- EUR/USD and NZD/USD have been pressured recently

- Both have returned to territory that has flushed out buyers in the recent past

- With bad news arguably priced in and focus on soft US inflation, there are grounds for a potential squeeze

EUR/USD and NZD/USD have returned to territory where they’ve attracted buying in the recent past. Given this week is likely to confirm ebbing inflationary pressures in the United States, adding to the case for Fed rate cuts, and with French election uncertainty now arguably priced in, there’s fuel around to spark some form of squeeze in the days ahead.

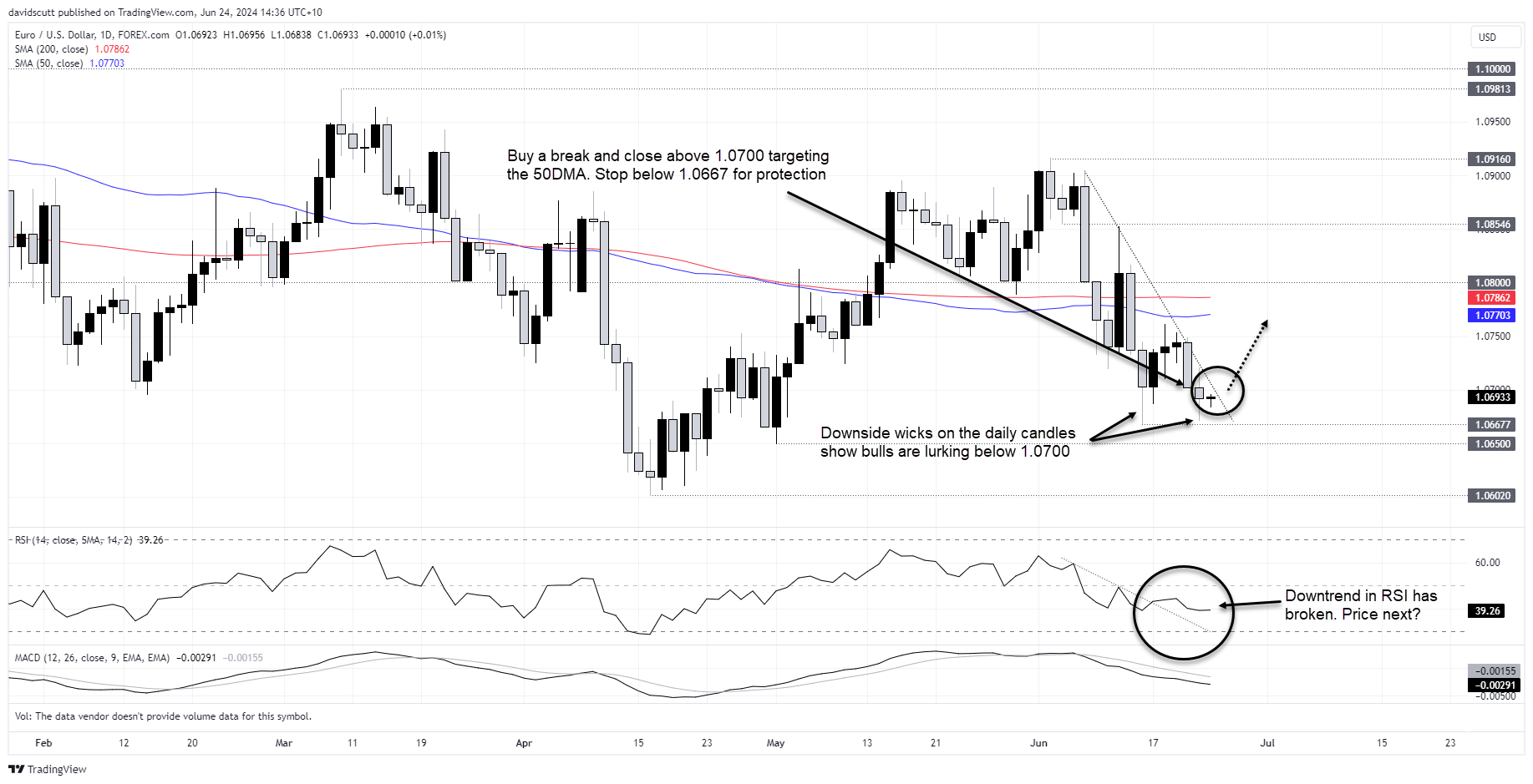

EUR/USD dips below 1.0700 have been bought

EUR/USD finds itself at an interesting juncture on the charts, stuck between downtrend resistance and horizontal support. While the pair has been a sell-on-rallies play for much of June, there are signs that bulls may be starting to turn the tide against the bears.

The downside wicks on the daily candles over the past fortnight suggest there are buyers lurking around these levels, as has been the case for the entirety of the year. With RSI breaking its downtrend last week, that’s another signal the bearish trend may be nearing its use by date.

Should we see a clean break and close above 1.0700 where the downtrend is located, consider buying targeting an initial push towards the 50-day moving average shown in blue, a level that has often been respected this year. A stop below 1.06670 would offer protection against reversal.

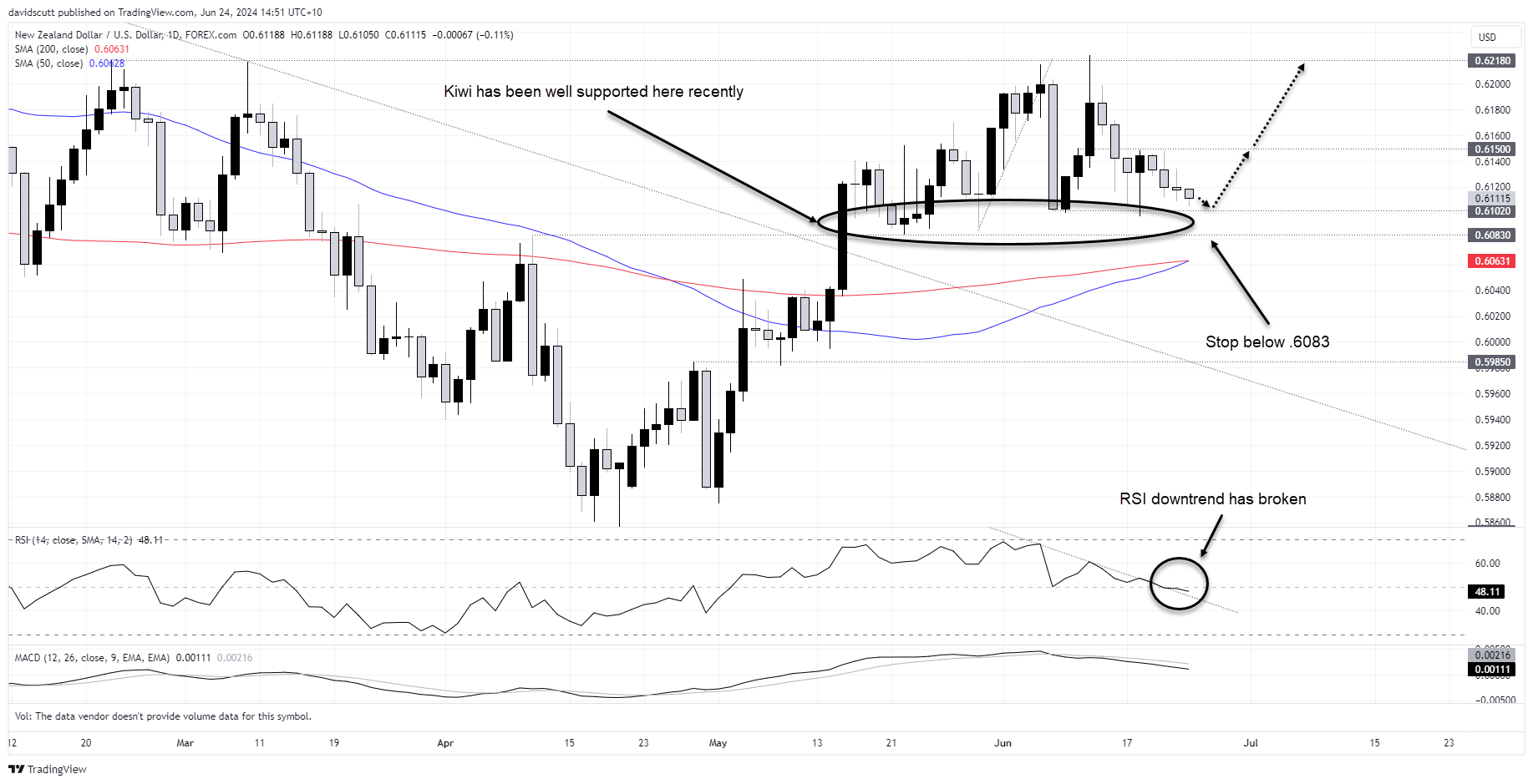

NZD/USD nearing range lows

The setup is not dissimilar for NZD/USD which finds itself just above support at .6102, a level its either tested or approached without a clean break on multiple occasions in June. It too has seen RSI break its downtrend, pointing to a potential shift in directional risks.

Given the price action and possible shift in market momentum, traders may want to consider buying dips towards .6102 with a stop below support at .6083 for protection. .6150 could be an initial trade target with .6218 after that.

Given the likelihood of choppy price action as we near quarter-end, should trades move in your favour consider lifting your stop to entry level to provide a free hit on upside.

-- Written by David Scutt

Follow David on Twitter @scutty