The resounding “no” that resulted from Italy’s referendum on constitutional reform over the weekend placed the future of the euro firmly in the spotlight, yet failed to weigh on the common currency in the immediate aftermath. The euro rebounded powerfully from its new lows against the dollar just a day after the vote, defying any concerns over the referendum’s potential financial and economic implications. However, the new post-Renzi (Italy’s outgoing PM Matteo Renzi) order is only just beginning, and concerns for the euro have the strong potential to multiply as Italy’s political turmoil deepens. But perhaps even more pressing for the euro at the moment will be the European Central Bank’s (ECB) policy decision on Thursday.

The ECB is expected to extend its bond purchase program throughout much of 2017 when it announces its decision and holds its press conference on Thursday. Since this expectation may have largely been priced-in to the heavily-pressured euro, the more critical question will be whether the central bank will formally announce any decision to taper its bond-buying. If so, the euro could get a boost and further rebound from this week’s long-term lows against the dollar. If not, however, a non-tapering extension of the program could weigh even more on the euro than it already has.

Following the ECB decision, of course, will be the Federal Reserve’s rate decision next Wednesday. Much has already been said about the prospects for this highly-anticipated event, as expectations for a 25-basis-point rate hike have continued to run extremely high. Again, however, much of these expectations for a likely December rate hike may have already been priced-in to the recently surging US dollar. Therefore, a more critical variable to watch for in next week’s FOMC announcement will be how the Fed may frame the future of interest rate increases, given the recently higher expectations of rising inflation that could potentially be driven by the new Trump Administration. Any hints of increased monetary policy tightening for next year could boost the dollar even more, while any continued focus on the often mentioned “gradual pace” could cap dollar gains.

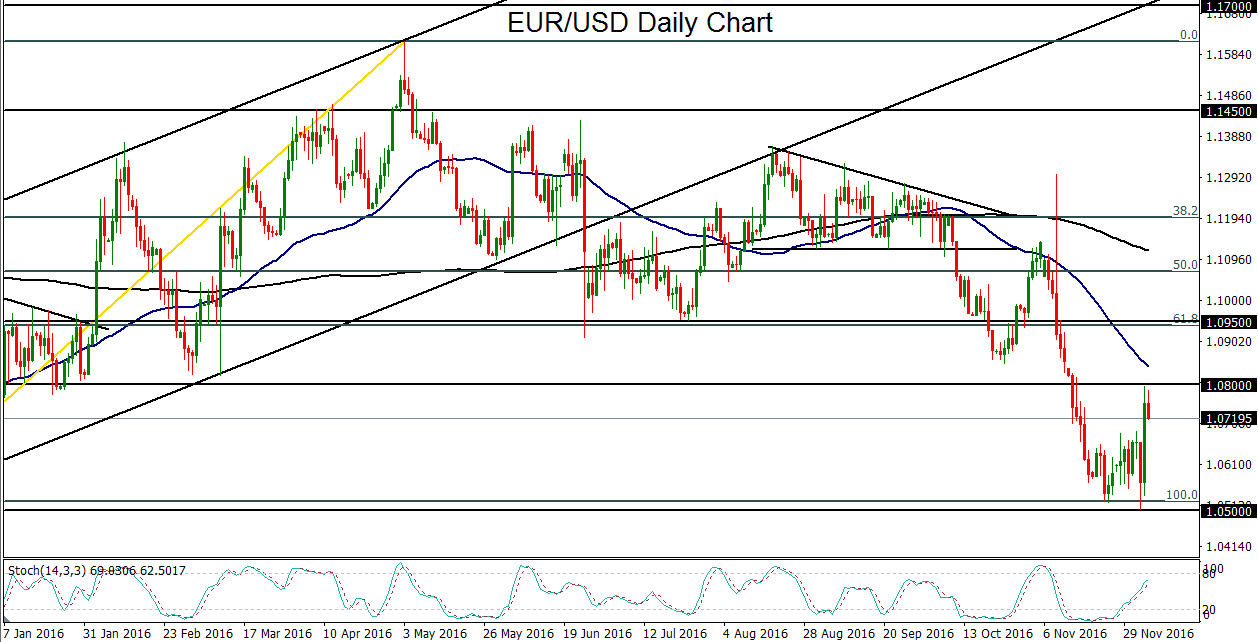

Just as EUR/USD is stuck between the ECB and the Fed, its price action is likewise stuck between two major support/resistance levels. To the downside, of course, is the major 1.0500 support level, which was closely approached immediately after the Italian Referendum. To the upside is the equally important 1.0800 resistance level that was almost as closely approached on the subsequent rebound.

Overall, we see the divergent policies and expected inflation trajectories between the Fed and ECB as an overpowering weight on EUR/USD that is not likely to go away soon. Therefore, the general bias continues to be towards the 1.0500 level, with any further declines below 1.0500 potentially clearing the way towards a medium-term target at 1.0200.

The ECB is expected to extend its bond purchase program throughout much of 2017 when it announces its decision and holds its press conference on Thursday. Since this expectation may have largely been priced-in to the heavily-pressured euro, the more critical question will be whether the central bank will formally announce any decision to taper its bond-buying. If so, the euro could get a boost and further rebound from this week’s long-term lows against the dollar. If not, however, a non-tapering extension of the program could weigh even more on the euro than it already has.

Following the ECB decision, of course, will be the Federal Reserve’s rate decision next Wednesday. Much has already been said about the prospects for this highly-anticipated event, as expectations for a 25-basis-point rate hike have continued to run extremely high. Again, however, much of these expectations for a likely December rate hike may have already been priced-in to the recently surging US dollar. Therefore, a more critical variable to watch for in next week’s FOMC announcement will be how the Fed may frame the future of interest rate increases, given the recently higher expectations of rising inflation that could potentially be driven by the new Trump Administration. Any hints of increased monetary policy tightening for next year could boost the dollar even more, while any continued focus on the often mentioned “gradual pace” could cap dollar gains.

Just as EUR/USD is stuck between the ECB and the Fed, its price action is likewise stuck between two major support/resistance levels. To the downside, of course, is the major 1.0500 support level, which was closely approached immediately after the Italian Referendum. To the upside is the equally important 1.0800 resistance level that was almost as closely approached on the subsequent rebound.

Overall, we see the divergent policies and expected inflation trajectories between the Fed and ECB as an overpowering weight on EUR/USD that is not likely to go away soon. Therefore, the general bias continues to be towards the 1.0500 level, with any further declines below 1.0500 potentially clearing the way towards a medium-term target at 1.0200.

Latest market news

Today 09:11 AM

Yesterday 11:57 PM

Yesterday 08:25 PM