Summary

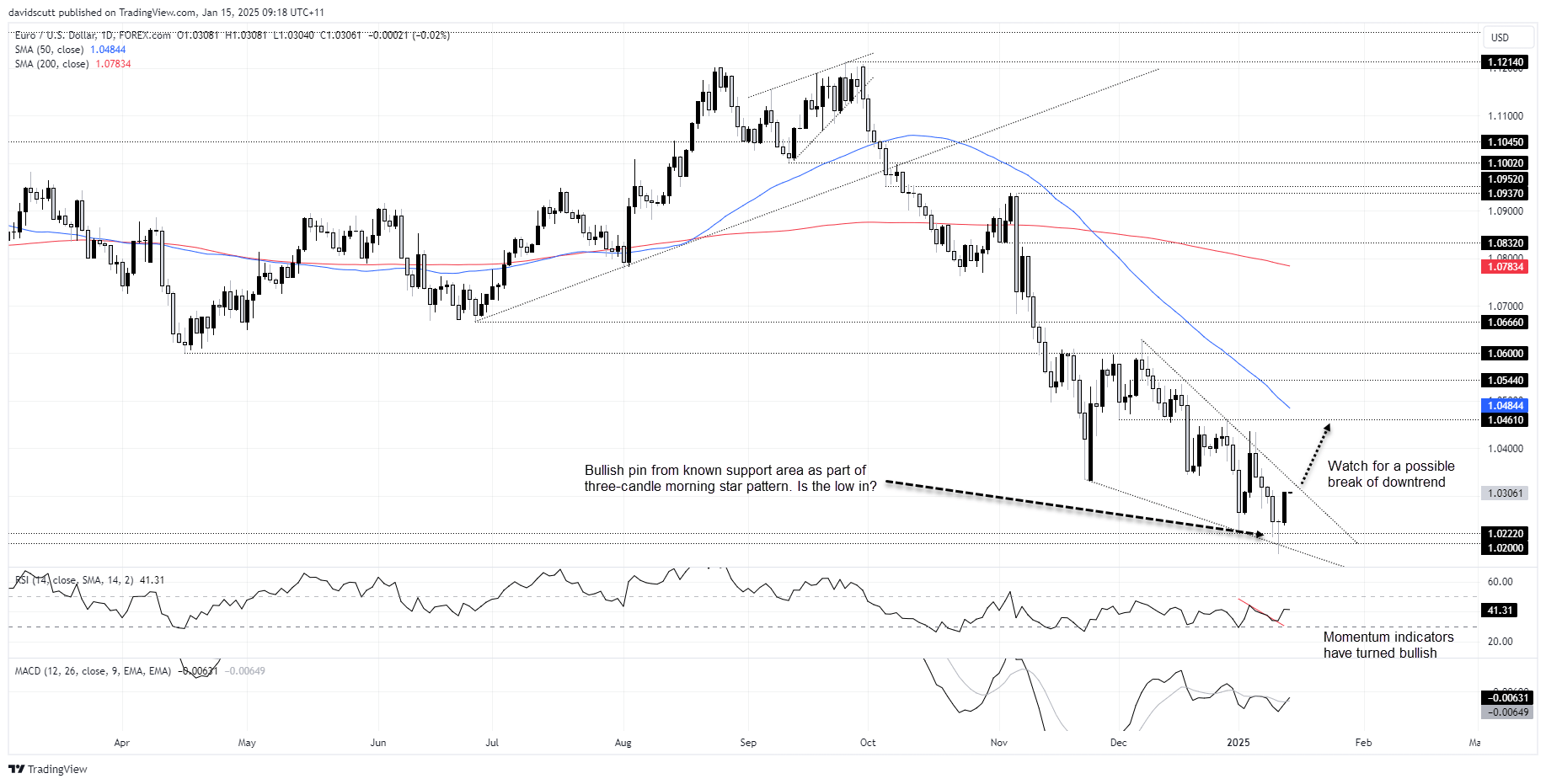

Sitting in a declining wedge and completing a three-candle morning star pattern, traders must be wondering whether EUR/USD has just marked its near-term lows.

While Wednesday’s US consumer price report poses a major hurdle for further upside, a truly horrendous core inflation print – one that quashes any chance of further Fed easing this year – would likely be needed to deliver further downside.

Beyond that, Scott Bessent’s Treasury Secretary confirmation hearing before the Senate Finance Committee on Thursday looms as an event that could trigger a reversal in both yields and riskier assets. Given the strong relationship EUR/USD has maintained with both over the past month, such a scenario could turn this fleeting bounce into something far more significant.

EUR/USD bottoming?

The morning star pattern on the EUR/USD daily chart is as clear as day, with Monday’s bullish pin candle from a known support area reinforcing the case for near-term lows being in. Momentum indicators such as RSI (14) and MACD have also generated fresh bullish signals, hinting at a potential retest of the downtrend resistance first established on December 6. A clean break above that level would pave the way for a move towards 1.0461—a level that acted as both support and resistance late last year.

Source: TradingView

My preference would be to wait for a break of the downtrend before initiating positions, but longs are favoured over shorts at current levels. Markets rarely move in straight lines, and much of the bullish sentiment is already baked into the USD. With US yields having recalibrated significantly higher, they too appear vulnerable to a near-term reversal.

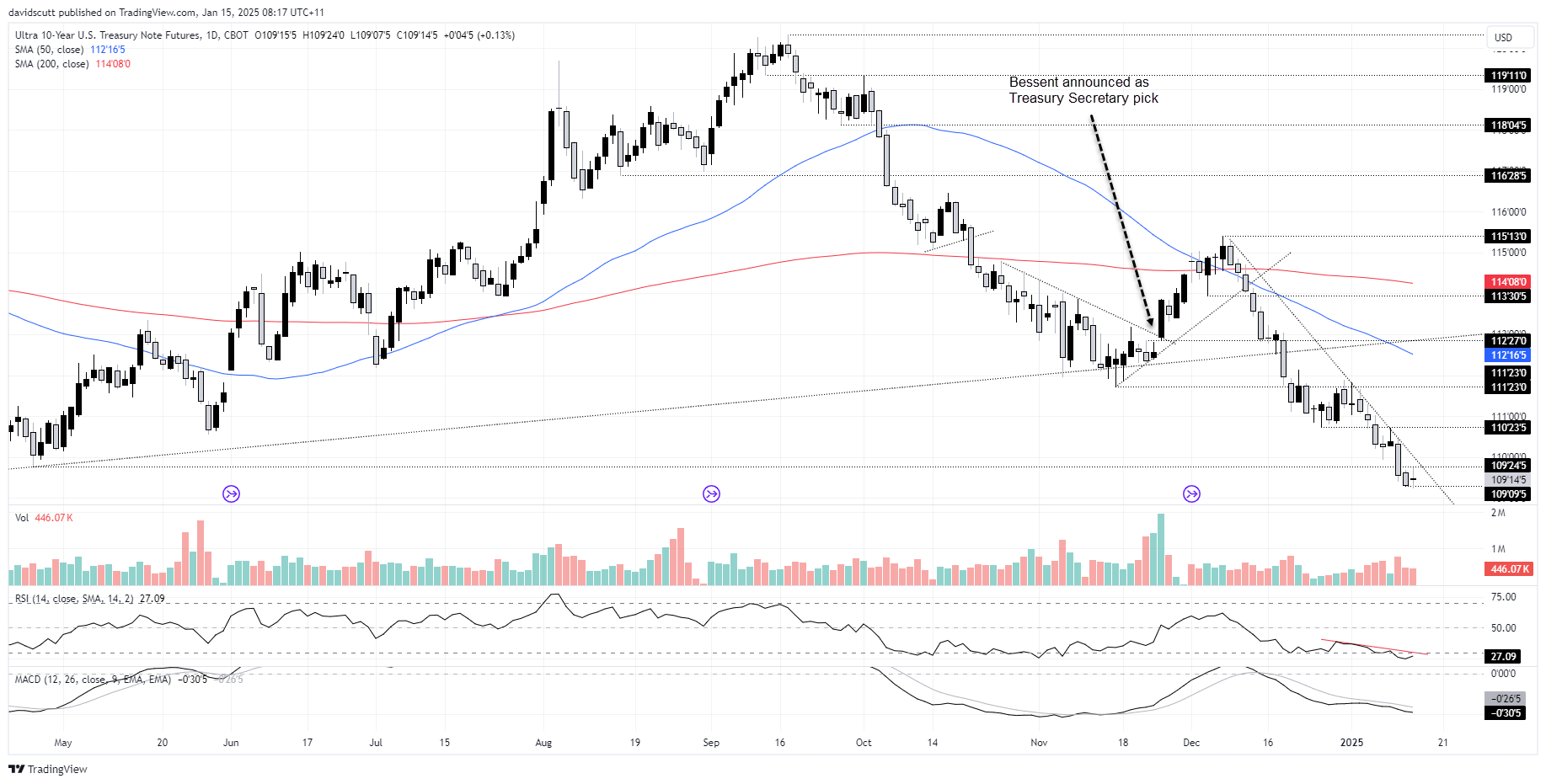

Bessent confirmation arguably more important than inflation

One area I’m closely monitoring is US 10-year Treasury note futures, which have been a reliable guide for directional signals in benchmark yields.

Source: TradingView

While futures remain in a strong downtrend, with RSI (14) and MACD continuing to flash bearish signals (implying the risk of higher yields), traders should be on alert for a potential break of this downtrend. Scott Bessent’s confirmation hearing before the Senate Finance Committee could serve as the catalyst for a reversal in the bond bear market.

As marked on the chart, when news first broke in late November that Trump had tapped Bessent for Treasury Secretary, there was a significant breakout in futures, sending yields sharply lower. Even though many of his policy positions are now well-known, markets clearly view him as dovish on rates.

While this doesn’t guarantee a repeat reaction, it does present a potential roadblock to an even uglier rout in Treasuries.

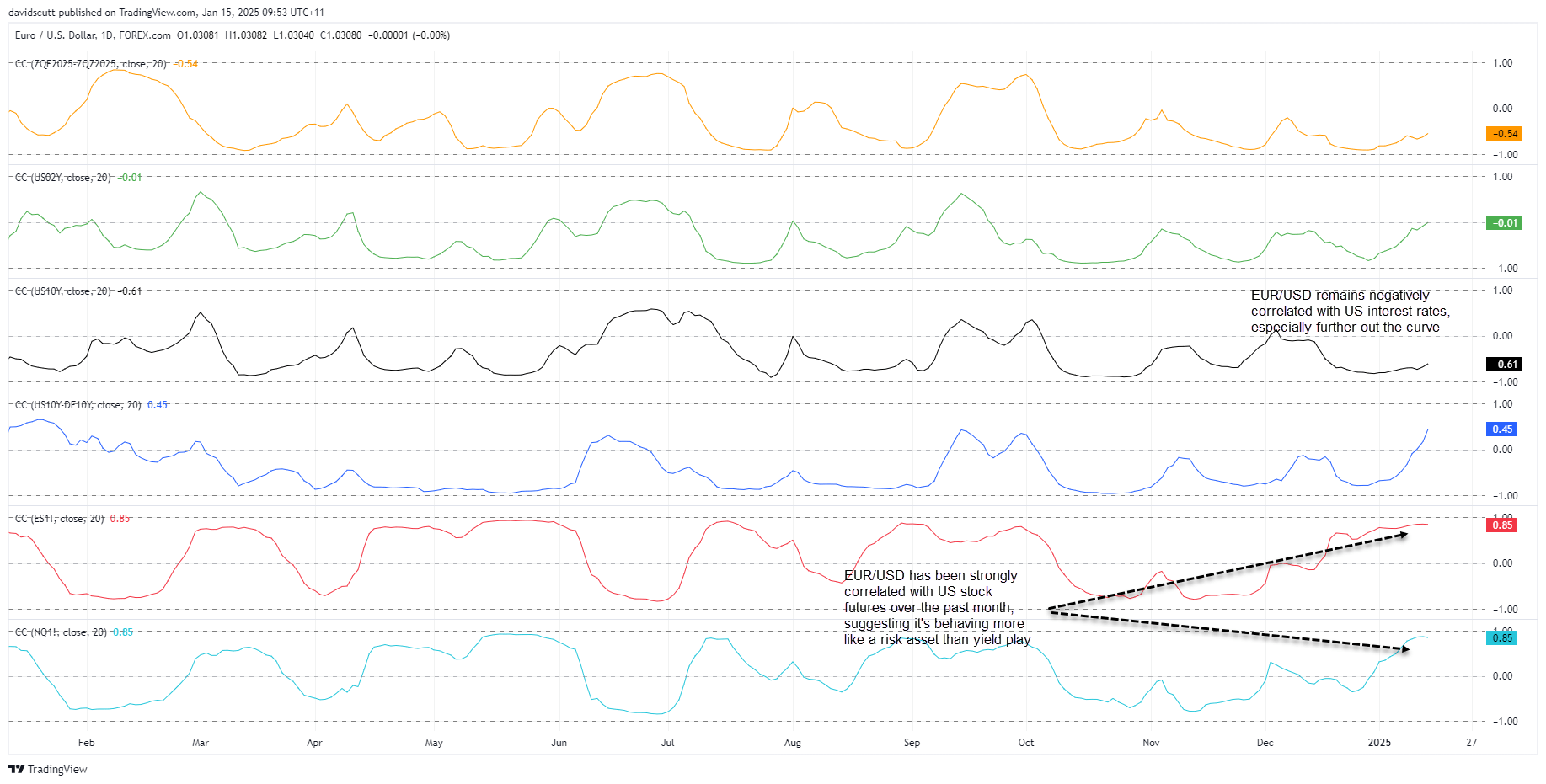

EUR/USD acting more like a risk asset rather than a yield play

This is significant for EUR/USD, given its inverse relationship with US 10-year Treasury yields on a rolling 20-day basis in recent months.

Source: TradingView

Interestingly, EUR/USD has shown an even stronger relationship with S&P 500 and Nasdaq futures over the same period, suggesting it’s behaving more like a risk asset than a pure yield play at present. US stock futures have been strongly negatively correlated with US 10-year yields over the past month. If yields were to reverse, it could lift both EUR/USD and US equities.

-- Written by David Scutt

Follow David on Twitter @scutty