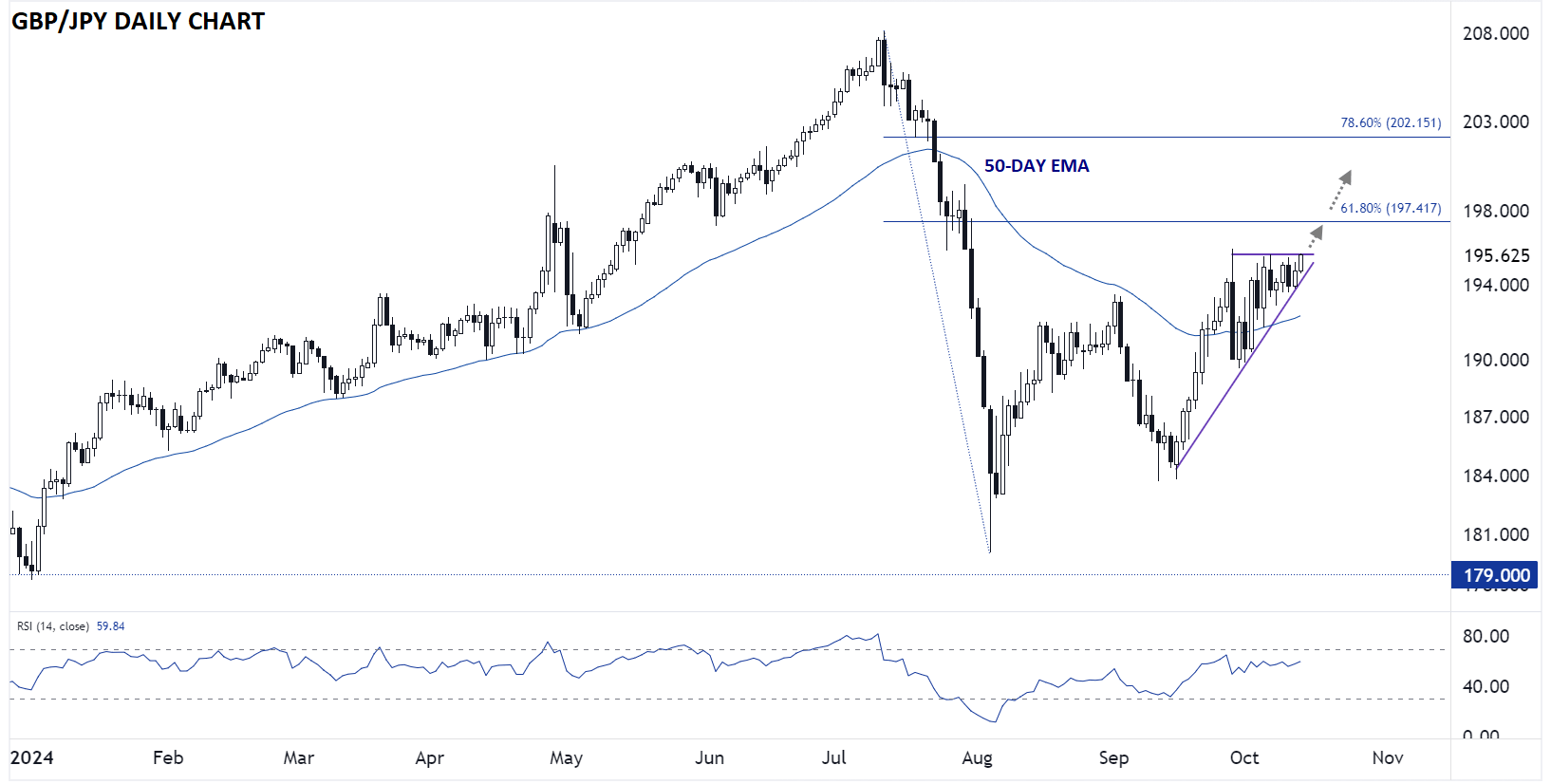

Japanese Yen Technical Analysis – GBP/JPY Daily Chart

Source: TradingView, StoneX

Turning our attention to GBP/JPY, the chart and interpretation are similar. In its case, GBP/JPY has already retraced more than 50% of the July drop, and the notoriously-volatile pair is carving out a large ascending triangle pattern just below the 196.00 handle. The consistent series of “higher lows” suggests that buying pressure is growing beneath that horizontal resistance level, potentially setting the stage for a big bullish breakout in the next couple of days.

Above the triangle pattern, bulls will look to target 197.40, 200.00, and 202.15 as the next logical targets, whereas a bearish breakdown could expose the 50-day EMA at 192.30 next.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX