The risk of persistent inflation and concerns about the sustainability of the US fiscal trajectory have hammered government bond prices recently. Longer duration securities – maturing decades into the future – have been no exception. Yields have risen sharply, signaling investors are demanding greater returns to account for greater levels of uncertainty. Given this is how risk-free government debt has been treated, it explains why other asset classes have struggled, especially those offering little to no yield.

Bond bloodbath over?

But something happened on Wednesday, potentially significant. The long bond selloff ended abruptly with yields falling sharply as one piece of economic data raised questions on whether the period of outperformance the US economy recently may be coming to an end.

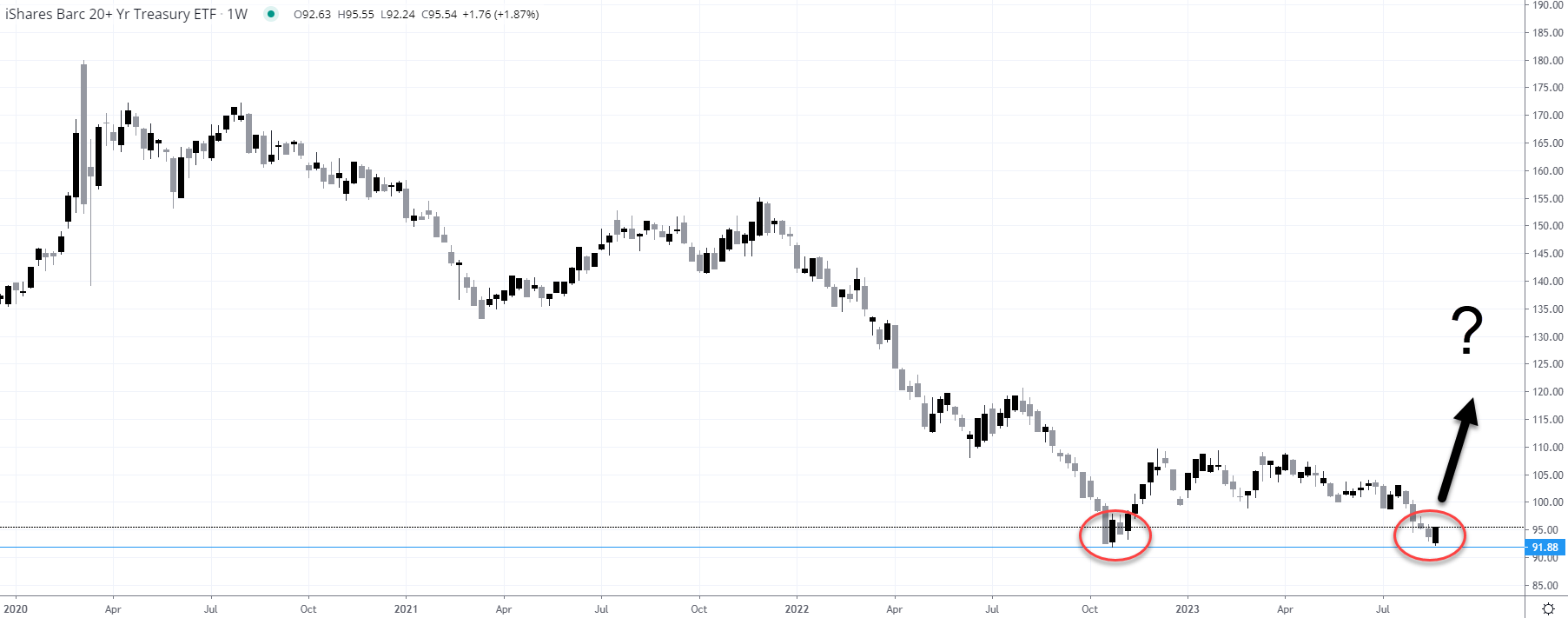

Look at the chart below. It’s iShares Barclays 20+ Year Treasury ETF, a fund that tracks a basket of US government bonds maturing in more than twenty years’ time. Rather than dealing with

the complexities of how a bond is priced, its concept is easy to understand – it goes up when the value of the bonds goes up and down when the opposite occurs.

The interesting development from Wednesday was the ETF price bounced strongly from the lows it struck in October last year. That’s enough to suggest we now have not only a decent support level to watch but also the potential for further price gains and lower yields.

Positioning for peak US yields without touching a bond

While some of you may want to choose that fund to play a potential reversal in US yields, bonds are not for everyone, no matter how easy the product is to understand. Thankfully, there are plenty of ways to take a view that yields may have topped. Gold is an obvious one, so too growth stocks and growth indices and funds. FX markets are another.

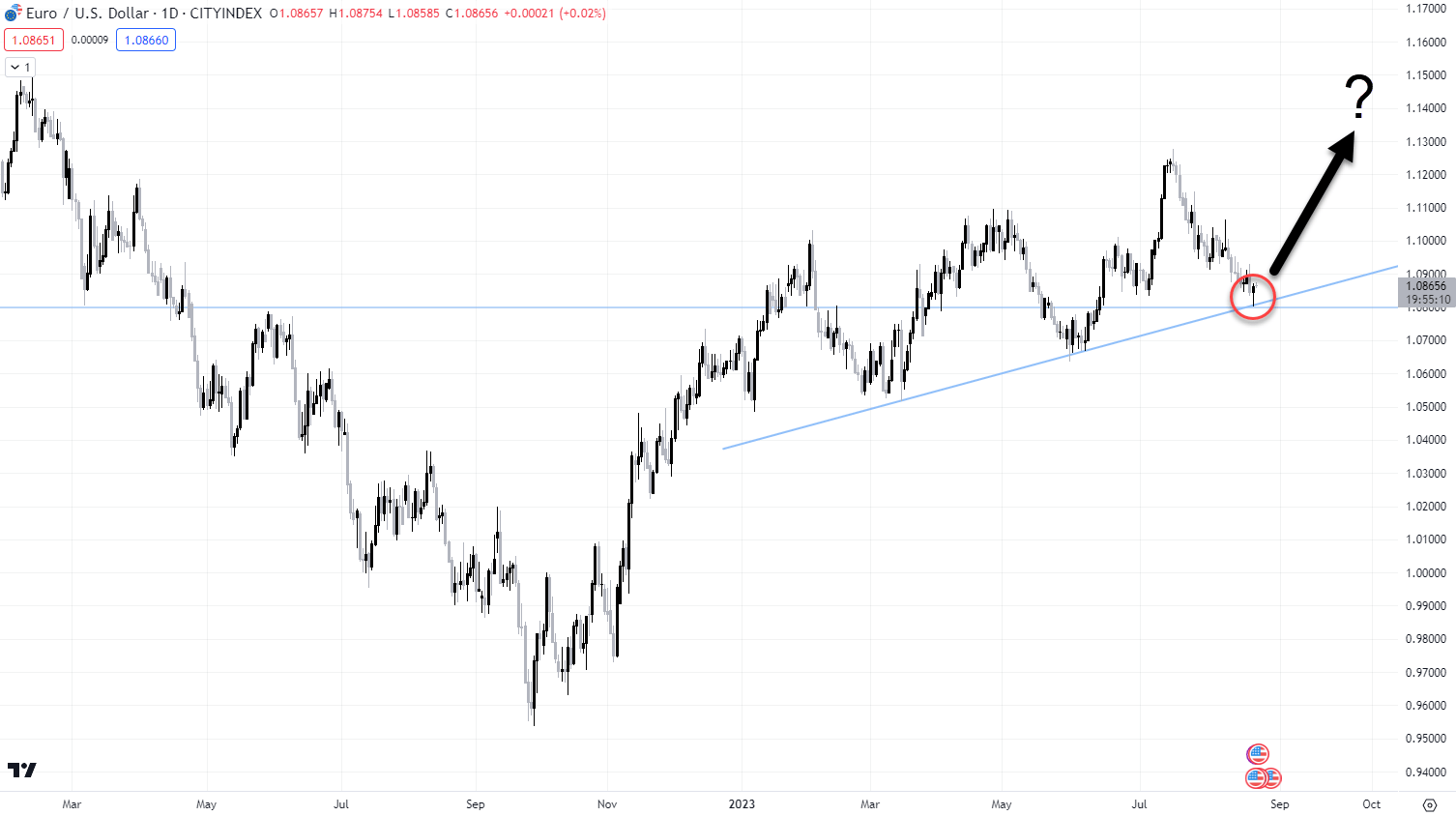

As US yields have been ratcheting higher, so too has the US dollar index (DXY). It’s been strengthening against pretty much every major currency recently, including the EUR, by far the largest weighting in the DXY market.

All else being equal, falling US yields usually helps the EUR/USD by diminishing the dollar’s appeal. Even with the release of weak Eurozone economic data on Wednesday, it was noteworthy the EUR/USD still managed to close higher following similarly soft data from the States. Not only that, it bounced off a decent support level at 1.0800.

Two charts, two different asset classes with similar price action. If you’re of the view US yields have peaked but don’t want to get involved in bonds, taking a long EUR/USD position could be an option with a stop-loss order below the 1.0800 level.

-- Written by David Scutt

Follow David on Twitter @scutty