Weekly Technical Trade Levels on USD Majors, Commodities & Stocks

- Technical setups we are tracking into the weekly open- US CPI on tap

- Next Weekly Strategy Webinar: Monday, January 20 at 8:30am EST

- Review the latest Video Updates or Stream Live on my YouTube playlist.

In this webinar we take an in-depth look at the technical trade levels for the US Dollar (DXY), Euro (EUR/USD), British Pound (GBP/USD), Australian Dollar (AUD/USD), Canadian Dollar (USD/CAD), Japanese Yen (USD/JPY), Swiss Franc (USD/CHF), Gold (XAU/USD), Silver (XAG/USD), Crude Oil (WTI), S&P 500 (SPX500), Nasdaq (NDX), and the Dow Jones (DJI). These are the levels that matter on the technical charts into the weekly open.

British Pound Price Chart – GBP/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

The British Pound plunged into a key support zone this week at 1.2084-1.2114- a region defined by the objective 2023 yearly open and the 2023 low-week close (LWC). While the medium-term outlook remains tilted to the downside, the immediate decline may be vulnerable while above this pivot zone. Initial weekly resistance now eyed back at 1.2367/97 with broader bearish invalidation now lowered to the 2024 low-week close at 1.2494. A break below this key level threatens another bout of accelerated Sterling losses towards the January 2024 swing low / 50% retracement of the 2023 rally at 1.1841/89. Review my latest British Pound Short-term Outlook for a closer look at the near-term GBP/USD technical trade levels.

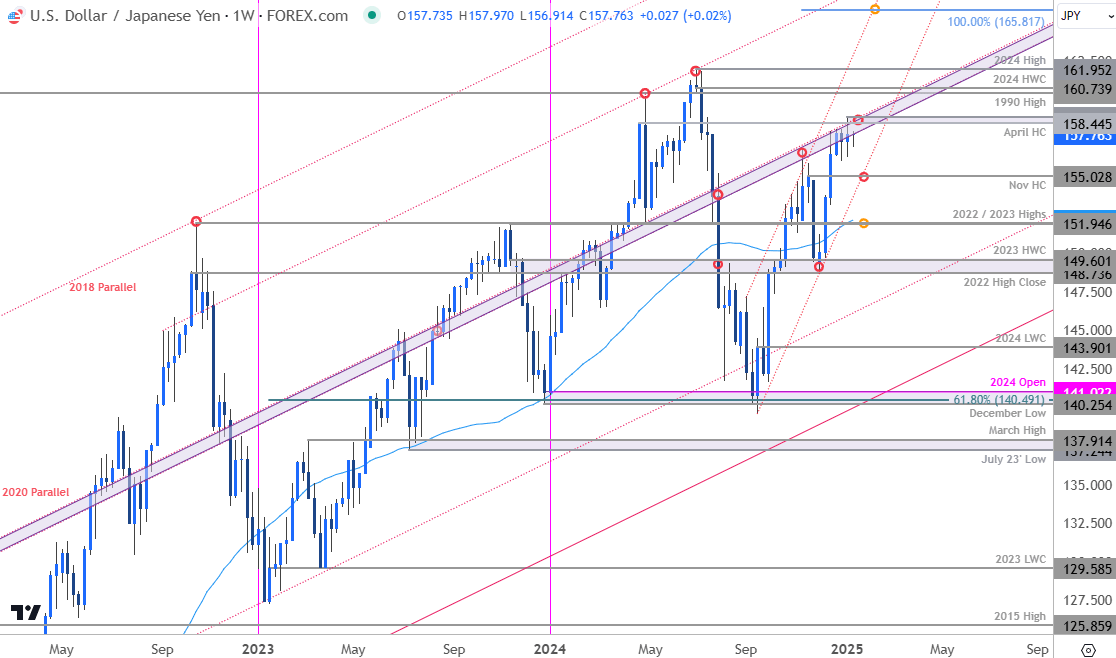

Japanese Yen Price Chart – USD/JPY Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/JPY on TradingView

USD/JPY continues to hold just below major slope resistance for a fifth consecutive week. We have adjusted the resistance zone to the April high-close / monthly high at 158.45/88 and a breach / weekly close above this threshold is needed to mark uptrend resumption. Subsequent objectives are eyed at the 1990 high / 2024 high-week close (HWC) at 160.40/74 and the 2024 swing high at 161.95- look for a larger reaction there IF reached with a close above needed to fuel the next major leg of the advance towards the 100% extension of the September advance at 165.81.

Initial weekly support rests with the November high-close at 155.03- a break below the September trendline would threaten a larger correction towards key support / bullish invalidation at 151.91-152.15 – a region defined by the 2022/2023 swing highs and the 52-week moving average. Keep in mind we get the release of key U.S. inflation data this week with the December Consumer Price Index (CPI) on tap Wednesday. Stay nimble into the release and watch the weekly close here for guidance.

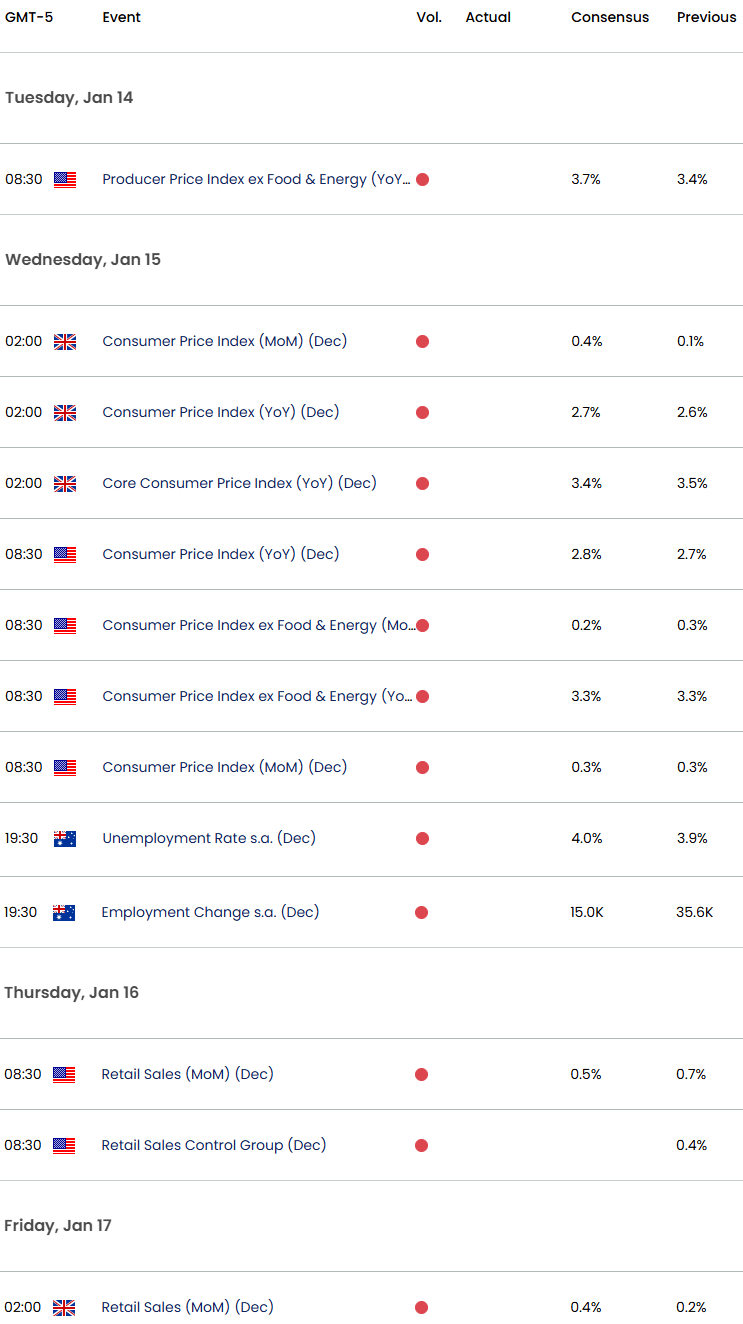

Economic Calendar – Key USD Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

--- Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex