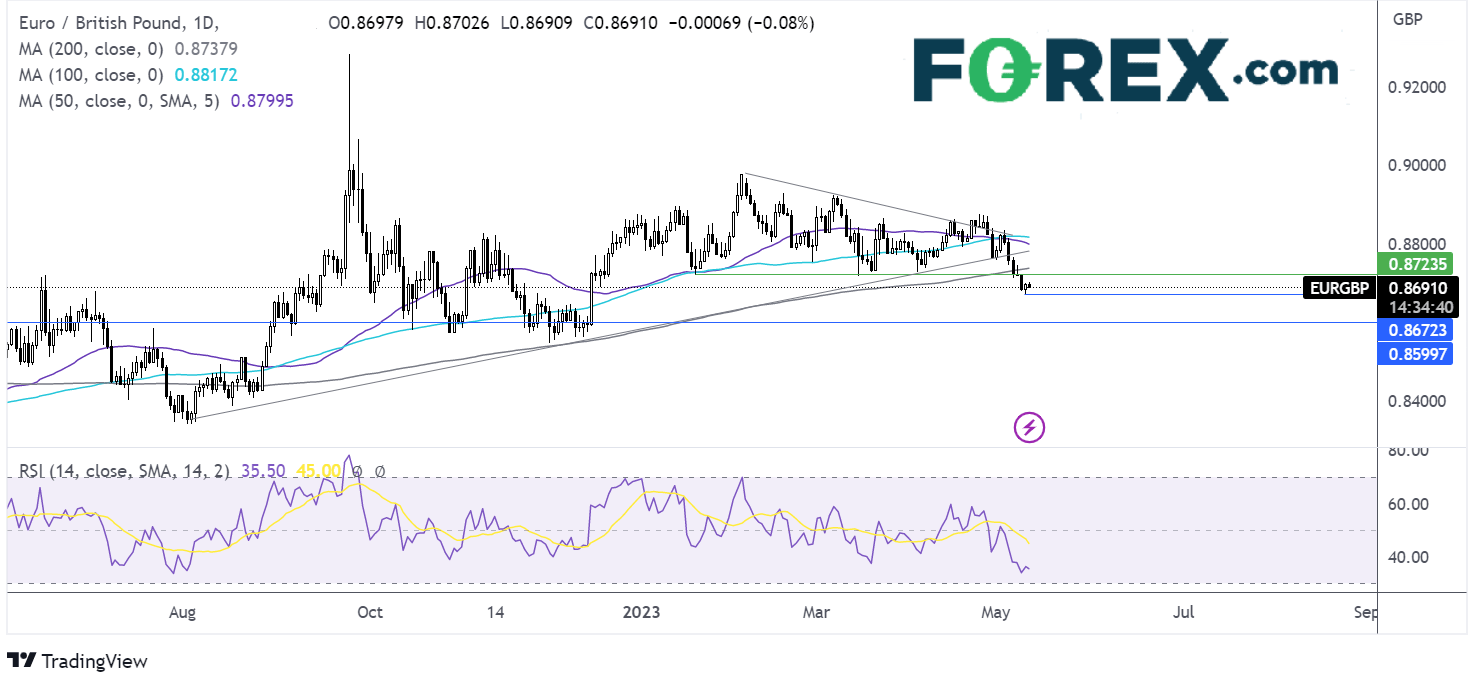

Will the BoE boost the pound?

- BoE to hike rates by 25 bps

- Likely to keep the door open for another move in June

- EURGBP could test a 5-month low at 0.8670

EURGBP is edging higher, after falling to a 5-month low earlier this week, as investors look cautiously ahead to the BoE interest rate decision.

The BoE is widely expected to raise interest rates by 25 basis points to 4.5%, marking the 12th straight rate hike and taking rates to the highest level since 2008.

The move comes as the central bank continues to battle inflation which remains in double digits, considerably higher than inflation in the eurozone (7%) and the US (4.9%). The hot inflation comes as food inflation remains elevated, the UK economy has proved to be more resilient than expected and the labour market remains tight.

The central bank is expected to upwardly revise its growth and inflation outlook, which was expected to be at 4% by the end of the year.

The vote split is expected to be 7-2, and the central bank is expected to keep the door open for further hikes, given the sticky inflation.

A hawkish-sounding BoE, could lift the pound further, pulling the pair back towards the 5-month low.

EURGBP outlook – technical analysis

The EUR/GBP broke out of the symmetrical triangle falling through the 200 sma to a low 0.8670. The 50 sma crossing below the 100 sma & the RSI below 50 supports further downside.

Sellers could look for a fall below 0.8670 to create a lower low and bring 0.86 round number in to focus.

Meanwhile, buyers could look to retake 0.8720, a level that has offered support on several occasions this year. A break above here exposes the 200 sma at 0.8740 and the rising trendline resistance at 0.8780.

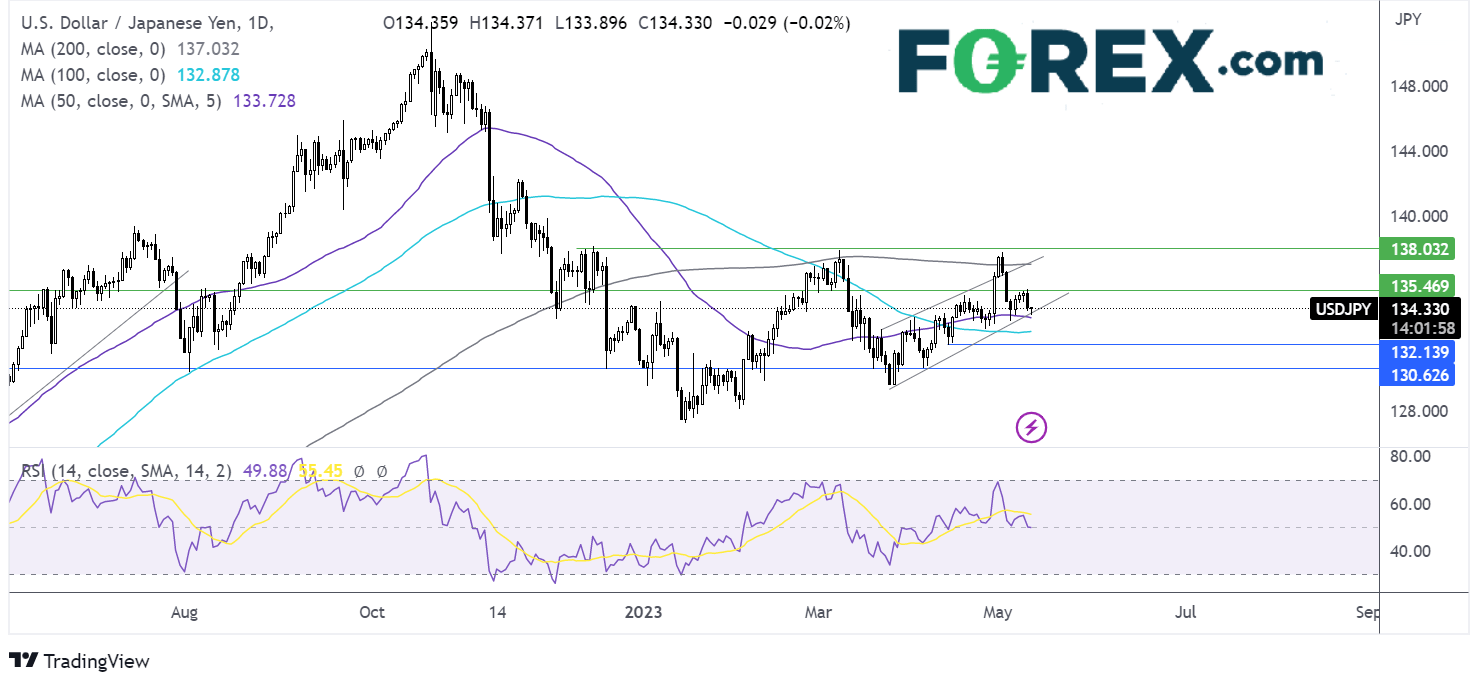

USDJPY falls despite dovish BoJ minutes & after cooling US CPI

- US CPI cools to 4.9%, PPI & jobless claims in focus

- BoJ minutes support accommodative policy

- USDJPY tests rising trendline support

USDJPY is falling for a second straight day as investors look past dovish BoJ minutes and continue digesting US inflation data.

US CPI unexpectedly cooled to 4.9% YoY in April from 5% in March. Meanwhile, core inflation cooled in line with forecasts to 5.5%.

The data pulled yields lower as the market bet that the Fed would pause rate hikes in June.

Looking ahead attention will be on US PPI data which is expected to show that prices cooled in April to 2.4% YoY, from 2.5%.

Jobless claims will also be in focus and are forecast to rise slightly to 245k as the US jobs markets as investors look for signs that the US jobs market is softening. The data comes after US non-farm payroll smashed forecasts on Friday, showing that the jobs market was resilient.

Separately, the ongoing impasse surrounding the US debt ceiling could pull the pair lower, supporting the safe-haven yen.

The clock is ticking towards the early June X-date. Failure to reach an agreement would be unprecedented, and a protracted breach could see the US slide into a deep recession.

USDJPY outlook – technical analysis

USDJPY trades at the lower bounds of the multi-week rising channel. The pair is testing the trendline support and finds support from the 50 sma. The RSI is neutral, giving away few clues.

Sellers will be looking for a break below the trendline and 20 sma at 133.70 to expose the 100 sma at 132.90 and the mid-April low at 132.80.

Meanwhile, should buyers successfully defend the trendline support and 20 sma, bulls could look to retake 135.50 to create a higher high and expose the 200 sma at 137.00.