While the major indices rallied, FX markets were fairly contained in the first half of Friday’s session, with the EUR/USD trading flat around the 1.03 handle. Other euro crosses were all higher as risk appetite improved further with some of the major European indices such as the German DAX and UK’s FTSE 100 hitting new record highs. The improvement in sentiment has been driven this week by a sharp drop in global bond yields, owing to weaker-than-expected inflation data from both the US and UK. We also had some surprisingly strong Chinese data overnight, which helped to reduce fears about China’s economy. What’s more, the ceasefire in Gaza has also helped to soothe investor concerns. But with Trump set to take office on Monday, we could see the return of heightened volatility again. After all, he has promised implementing drastic policies from day one. So, the short-term EUR/USD forecast is subject to increased risks from Trump’s unexpected

Trump inauguration and PBOC rate decision (Monday)

The People’s Bank of China will set the 1- and 5-year Loan Prime Rate (LPR) hours before Donald Trump officially takes office. This is a benchmark lending rate to influence short-term interest rates as part of its monetary policy strategy. After months of sub-par growth, and negative inflation, China has been stuck in a deflationary environment. Throughout last year, the PBOC and China’s government were quite busy unleashing various stimulus measures to revive the economy. Judging by the latest data released overnight, it seems like efforts paid some dividends. GDP grew 5.4% in the final quarter of 2024 compared to a year earlier, exceeding analysts’ expectations and marking the fastest pace of growth in 6 quarters. Industrial production and retail sales also beat. The key takeaway point is that China met its growth objective. But with Trump’s return, we could see Chinese exports suffer amid raised tariffs in the coming months and so volatility could return to markets. However, at this meeting, the PBOC may decide against increasing its stimulus measures, and keep rates on hold. But it may still surprise given the ongoing slump in the stock market, yuan and its bond yields.

Global PMIs could impact EUR/USD forecast

The PMI data will be released on Friday, January 24, from around the world. Perhaps most important to the EUR/USD forecast will be those from the Eurozone. Global growth concerns have been among factors behind the softness in some of the major currencies such as the euro, pound and yuan. The Purchasing Manager’s Indices are leading indicators of economic health. The rationale is that businesses react quickly to market conditions, and their purchasing managers hold some of the most current insights into the company's view of the economy. Therefore, if we see some improvement, it should at least help to relief some selling pressure on the single currency.

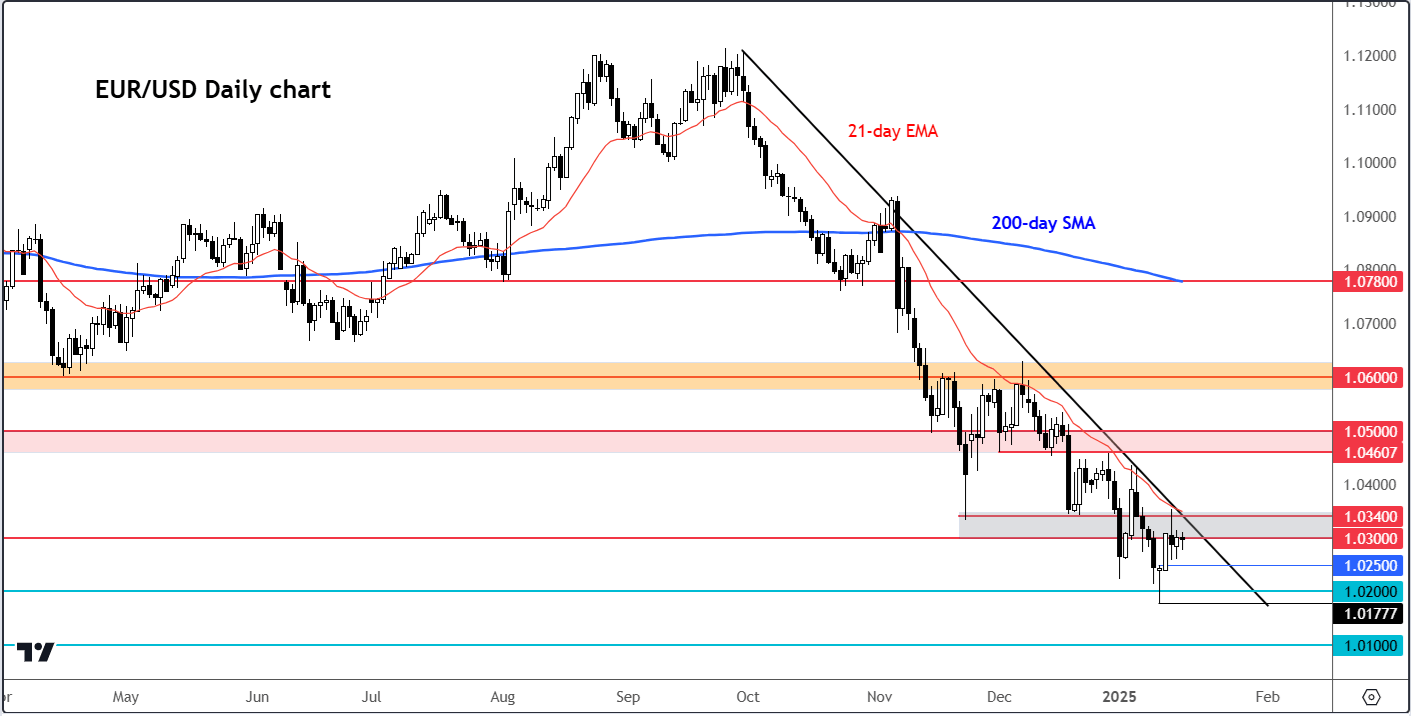

EUR/USD technical analysis

Source: TradingView.com

The near-term technical EUR/USD forecast remains tilted to the downside. The question remains whether the pair will test and possibly break below the parity (1.000) level in the coming weeks. So far, the 1.0200 level has provided decent support.

Meanwhile, in terms of resistance levels to watch, 1.0300-1.0340 now marks a key resistance zone. This area had previously served as support, so we may see some pressure come back into the market from around this zone. The bearish trend line comes in just above this zone, too. While below these levels, the path of least resistance on the EUR/USD remains to the downside. A potential break above here would be a bullish development – we will cross that bridge if and when we get there.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R