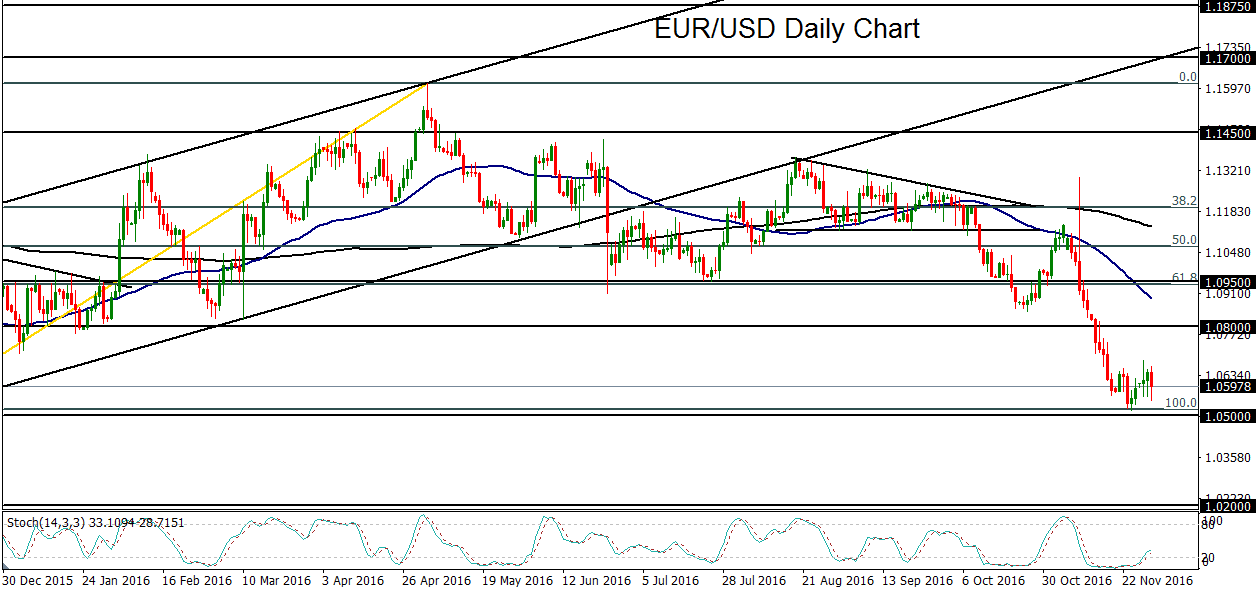

The 1.0500 level has served as a major historical support area for EUR/USD within the past two years. Previously, the currency pair had not traded at these depths for more than a decade – since early 2003. While it was breached to the downside slightly and briefly in March of 2015, the 1.0500 level has been repeatedly tested and has held its ground several times since then. The last time the level was tested was only one week ago, when EUR/USD extended its recent plunge to approach 1.0500 before bouncing abruptly as the dollar made a modest pullback.

As of Wednesday, that dollar-pullback has tentatively ended with a strong rebound as surging oil prices driven by the newly-minted OPEC deal have further boosted expectations of higher inflation spurring higher interest rates. This was combined with a significantly better-than-expected ADP jobs report that may serve as a potential precursor to Friday’s official non-farm payrolls report which, in turn, should serve as one of the precursors to the Federal Reserve’s interest rate decision two weeks from now. Higher Fed rate hike expectations and sharply rising bond yields have been driving up the dollar for the past three weeks since the US presidential election, and EUR/USD has been plummeting precipitously as a result.

On the euro side of the currency pair, the European Central Bank has long been in a perpetually dovish mode, which has helped to further pressure EUR/USD. What could pressure the euro even more, however, will be this weekend’s Italian Referendum on constitutional reform. While this referendum is unlikely to have anywhere near the magnitude of immediate currency impact that June’s Brexit referendum had, a “no” vote could place very substantial pressure on the euro. When coupled with potentially looming Fed rate hike(s) boosting the US dollar, EUR/USD could have significantly further to fall.

As of late Wednesday, the currency pair has traded below 1.0600, once again approaching the key 1.0500 support level. As noted, this major support is clearly the breakdown trigger to watch. In the event of such a breakdown, with little in the way of recent precedents at these low levels, EUR/USD could begin to target parity (1.0000) on a longer-term basis, particularly if US inflation and interest rates begin to rise at an increased pace as expected.

As of Wednesday, that dollar-pullback has tentatively ended with a strong rebound as surging oil prices driven by the newly-minted OPEC deal have further boosted expectations of higher inflation spurring higher interest rates. This was combined with a significantly better-than-expected ADP jobs report that may serve as a potential precursor to Friday’s official non-farm payrolls report which, in turn, should serve as one of the precursors to the Federal Reserve’s interest rate decision two weeks from now. Higher Fed rate hike expectations and sharply rising bond yields have been driving up the dollar for the past three weeks since the US presidential election, and EUR/USD has been plummeting precipitously as a result.

On the euro side of the currency pair, the European Central Bank has long been in a perpetually dovish mode, which has helped to further pressure EUR/USD. What could pressure the euro even more, however, will be this weekend’s Italian Referendum on constitutional reform. While this referendum is unlikely to have anywhere near the magnitude of immediate currency impact that June’s Brexit referendum had, a “no” vote could place very substantial pressure on the euro. When coupled with potentially looming Fed rate hike(s) boosting the US dollar, EUR/USD could have significantly further to fall.

As of late Wednesday, the currency pair has traded below 1.0600, once again approaching the key 1.0500 support level. As noted, this major support is clearly the breakdown trigger to watch. In the event of such a breakdown, with little in the way of recent precedents at these low levels, EUR/USD could begin to target parity (1.0000) on a longer-term basis, particularly if US inflation and interest rates begin to rise at an increased pace as expected.

Latest market news

Today 09:11 AM

Yesterday 11:57 PM

Yesterday 08:25 PM

Yesterday 07:48 PM