Just hours away from this month’s ECB meeting, EUR/GBP is consolidating below a key zone of resistance.

There are some expectations for ECB staff to lower their projections after a slew of weak data, and rates are expected to remain on hold. However, the level of dovishness is likely to be deciding factor of how Euro crosses change in the aftermath, as failure to provide such a dovish meeting could send the Euro broadly higher. Still, we note EUR/GBP is stuck below a key zone of support, which itself could provide a pivotal area for bull or bears. Technically our bias favours further downside (eventually) based on monthly price action.

A monthly close beneath 0.8620 reaffirmed our bias that a longer-term top could be playing out on EUR/GBP. January’s bearish engulfing candle marks a lower high at 0.9116 and, as the most volatile months have been bearish since the 2017 high at 0.9306, we suspect there is further downside to come. With the nearest structural low sitting at 0.8313, this leaves a around 250 pips of potential downside if it can break beneath the 50-week eMA in due course.

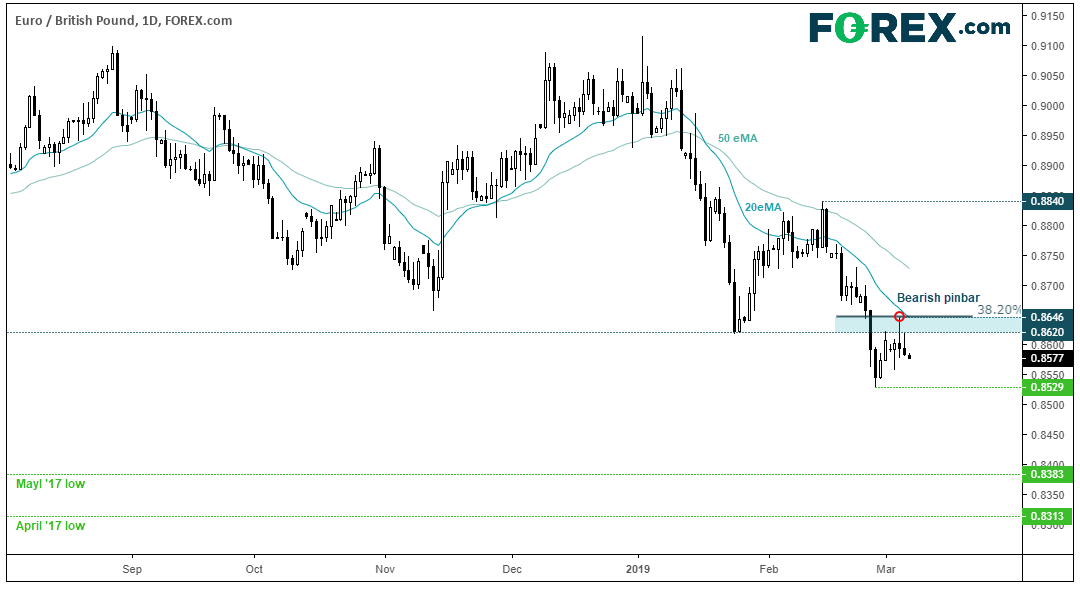

Switching to the daily chart shows that prices are trying to consolidate beneath the 0.8620 low. A bearish pinbar marks a swing high around 0.8646, and we’ve seen a hanging man reversal and second bearish hammer to show a hesitancy to break higher. The 50 and 20-day eMA’s both point lower, with the latter capping as resistance along with a 38.2% Fibonacci level. These levels place a zone of resistance around 0.8620-0.8650, which we’d prefer to see hold to retain the near-term bearish bias. We could wait for a break of the 0.8529 before assuming further downside, but for extra confirmation we’d want to see it break the 50-week eMA around 0.8517.