- Patterns in data and markets before prior US recessions are flashing red

- ISM non-manufacturing PMI to provide clarity on recession risks

- Interest rate markets are moving towards pricing a hard landing

- EUR/USD likely to move in the opposite direction to recession probabilities

It looks like the United States may be entering recession. For EUR/USD traders, whether incoming data solidifies or weakens that view will likely determine how the pair performs this week. The tone will be set early with the most important piece of information arriving Monday.

Recession indicators flashing red

Many US recession indicators are flashing warning signals. The ‘Sahm rule’, where the three-month moving average of the US unemployment rate increases by half a percentage point or more from the lowest three-month average of the past 12 months, has been triggered following Friday’s nonfarm payrolls report. It has an excellent track record for predicting economic downturns, as shown below.

Source: St Louis Fed

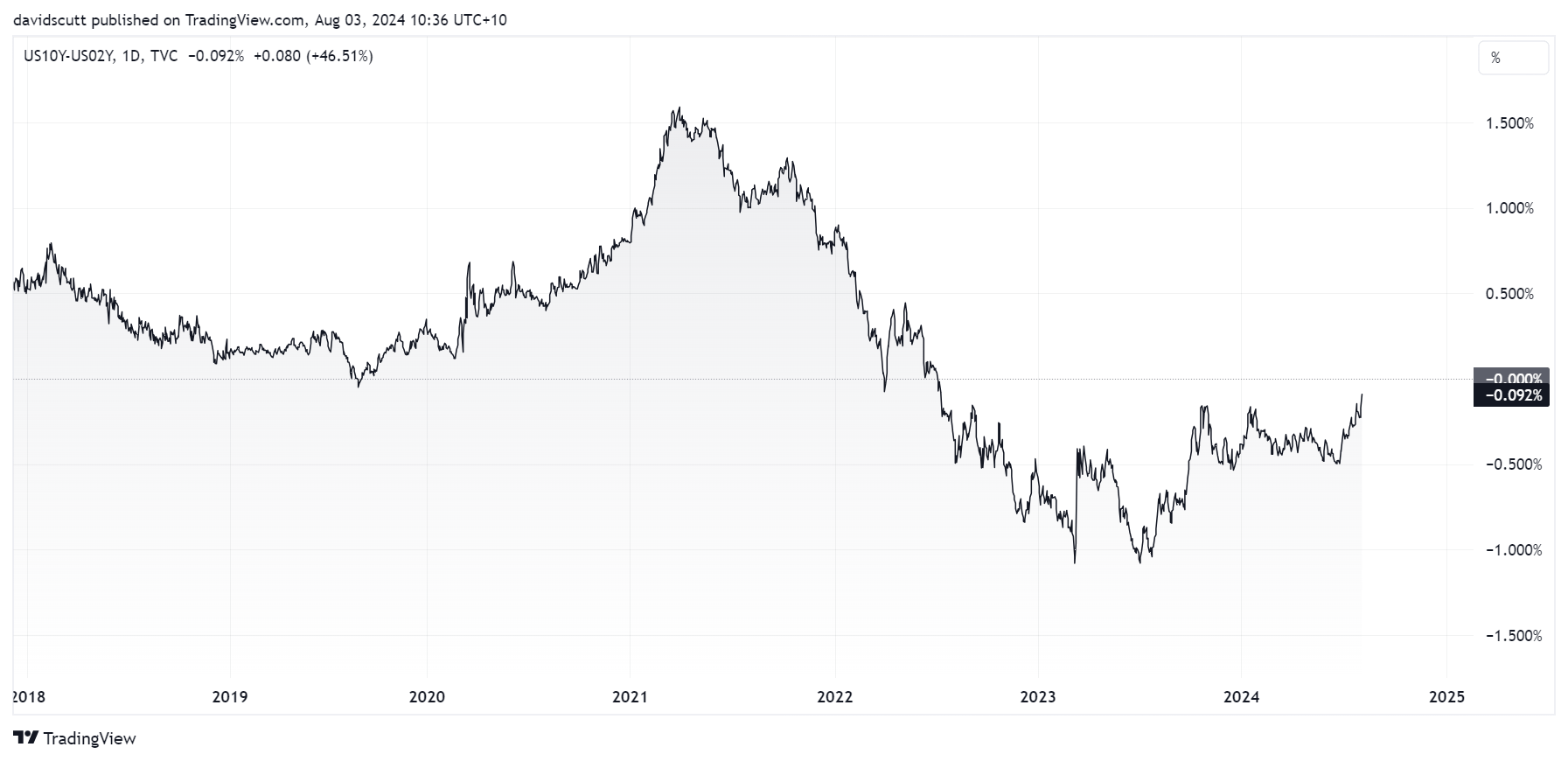

The US 2s-10s yield curve, calculated by subtracting the 10-year Treasury rate from the two-year rate, is also close to disinverting. This is often seen as the US enters a recession, reflecting the rush by traders to price in interest rate cuts from the Fed.

Source: TradingView

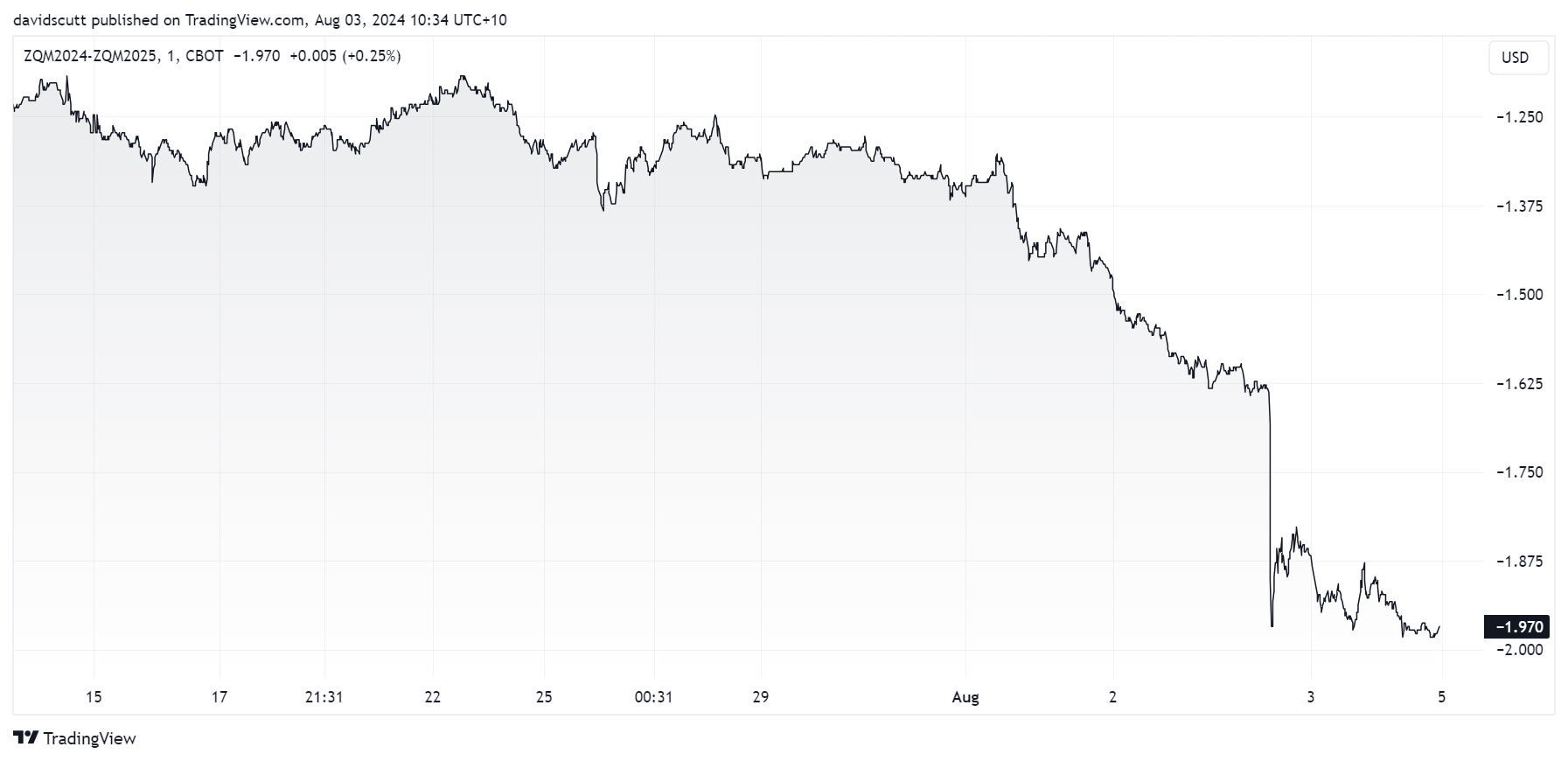

And traders are doing just that, boosting the amount of cuts expected by June 2025 to 200 basis points on Friday. It was barely 50 basis points a few months ago.

Source: TradingView

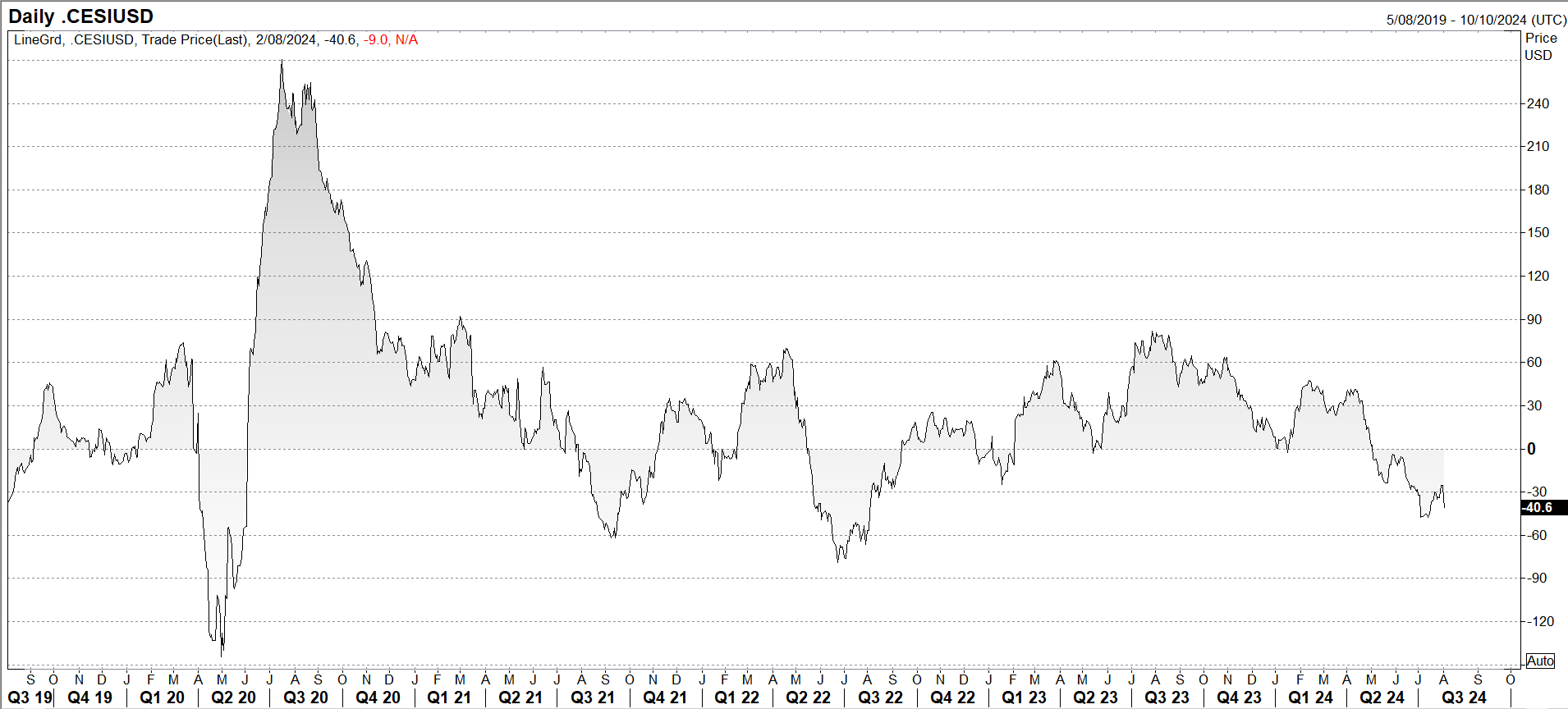

It’s not just the US labour market picture that has deteriorated. Aggregate economic data surprises, as measured by Citi’s US economic surprise index, have been undershooting for months despite lowered market expectations.

Source: Refinitiv

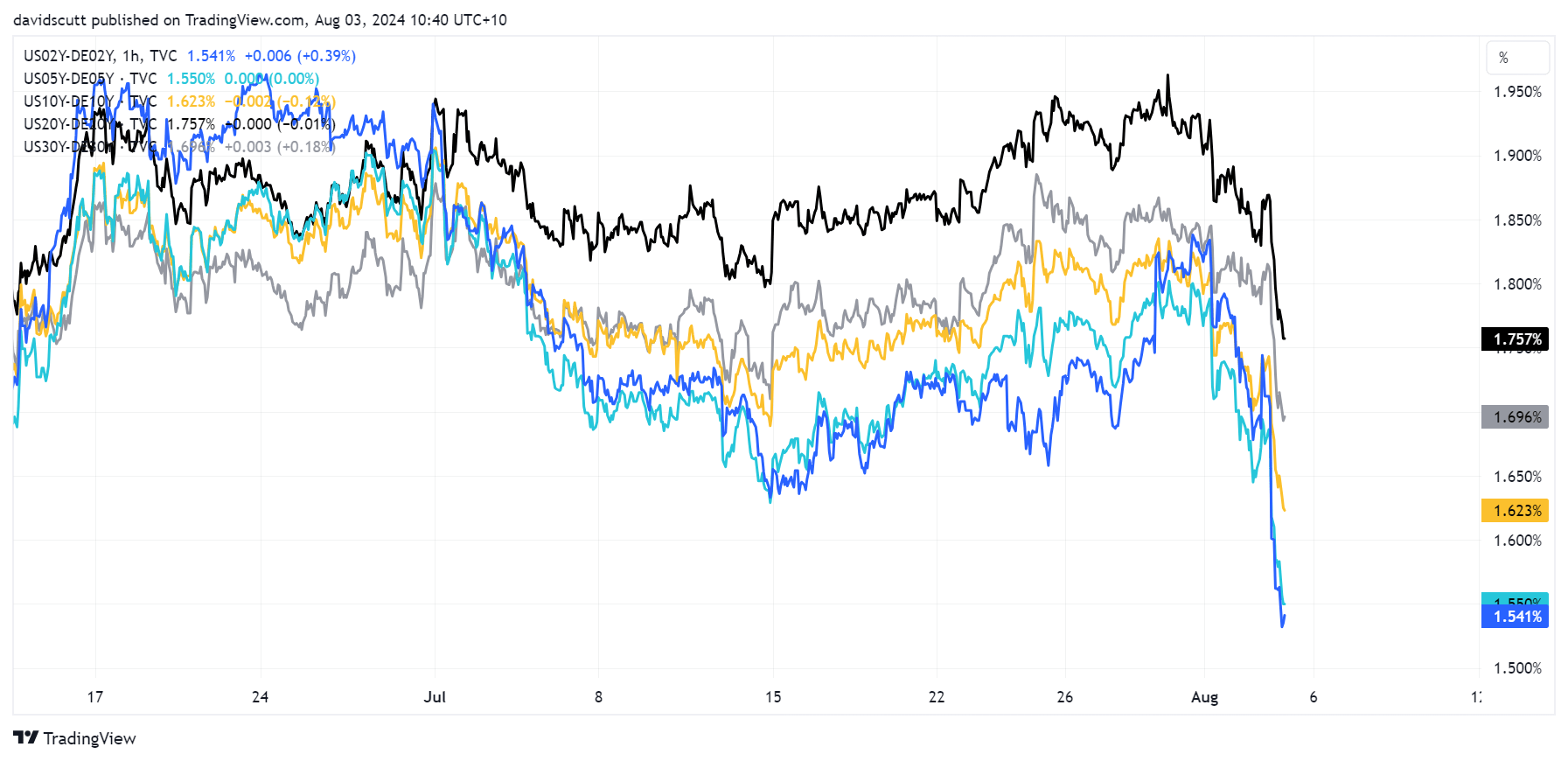

As the US economic exceptionalism tag has tarnished, the US yield advantage over Germany (which is used as a proxy for European bonds) has compressed rapidly over recent weeks. While EUR/USD does not have a strong correlation with yield spreads across a variety of tenors, the move merely reflects the shift in market thinking about the trajectory for the US and European economies.

Source: TradingView

Litmus test arrives Monday with ISM

When it comes to near-term EUR/USD, the pair is likely to move in the opposite direction to where incoming US economic data – and sentiment – does.

After an extremely busy calendar last week, the week ahead is dominated by one release in particular: the ISM US non-manufacturing purchasing managers index (PMI) for July.

It was the separate manufacturing PMI on Thursday last week that saw downturn fears really flare, making this read on a far larger part of the US economy significant when it comes to sentiment. If it confirms the recessionary signal, many of the market moves seen late last week may extend further in the coming days. However, if it doesn’t, it has the potential to spark a big reversal.

Other than the PMI, Thursday’s jobless claims data will be another release that will likely deliver an outsized market reaction.

EUR/USD technical picture

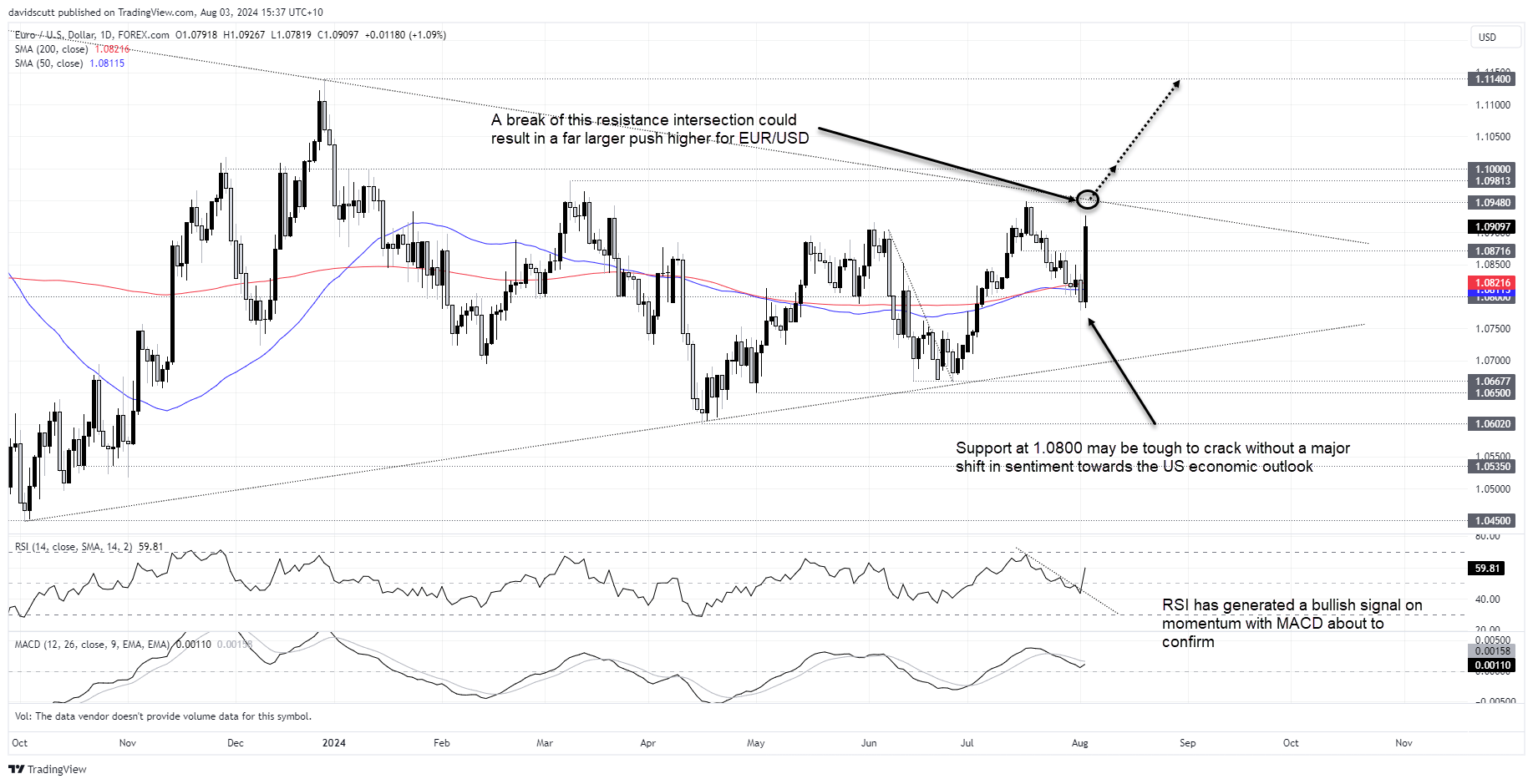

Looking at the savage EUR/USD reversal on the daily following the payrolls report on Friday, you get the sense this move may have legs. With RSI breaking its downtrend and MACD on the cusp of generating a bullish signal, a retest of the July high of 1.0948 looks on the cards. Should that give way, the next level is downtrend resistance as part of a larger triangle pattern. Given how long the pair has been coiling in the triangle, a topside break could encourage bulls to pile in, resulting in a potential significant move. 1.1000 would be the first topside target with 1.1140 after that.

On the downside, horizontal support at 1.0800 has thwarted bears over recent weeks, likely bolstered by the close proximity of both the 50 and 200-day moving averages. It would need a substantial shift in thinking towards the US economic outlook to see that support zone crack in the week ahead.

-- Written by David Scutt

Follow David on Twitter @scutty